Election season can bring a lot of excitement, debate, and even some anxiety—especially when it comes to the impact on your investments. You may wonder how the results will affect your 401(k) or if it’s a good time to adjust your strategy. Here’s a closer look at what typically happens to 401(k) investments after an election and some tips on how to stay prepared.

Immediate Market Reaction

Immediately after an election, markets can be volatile. Both stocks and bonds may react strongly, as investors digest the results and consider what the new or re-elected administration’s policies might mean for the economy. Market fluctuations are common in the days and weeks following an election as people recalibrate their expectations. Historically, these fluctuations are often temporary, and markets tend to stabilize as policies become clearer.

Why Does This Happen?

Election results can create uncertainty or optimism about specific industries based on anticipated policy changes. For instance:

- If there’s a focus on renewable energy policies, stocks in that sector may rise.

- Defense and energy sectors may respond to shifts in international relations or energy policy.

- Tax policies can also affect corporate earnings, influencing broader market performance.

It’s essential to remember that markets don’t just react to the election outcome itself but also to the lead-up and anticipated policy changes. While these swings can seem dramatic, they’re often just part of the economic cycle.

Election Long-Term Effects on Your 401(k)

When it comes to 401(k)s, the good news is that short-term market volatility usually has little long-term impact. If you’re investing for retirement, you’re likely focused on a horizon far longer than one election cycle. Historically, markets tend to rebound after election-related fluctuations. While individual sectors may experience ups and downs based on regulatory changes or shifts in government spending, diversified portfolios tend to smooth out these variations.

A Look at Historical Trends

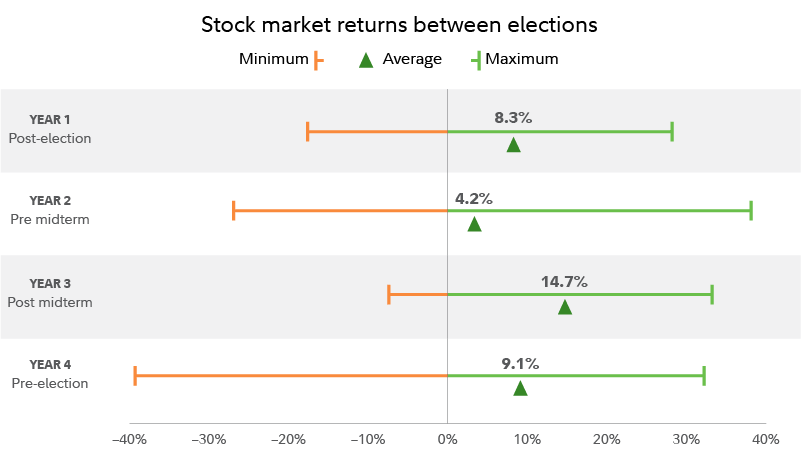

Historically, U.S. markets have performed relatively consistently over the long term, regardless of which political party is in power. Data shows that the stock market generally grows over time, even though it may experience brief periods of decline or stagnation. Since your 401(k) is likely diversified across various asset classes, these long-term trends help minimize the impact of short-term political events.

* Source: https://www.fidelity.com/learning-center/trading-investing/election-market-impact ; Past performance is no guarantee of future results. Data spans from November 30, 1950, to November 14, 2023. Years represent the 12-month period from November 30 to November 30 following a US presidential or midterm election. The chart depicts the average, minimum, and maximum price return achieved during this period. Stocks are represented by the S&P 500®. Indexes are unmanaged. It is not possible to invest in an index. Source: Haver, FactSet, FMR. As of November 14, 2023.* No content published here constitutes a recommendation of any particular investment, security, a portfolio of securities, transaction or investment strategy. To the extent any of the content published may be deemed to be investment advise, such information is impersonal and not tailored to the investment needs of any specific person. The material presented is not intended to be complete in all material respects. Consult your advisor about what is best for you.

Tip: If you have concerns about market fluctuations after elections, review your asset allocation with a long-term view. A diversified 401(k) helps to minimize risks associated with any one sector or policy change.

What You Can Do to Protect Your 401(k) Post Election

While it’s easy to get swept up in the news and market commentary, there are simple ways to protect your 401(k) and stay on track:

- Stick to Your Long-Term Plan: Retirement planning is a marathon, not a sprint. Trying to “time the market” based on political events usually leads to more harm than good. Review your financial goals and risk tolerance, and make sure your current investments align with them.

- Regularly Rebalance Your Portfolio: Over time, some investments in your portfolio may grow faster than others, throwing off your ideal allocation. Rebalancing once a year or as recommended by your plan’s advisor can help maintain your desired level of risk.

- Review Your Contribution Levels: Election season can be a good reminder to ensure you’re contributing enough to your 401(k). Many employers offer matching contributions, so be sure you’re contributing at least enough to get the full match.

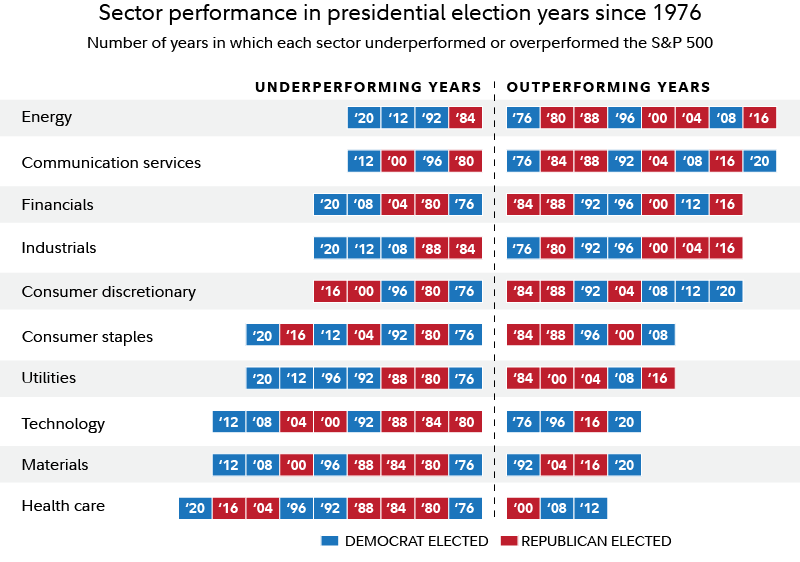

- Consider Sector Exposure: If you’re particularly concerned about the impact of new policies on specific industries, you might consider discussing sector exposure with a financial advisor. While diversification generally protects against individual sector declines, some investors choose to adjust their sector exposure based on anticipated policy shifts.

* Source: https://www.fidelity.com/learning-center/trading-investing/election-market-impact. Past performance is no guarantee of future results. Each box represents 1 calendar year of performance for a calendar year that included a US presidential election. Underperforming indicates that price performance was lower than the S&P 500. Outperforming indicates price performance exceeded the S&P 500. Color of each box indicates whether a Democrat or Republican candidate was elected to the presidency that year. Real estate is omitted due to a lack of sufficient performance history. It was not established as an independent sector until 2016. Each sector is represented by companies included in the S&P 500 that are classified as members of that sector. Source: Strategas Research Partners, as of November 5, 2023. No content published here constitutes a recommendation of any particular investment, security, a portfolio of securities, transaction or investment strategy. To the extent any of the content published may be deemed to be investment advise, such information is impersonal and not tailored to the investment needs of any specific person. The material presented is not intended to be complete in all material respects. Consult your advisor about what is best for you.

What About Taxes?

Tax discussions often surface during election cycles, and changes in tax policy can significantly impact retirement planning. For instance, if new policies alter the tax treatment of contributions, distributions, or capital gains, you may need to reassess how your contributions are allocated between traditional 401(k) and Roth 401(k) accounts.

However, tax changes typically take time to implement, giving you and your financial planner ample opportunity to adjust your strategy. A key area to monitor is the SECURE Act 2.0, which introduced substantial reforms to the retirement industry, including Automatic Enrollment starting January 1, 2025. These changes aim to strengthen the retirement system and address existing gaps in retirement plans.

Bottom Line: Stay the Course During an Election

While elections may create short-term uncertainties, they are just one of many factors that can influence markets. Historically, the best approach for 401(k) investors is to stay focused on long-term goals and avoid making emotional decisions based on short-term news. With a well-diversified portfolio and a disciplined approach, your 401(k) is designed to weather these events and grow steadily.

If you’re ever uncertain about the impact of an election on your 401(k) or whether your investment strategy should change, consulting with a financial advisor can help ensure you’re on the right path.