The value of all goods and services produced in America in the first quarter of 2022, i.e. U.S. gross domestic product (GDP), declined by 1.4 percent.

That was worse than expected and the first negative print since the pandemic – and lockdown-induced recession in 2020. Naturally a shrinking GDP will sound some alarm bells because it only takes two consecutive quarters of contraction to mean we are in a recession, based on the NBER’s official definition.

However, any business economist worth their salt will tell you that employment is the more stable and higher frequency measure of economic activity than the quarterly GDP reports that continue to be revised for several months after the initial release. Moreover, if one was to take the negative GDP print at face value, it would mean U.S. employers added millions of jobs in the first quarter just to have workers produce nothing (the “product” in “GDP”). Does anyone really believe that? No, and we saw a similar dynamic several times after the financial crisis where employment data remained quite strong even as incoming GDP reports were discouraging. Ultimately the positive labor market data proved to be correct and GDP figures eventually converged onto employment. So far there is little evidence that this time will be any different.

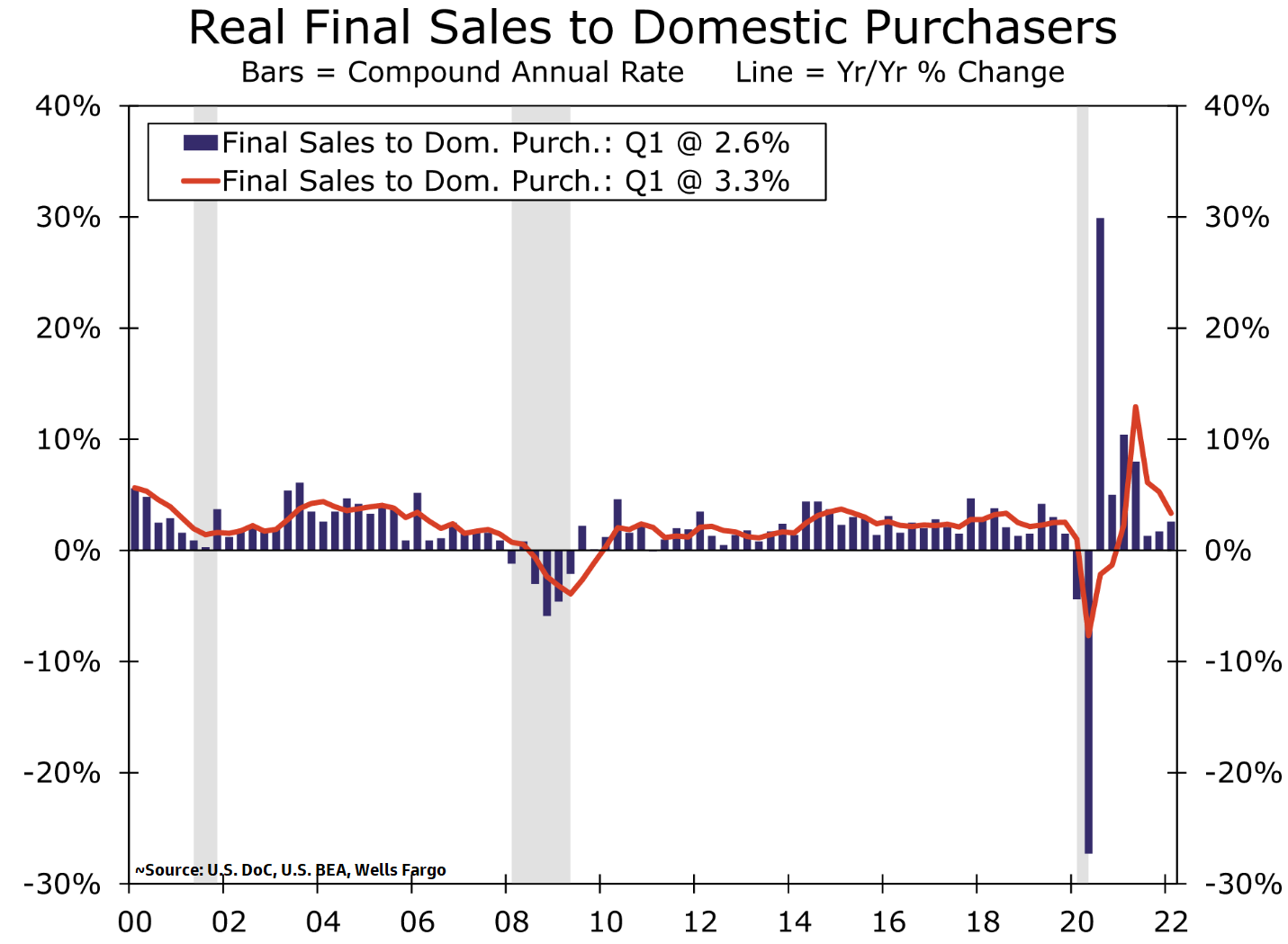

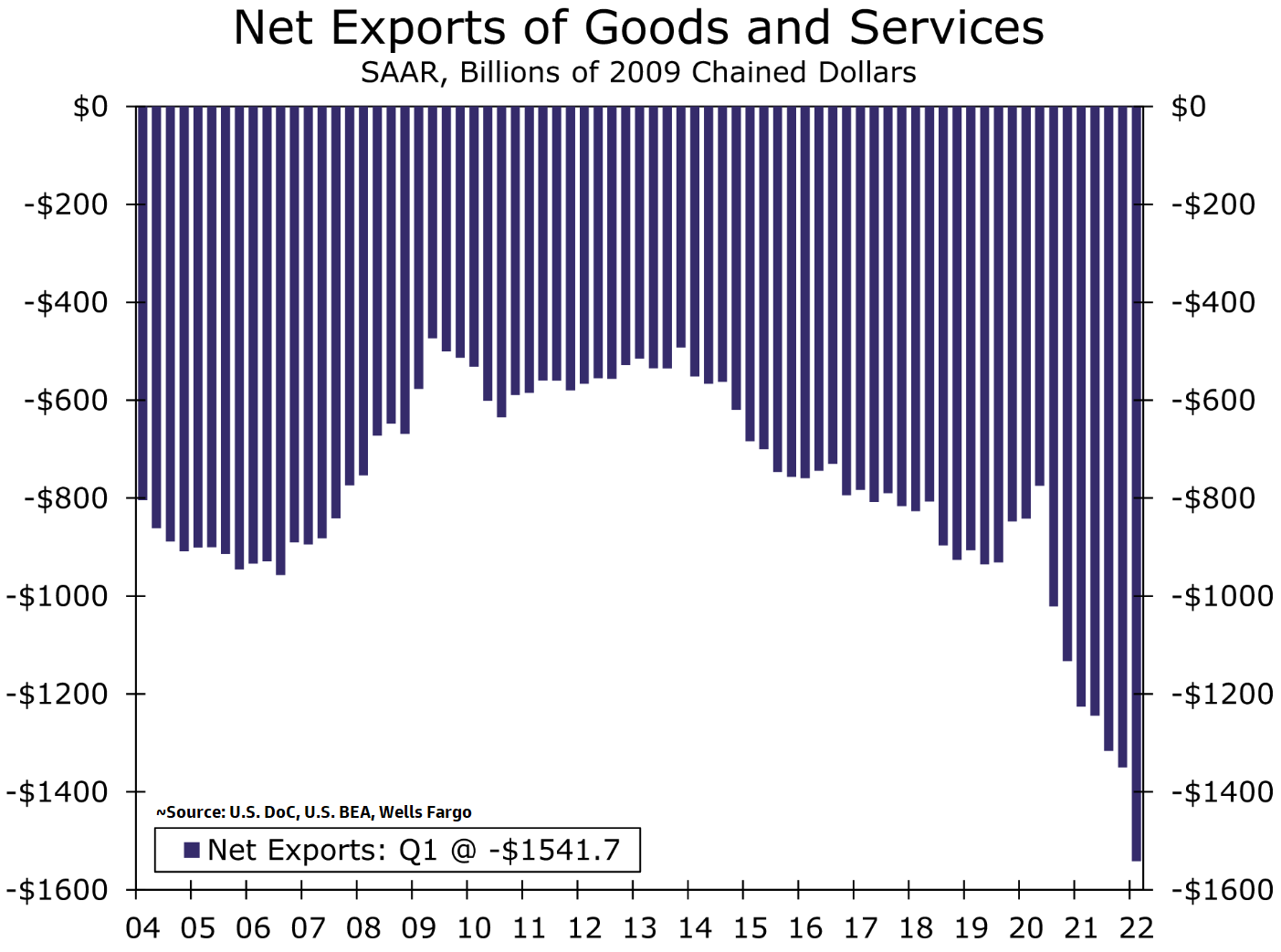

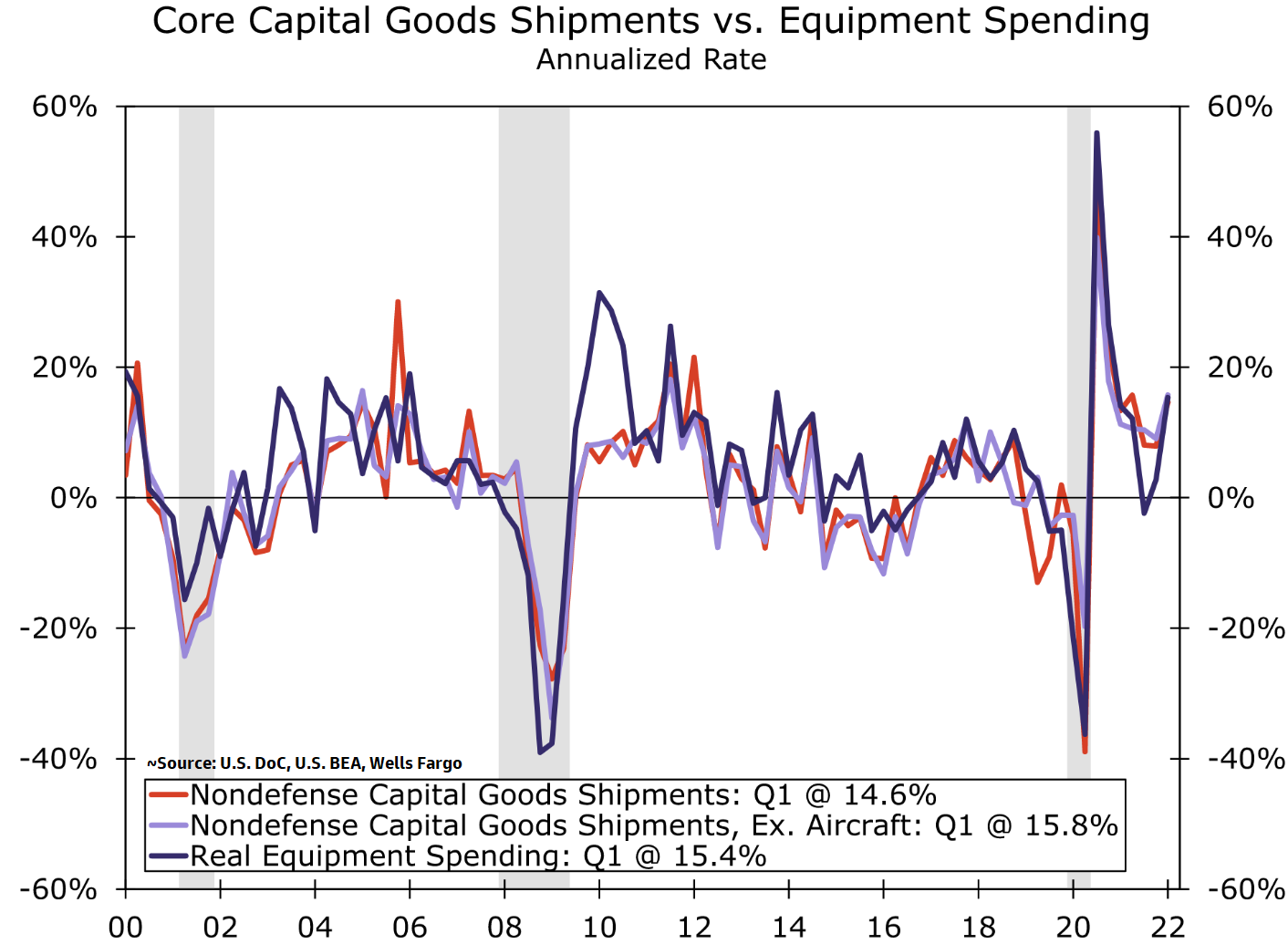

Another reason not to read too heavily into the Q1 GDP report is that the weakness was primarily concentrated in two areas: net exports and inventory investment. Statistically these components are the most volatile data points released and they have routinely provided the least signal with regard to next-quarter GDP growth. Further, the statistically most useful (predictive) GDP component has been private domestic demand, i.e. GDP net of inventories, trade, and public sector spending and investment, and this number grew at a healthy pace in Q1. So altogether it is more likely we see a rebound in GDP when the Q2 figures are released that confirms underlying economic growth is nowhere near as weak as the headline Q1 print would suggest. This is supported by other data points released for the first quarter, which along with the strong labor market reports suggest the weak GDP figure was more of an outlier than an omen.

None of this means a recession is not a possibility because inflation and policy errors from the Fed and lawmakers in Washington can obviously have an effect on economic growth, as can geopolitical surprises and other exogenous shocks. Moreover, based on the recent behavior in the yield curve the economy is definitely more “exposed” to a macro hit than it was a year ago, but altogether the incoming data have yet to justify any recessionary alarm bells. It is also worth noting that the S&P 500 as of this writing is up 2.78 percent since the release of the weak GDP report. Yes there are numerous variables influencing stock prices at any given moment but the fact that the market, an excellent discounting mechanism of new information, has for the most part taken the disappointing GDP figure in stride suggests the report by itself did little to change investors’ recessionary concerns.

What To Watch This Week

Monday

- Raphael Bostic Speaks 8:45 AM ET

- Wholesale Inventories (Preliminary) 10:00 AM ET

Tuesday

- NFIB Small Business Optimism Index 6:00 AM ET

- John Williams Speaks 7:40 AM ET

- Raphael Bostic Speaks 8:30 AM ET

- 3-Yr Note Auction 1:00 PM ET

- Loretta Mester Speaks 3:00 PM ET

- Raphael Bostic Speaks 7:00 PM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- CPI 8:30 AM ET

- Atlanta Fed Business Inflation Expectations 10:00 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- Raphael Bostic Speaks 12:00 PM ET

- 10-Yr Note Auction 1:00 PM ET

Thursday

- Jobless Claims 8:30 AM ET

- PPI-Final Demand 8:30 AM ET

- EIA Natural Gas Report 10:30 AM ET

- 10-Yr TIPS Announcement 11:00 AM ET

- 20-Yr Bond Announcement 11:00 AM ET

- 30-Yr Bond Auction 1:00 PM ET

- Mary Daly Speaks 4:00 PM ET

Friday

- Import and Export Prices 8:30 AM ET

- Consumer Sentiment 10:00 AM ET

- Neel Kashkari Speaks 11:00 AM ET

- Baker Hughes Rig Count 1:00 PM ET