Looking back at 2021 provides little value as a predictor for what may happen in 2022. The events of 2020 and 2021 from a global pandemic — economic shutdowns in every country, unprecedented federal government intervention in the US economy followed by every other country in the globe with their version of the same — are essentially, unrepeatable. The compounded disruption of the pandemic and economic shutdown followed by spectacular stimulus has produced an acceleration of change like we have never seen before. It’s safe to say, predicting the future based on the recent past is a fool’s errand.

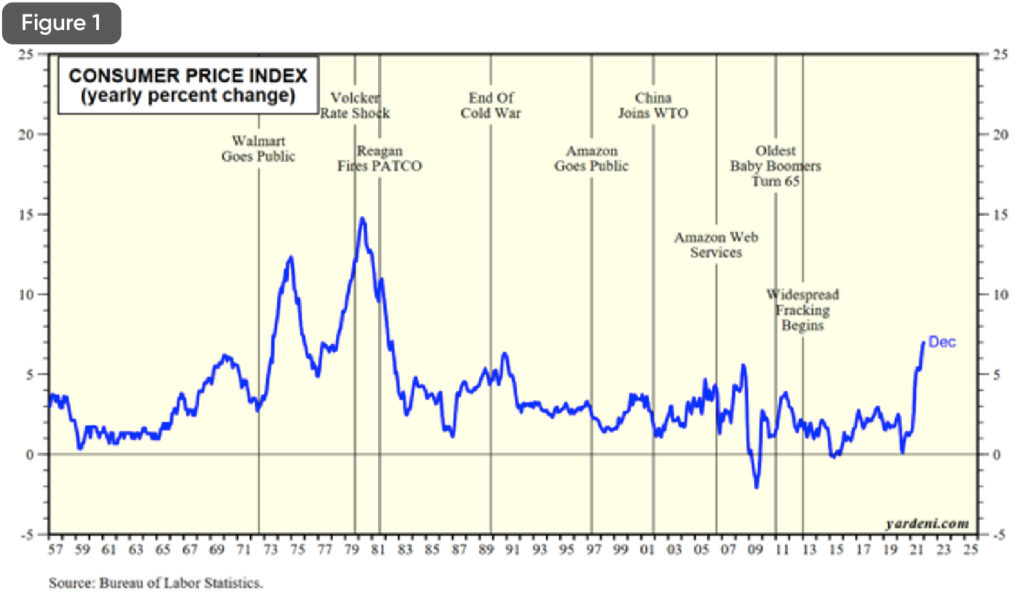

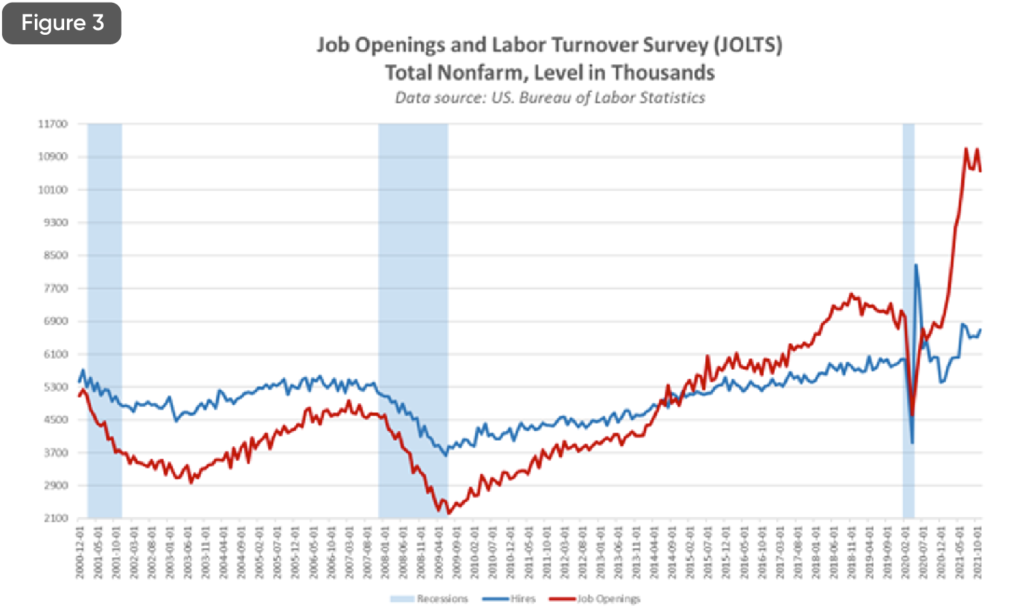

The only valid question is – where are we now? Currently, inflation is being reported at 7% — the highest rate since 1982 {figure 1}. Supply-chain issues continue to be disruptive. There is a general shortage of workers throughout the economy with 11 million job openings {figure 2} . Those unfilled jobs range across almost all categories, from hourly hospitality workers (hotels, retirement community workers, restaurant workers) to advanced technology positions. We are truly in a unique time in history from an economic perspective {figure 3}. Of course, the pandemic is at the root of these issues. Federal and state mandated shutdowns across the country, followed by the Federal government’s aggressive stimulus and the Federal Reserve’s quantitative easing and low interest rates produced an economy that was essentially brought to a halt, and then accelerated at warp speed, creating the conundrum of disruption.

The stock market is generally the best indicator of future economic activity, with a view that’s six-to-nine months out into the future. What has been puzzling to most is, why is the stock market setting record after record during this type of struggling economy? The primary answer is that economic trends, especially around technology, were already moving prior to the pandemic but were accelerated by the unique economic environment just described. As a result, growing companies grew faster due to the free money floating through the economy from the stimulus packages of the Federal government, and cheap money was readily available through the Federal Reserve. The money quickly worked its way through the economy and mostly into some of the country’s biggest businesses. Even Target, Walmart and Ford Motor Company benefited through consumer spending, augmented by strategic technology investments.

The flow of this money through the economy has not made its way to small and medium-sized businesses. These businesses were helped temporarily by forgivable loans from the Federal government. Once that money was depleted, many were faced with the harsh realities of a rapidly changing economy. The labor shortage left many without the workers necessary to operate at or near full capacity. Few can survive long periods of operating at 50% or less of pre-pandemic levels, especially businesses that require on-site workers to function. This problem is further compounded by the incredibly tight labor market that requires higher pay and better benefits to retain workers.

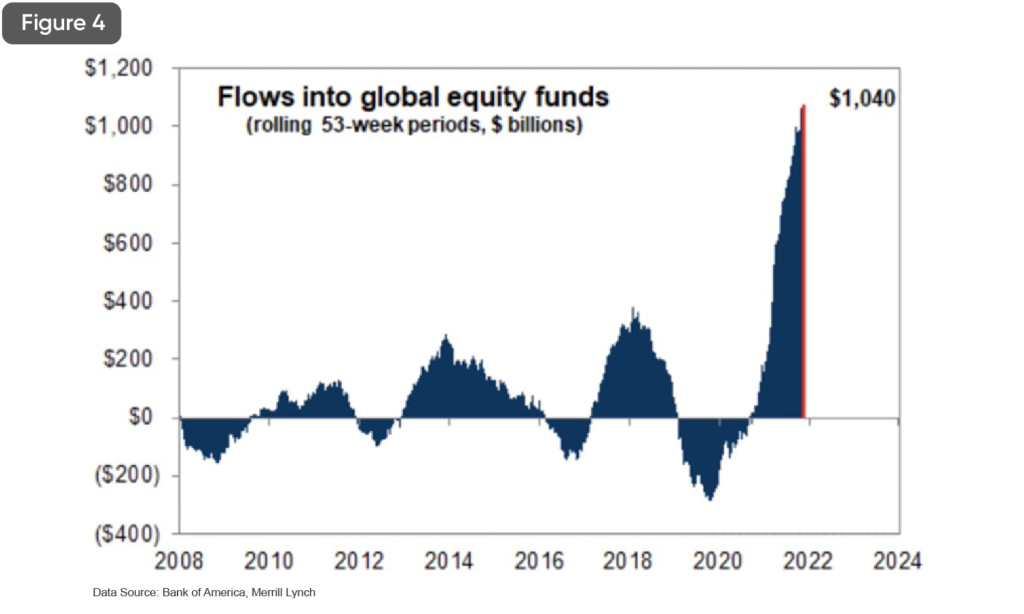

On the other hand, businesses that provide services utilizing technology as a foundation generally have thrived. Their businesses have essentially doubled down on the technology accent and have experienced accelerated growth. Unlike historical periods of economic expansion and contraction where businesses tend to rise and fall together; we are in the midst of a business reordering that we have not seen before. The only parallel was the rapid economic expansion in the US following WWI and the Spanish Flu pandemic of 1917. At the time, many businesses simply and quietly closed their doors and were replaced with new businesses that did not exist before. For example, horse and buggy transportation was replaced by cars and trucks. This transition occurred throughout the economy across many industries. The transition elicited speculative buying in the stock market, culminating in the Crash of 1929. It was not just the stock market crash, but the reordering throughout the economy that ultimately ushered in the decade long Great Depression of the 1930’s {figure 4}.

It is unlikely that a similar outcome is before us, but it is safe to say that the reordering is underway and picking up steam as successes and failures mount on each side of the winning and losing ledger. The stock market is beginning to give us clues as to how the reordering will unfold. During the tremulous market run up following the pandemic shutdown, almost any publicly traded company that had a technology accent would be blindly bought with or without profits. The shift of the market since the first of the year is not a market sector rotation as most analysts have thought. Instead, the market will begin to reward companies that not only have innovative services or technology, but those who have revenue and better yet, real profits. As the cheap money of ultra-low interest rates subsides, the real winners and losers will become evident across all industries and market sectors.

The market has an automatic process of identifying the winners and losers… it’s called the S&P 500 Index. The Index is comprised of the top 500 companies traded on the various stock exchanges. Companies that falter and lose value fall out of the top 500. Those that grow and increase in value, replace them. Periodically, the S&P 500 is reordered, so that fewer than ten companies listed in the Index today were also there 50 years ago. The average person doesn’t have to become a market expert, they just use the S&P 500 as a base for all their investing and manage risk with other types of investments such as money market funds, bond funds and even some alternative type investments such as oil, utilities, or even precious metals.

Finally, the increasing social and political polarization in the US will at some point, begin to recognize the economic reordering process already underway and the increasing wealth gap that has accompanied it. It could potentially produce a volatile social and political condition, particularly as the mid-term elections approach and the 2024 presidential election on the horizon.

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Source: Bank of America, Merrill Lynch

The commentary and market insights provided by John Slavic are for informational purposes only and do not guarantee future results.