You’ve worked hard. You’ve contributed to your 401(k). But one day, you log in to check your balance… and the number staring back at you isn’t quite what you expected.

Unfortunately, this scenario is more common than you might think. A recent study conducted by the Center for Retirement Research at Boston College found that 40% of households are financially ready for retirement and are aware of it, while 20% know they are in trouble. The remaining households are at the highest risk of not saving enough. Even those who realize they’re in trouble might not take action unless encouraged.

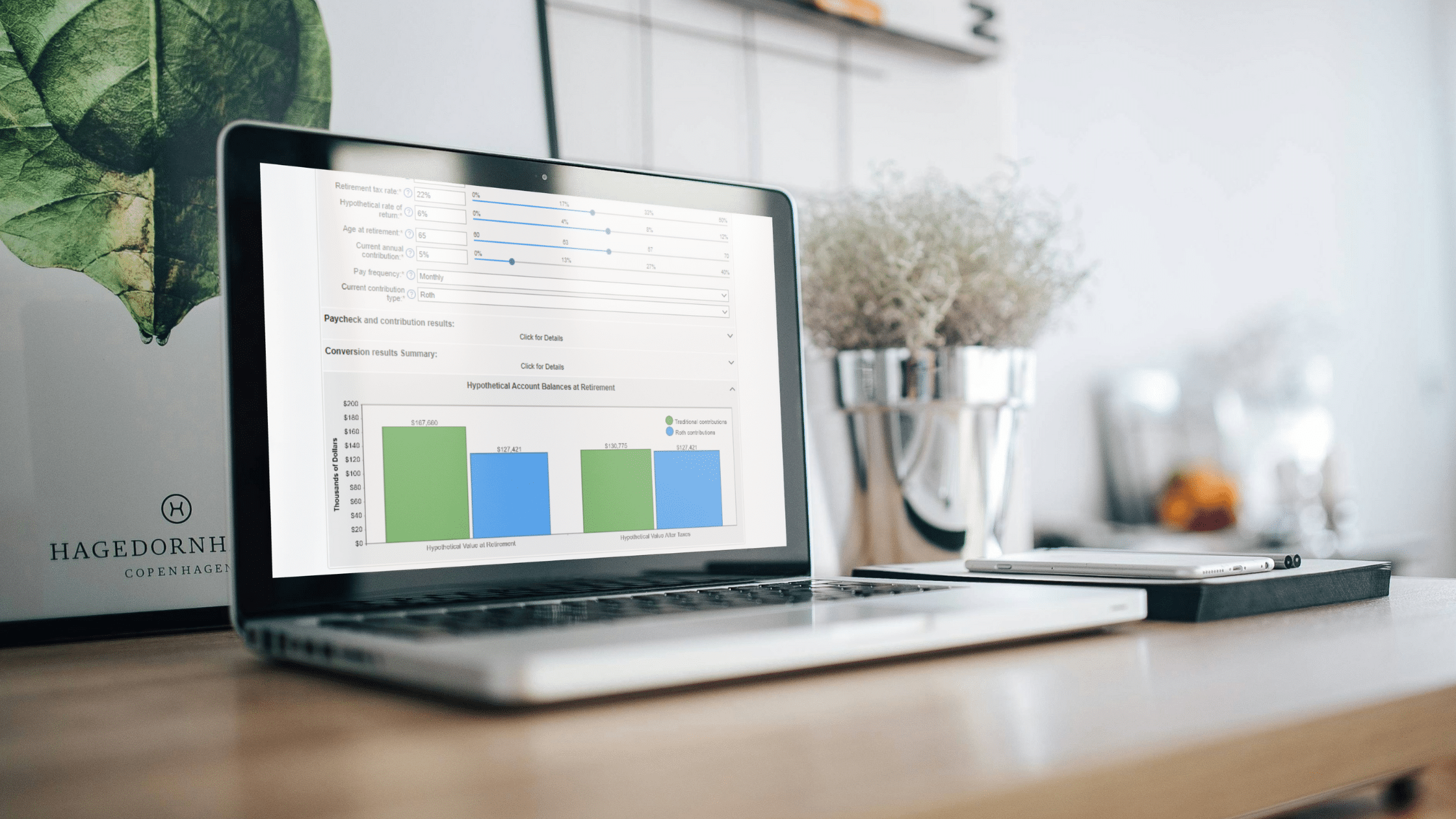

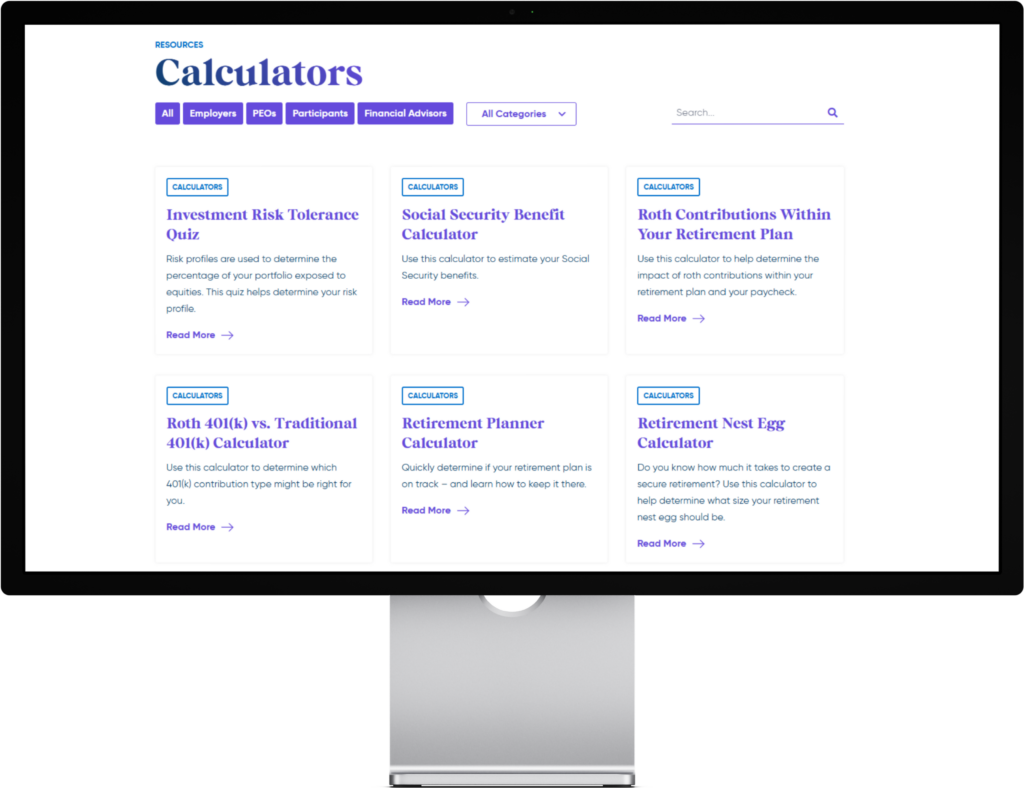

That’s where a 401(k) calculator comes in. It’s a powerful (and free!) tool that helps you figure out whether your current savings habits will support your future lifestyle—and what to change if they won’t.

Why Use a 401(k) Calculator?

Retirement isn’t one-size-fits-all. Your ideal savings amount depends on where you live, how you plan to spend your time, and what kind of lifestyle you want to maintain. Whether your dream is to travel the world or settle into a cozy home near family, a 401(k) calculator can help:

- Estimate how much money you’ll need annually in retirement

- See if you’re saving enough to get there

- Understand the impact of increasing your contributions

- Factor in employer matching and tax advantages

- Adjust for inflation, salary growth, and market returns

With just a few inputs—like your age, income, contribution rate, and retirement goals—you’ll get a clear snapshot of your financial future. Access all Slavic401k Calculators HERE!

What Assumptions Do 401(k) Calculators Use?

While each calculator is slightly different, many include:

- 3% annual inflation

- 7% average annual market return

- 3% annual salary increases

- 5% withdrawal rate in retirement

These assumptions provide a realistic (but adjustable) estimate of what you can expect at retirement age.

How Much Will I Need to Retire?

It’s difficult to determine how much you’ll need in retirement. A rule of thumb is to replace 75% of your current income. If you currently earn $100,000 a year, you want to get $75,000 annually in retirement.

How much money you’ll need to retire depends on many factors. The first thing to consider is your cost of living. Like California and New York, some places have high rent prices, making them more challenging to afford.

You’ll also consider other things like food, clothes, travel, entertainment, pets, medical expenses and family. How will you spend your golden years? Will you travel the world or stay at home?

A 401(k) calculator can help you determine how much you’ll have when you retire as you select what your expenses will be.

Maximize Your 401(k) Strategy

1. Don’t leave free money on the table.

Roughly 70% of employers offer a 401(k) match, yet many employees contribute less than needed to unlock the full benefit. If your company matches 3%, make sure you’re contributing at least that amount.

2. Know your limits (and raise them).

The IRS sets annual contribution limits for retirement accounts like 401(k)s. If you’re 50 or older, you can make additional contributions to catch up. Maximizing these contributions can significantly boost your future savings.

3. Revisit your risk tolerance.

Early in your career? You may benefit from a more aggressive portfolio. Closer to retirement? A conservative approach could help preserve your nest egg. A Investment Risk Tolerance calculator can show how different investment styles may affect your outcome.

Pro Tips to Stay on Track

- Start now. Even small contributions today can mean big savings later thanks to compound interest.

- Increase as you go. Got a raise? Great. Bump your 401(k) contributions too.

- Avoid early withdrawals. Taking out money before age 59½ can lead to taxes, penalties, and lost growth potential.

- Track spending habits. Cutting back on non-essentials could free up funds for your future self.

- Investing is a marathon, not a sprint. Consistent investing is the key to success.

- Most experts recommend that 15-20% of your salary goes towards your long-term investment goals.

Don’t Just Hope—Know

You don’t want to spend your retirement worrying about money or working longer than you planned. You want confidence. Clarity. Control.

That’s exactly what a 401(k) calculator offers.

At Slavic401k, our free Retirement Planner 401(k) Calculator does more than crunch numbers—it helps you take action. Whether you’re ahead of schedule or need to catch up, we’ll guide you toward a retirement plan that works for your goals and lifestyle.

Check out the Slavic401k Retirement Planner Calculators today and start building the future you deserve.