Making and spending money is part of life, but what’s even more important is managing the money you have. Budgeting can help you set appropriate financial goals and keep you on track, reducing financial stress for you and your family in the long run.

Whether you’re saving for a home, paying down debt, or simply managing your day-to-day spending, by understanding, organizing, and managing a budget, you can establish a solid pathway for financial freedom – all it takes is a little number crunching.

Step 1: Gather Your Financial Information

The first step to creating a monthly budget is to gather all your financial paperwork, including bank statements from savings, checking, and retirement accounts, W-2s and paystubs, and credit card bills and loan statements.

This allows you to appropriately analyze where your money is currently going, where it should be going, and how much you need. In later steps, the paperwork you collect will be helpful for adjusting your budget and allocating funds to different categories.

Step 2: Calculate Your Monthly Income

Next, you’ll want to calculate your monthly income by referring to your paperwork as needed. Where does your income come from? Make sure you include outlets such as:

- Career

- Side job

- Freelance work

- Child and/or spousal support

- Social Security

- Outside investment income (not retirement accounts)

By understanding where your money is coming from, and how much of it you have, you can start working on creating a better budget that aligns with your lifestyle, getting you one step closer to financial freedom.

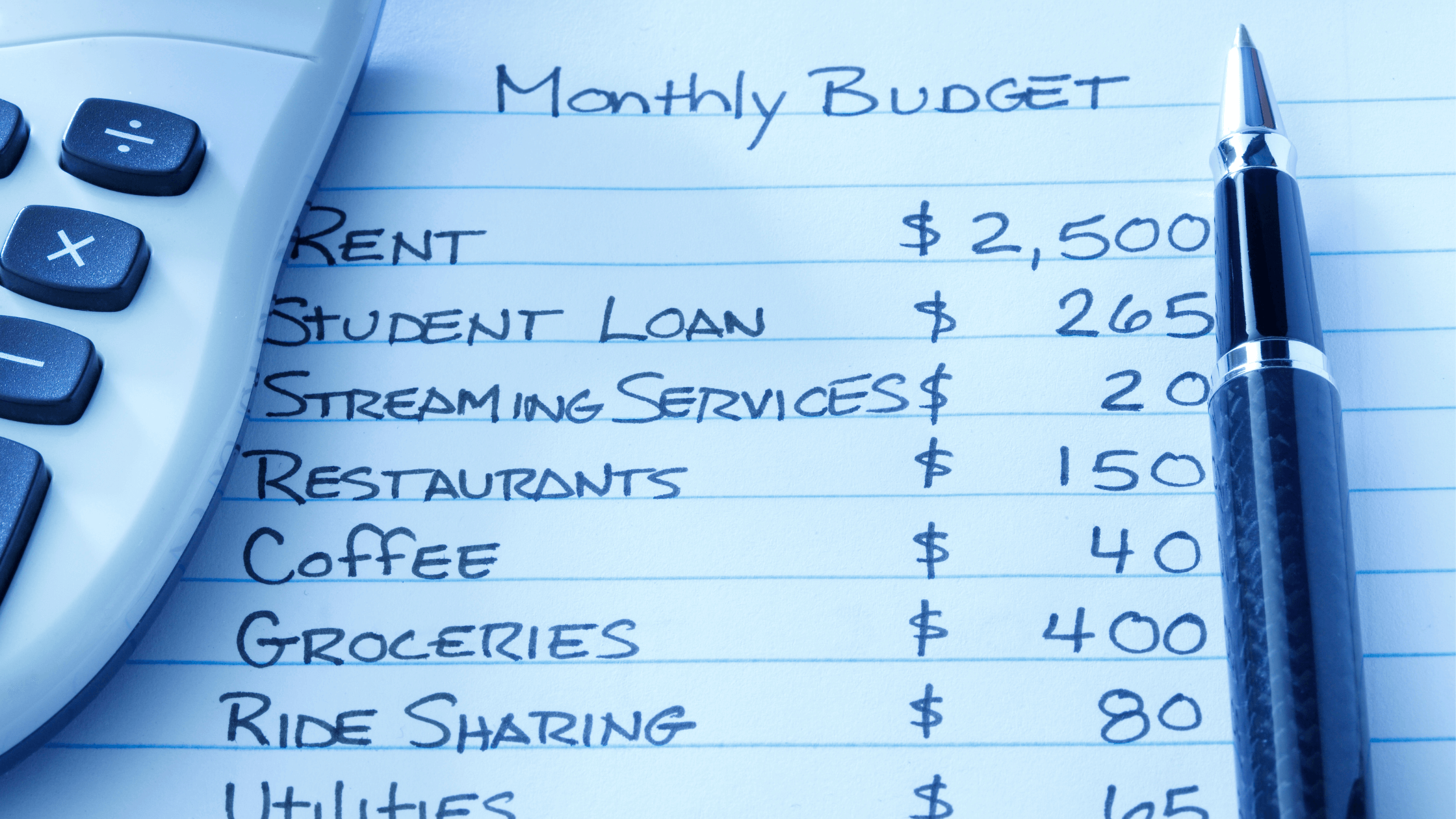

Step 3: Review Monthly Expenses

Now that you know your total income, it’s time to calculate your total expenses. Make a list of everything you spend money on each month, including:

- Loan payments for things such as your home, vehicles, education, credit cards, etc.

- Insurance for healthcare, vehicles, home, etc.

- Utility bills, including internet, water, gas, electricity, and other monthly bills

- Groceries and dining out

- Personal care items and services

- Childcare

- Transportation costs, such as gas, public transportation fees, or ride-share services like Uber and Lyft

- Money contributed to savings and retirement accounts

Once you have your total, you will better understand where your income is being used, which can highlight areas that need to be adjusted.

If you’re unsure of the dollar amount you’re contributing to your retirement plan, use our 401(k) Contribution Effects Calculator to see how much of your paycheck is going into your account.

Step 4: Fixed and Variable Expenses

When it comes to fixed and variable spending, there can be a fine line. By dividing your expenses into two categories, you will understand your spending patterns and visualize where your money should be going.

Fixed spending is mandatory spending. These expenses include things like mortgage or rent payments, utilities, childcare, car payments, and more. These recurring charges rarely change and are often on schedule, making it easy to plan appropriately.

Variable spending includes expenses that change every month, such as groceries, entertainment, gasoline, gifts, etc. There will be times that you need more money for gifts, such as the holiday season, or money for travel. Because these expenses change, you should assign each expense to a category so you can ensure you have the appropriate funds when you need them.

Step 5: Adjust Your Budget

Now that you have your total monthly income and expenses organized, you can identify gaps and adjust. For example, if you are spending more than you’re making, you can reduce the amount you spend in the variable category. You can reduce subscriptions, dine out less, and skip a hair appointment or two.

If you notice that you have a lot of discretionary funds, think of ways that you can make your money work for you. Can you afford to add more to your retirement account each month, maybe pay off your mortgage quicker, start an emergency fund for unexpected expenses? The adjustments you need to make will be made clear by your totals.

Once you’ve adjusted your budget, you can use it as a tool to keep you on track financially. There are budget apps to help you stay organized, such as Mint or Spendee. To learn about top financial planning apps, read this blog post.