The latest regional job report from the U.S. Department of Labor revealed that non-farm employment in America increased in 38 states in July, decreased nowhere, and was essentially unchanged everywhere else. As for joblessness, the unemployment rate fell in 17 states in July and was stable elsewhere.

In total, 23 states had unemployment rates lower than the national figure of 5.4 percent, and 13 states had higher rates. Nevada had the highest unemployment rate in July (7.7 percent), closely followed by California, New Mexico, and New York (7.6 percent each). Nebraska and Utah had the lowest jobless rates at 2.3 percent and 2.6 percent, respectively.

Some of these extremes are lingering side effects of the pandemic. With Nevada, for instance, it has had the highest jobless rate throughout most of the crisis since its economy is highly dependent on the leisure and hospitality industry which has been one of the hardest hit sectors due to its sensitivity to lockdowns and other activity restrictions. Nebraska, on the other hand, has maintained one of the lowest rates of unemployment thanks in part to its relatively more spread out population and an economy that is less reliant on close-proximity service-providing industries. As for New York and California, these states continue to experience some of the highest rates of unemployment in the country in large part because they continue to have some of the most restrictive, purportedly pandemic-fighting policies in place.

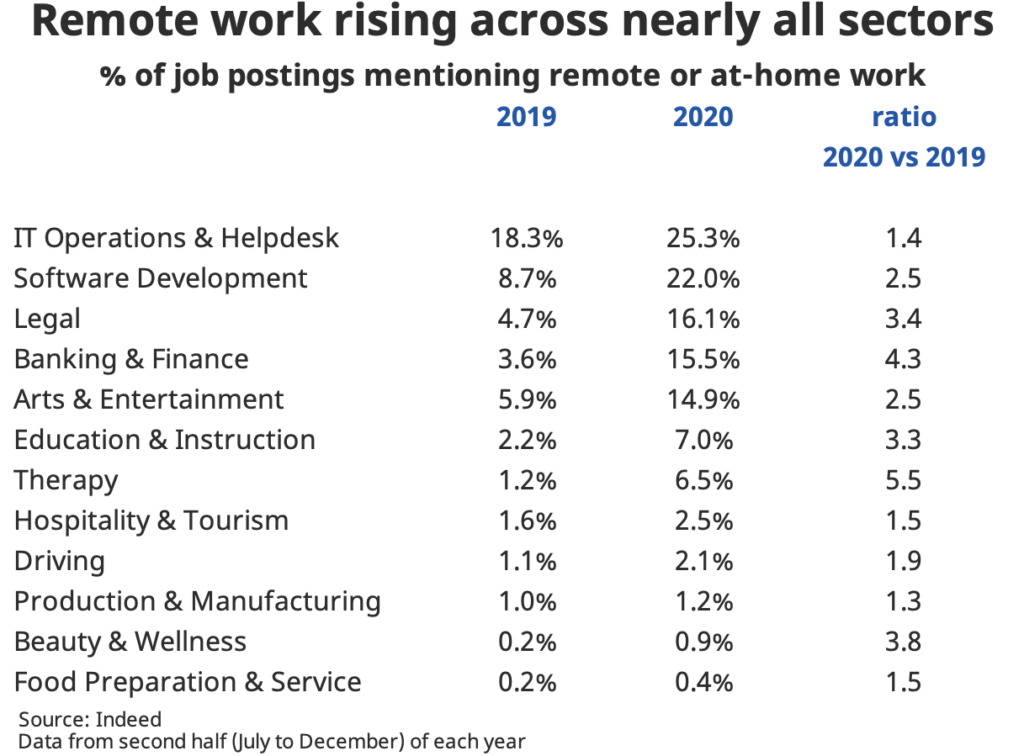

In some ways, such draconian measures have accelerated earlier migration trends in this country. Recently updated data from the U.S. Census Bureau showed that over the past decade the population has started to shift away from most urban counties toward the Sunbelt and the suburbs. This continued in 2020 with the San Francisco Bay Area, New York, Los Angeles, and Chicago being among the biggest population losers in 2020, whereas Texas and Florida continued to enjoy significant population growth. Some of the acceleration was perhaps caused by Americans simply not wanting to live where local politicians could on a whim deem one’s work “nonessential.” For others, the decision to move (to the suburbs) was likely motivated by the rapid rise in remote work, which lessens the need to live near expensive city centers.

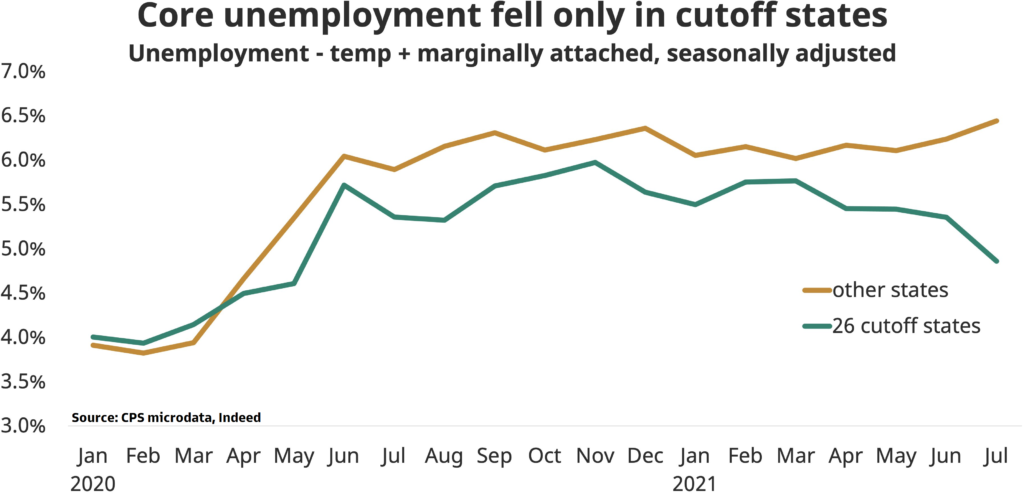

Another regional difference worth pointing out is the expiration of the federal unemployment insurance boost. The bump made sense during the height of the lockdowns when the government basically told Americans they were not allowed to work, but the necessity of these extra benefits currently is very difficult to justify given how strong the labor market is and the high vaccination rate of the population. Some states have already removed the federal UI boost, while others have opted to leave it on as long as possible. As one might have expected, recent data suggests that unemployment fell much more during the last two months in the 26 cutoff states than in other states. However, employment rose only slightly more in the cutoff states during this period. This is perhaps a reflection of reluctant job seekers still having a sizeable savings cushion to live off of, and in turn, meaning more time is still needed for certainty on this issue.

What To Watch This Week:

Monday

- Pending Home Sales Index 10 a.m. ET

- Dallas Fed Manufacturing Survey 10:30 a.m. ET

Tuesday

- 2-Yr Note Settlement

- 5-Yr Note Settlement

- 7-Yr Note Settlement

- 20-Yr Bond Settlement

- 30-Yr TIPS Settlement

- Case-Shiller Home Price Index 9 a.m. ET

- FHFA House Price Index 9 a.m. ET

- Chicago PMI 9:45 a.m. ET

- Consumer Confidence 10 a.m. ET

Wednesday

- MBA Mortgage Applications 7 a.m. ET

- ADP Employment Report 8:15 a.m. ET

- PMI Manufacturing Final 9:45 a.m. ET

- ISM Manufacturing Index 10 a.m. ET

- Construction Spending 10 a.m. ET

- EIA Petroleum Status Report 10:30 a.m. ET

Thursday

- Challenger Job-Cut Report 7:30 a.m. ET

- International Trade in Goods and Services 8:30 a.m. ET

- Jobless Claims 8:30 a.m. ET

- Productivity and Costs 8:30 a.m. ET

- Factory Orders 10 a.m. ET

- EIA Natural Gas Report 10:30 a.m. ET

- 3-Yr Note Announcement 11 a.m. ET

- 10-Yr Note Announcement 11 a.m. ET

- 30-Yr Bond Announcement 11 a.m. ET

Friday

- Employment Situation 8:30 a.m. ET

- PMI Composite Final 9:45 a.m. ET

- ISM Services Index 10 a.m. ET

- Baker Hughes Rig Count 1 p.m. ET