Artificial Intelligence (AI) isn’t just a buzzword—it’s a transformative force shaking up how we handle our finances. It’s everywhere, making things easier and smarter, especially when we’re talking about making choices with our cash.

In the retirement savings industry, the potential of AI is being carefully harnessed while financial engineers look to understand its boundaries. This approach is fine-tuning machine precision capabilities and knowing when to ensure we have human expertise in the loop strategically. It’s a forward-thinking collaboration that promises to revolutionize how we plan for our golden years.

Day-to-Day Interactions with AI: A Financial Perspective

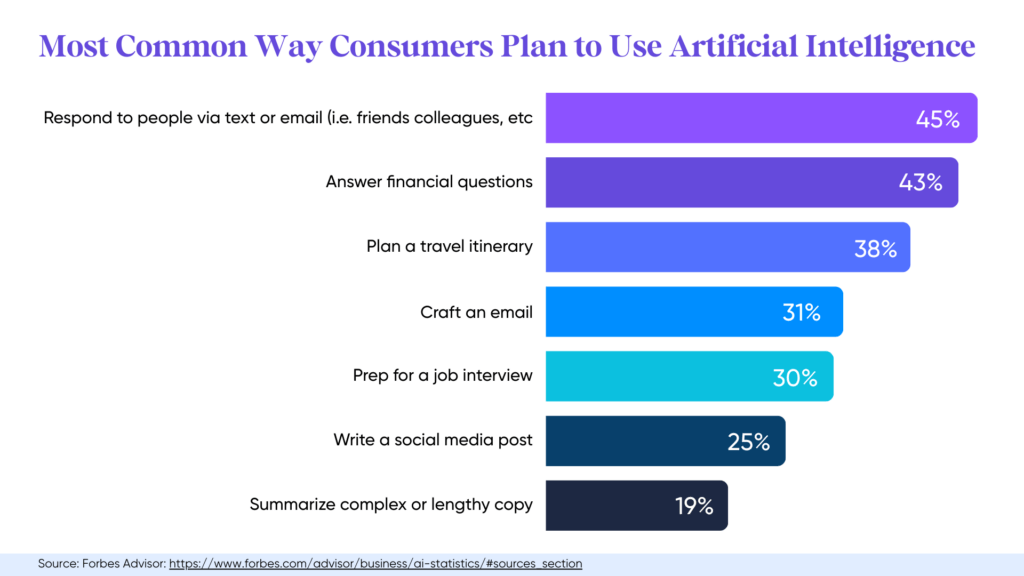

The future of financial management is here, and AI is at its core. It’s transforming our day-to-day interactions with money in ways we never thought possible. An impressive 43% of individuals now rely on AI for financial guidance, making it the second most popular use of this technology. Why are so many turning to AI for financial advice? The answer lies in the convenience, accuracy, and personalized insights that AI provides.

AI’s role in finance isn’t limited to advice; it’s also about engagement. Interactive budgeting tools and real-time investment tracking are examples of how AI makes managing money easier and more efficient. These tools learn from our behaviors, helping us to avoid common financial pitfalls and make smarter decisions with our money.

AI Data-Driven Retirement Management

Artificial Intelligence (AI) is offering new ways to manage and optimize retirement accounts. Its ability to analyze vast amounts of data enhances its capability to forecast market trends and inform investment strategies. As a result, this is becoming an invaluable tool for investors looking to secure their financial future.

Tailored Investment Advice: Algorithms process personal financial data to craft strategies suited to individual goals. Digital advisors, like Slavic401k’s Bespoke platform, not only use a proprietary algorithm but also provide access to our team of experienced professionals who can make your financial life goals the center of attention.

Market Predictions and Behavioral Analysis: AI analyzes market data to forecast trends, helping investors make informed decisions. By examining spending and saving behaviors, AI provides insights to guide better financial choices.

Interactive Education: AI platforms use conversational interfaces to demystify finance, making it easier for users to understand and manage their investments. AI can power interactive calculators and tools like simulations that view your investment tolerance risk. This physically shows you how different decisions will affect their retirement savings.

Safeguarding Your Retirement:

AI can enhance the security of 401(k) accounts by monitoring for unusual activity and potential fraud. This provides an added layer of protection for participants’ hard-earned savings. On the flip side, is AI itself safe to use? That’s where the Employee Retirement Income Security Act (ERISA) and Artificial Intelligence (AI) come into play. Let’s break down what these terms mean for you as a 401(k) participant.

What is ERISA?

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets standards to ensure that retirement plans, like your 401(k), are managed with your best interests in mind. It requires transparency from plan administrators, so you have the information you need about your investments. ERISA also mandates that those managing your funds—known as fiduciaries—act responsibly and in the participants’ best interest. If they don’t, they can be held accountable.

How Does AI Enhance Security?

AI systems are designed to protect your 401(k) account by constantly monitoring for signs of fraud or unusual activity. Think of AI as a vigilant guardian that never sleeps, always watching over your savings and alerting administrators of anything suspicious. This added layer of protection helps keep your hard-earned money safe.

Is AI Safe to Use?

While AI offers security benefits, it’s natural to wonder about the safety of using such technology. After all, AI systems run using vast amounts of data, including sensitive information. The good news is that AI developers and users, like Slavic401k, are aware of these concerns and take them seriously. They implement rigorous security assessments and protocols to ensure that AI systems are not just effective but also secure against cyber threats. There are still human developers on the backend carefully connecting the dots and ensuring this technology stays within the bounds of required regulations and guidelines.

Bringing AI to Retirement Savings at Slavic401k

At Slavic401k, we’ve dedicated ourselves to integrating the latest technology with our financial expertise to bring you a seamless and empowering platform experience. Our goal is to support the growth of your investments and ensure that managing your 401(k) is as user-friendly as possible.

In 2019, we launched Bespoke, our award-winning digital advisor. Bespoke was designed to help you determine the optimal deferral amounts and investment strategies that align with your unique financial goals. This platform has been recognized with the FIS Impact Award for its groundbreaking approach to investment technology, and it represents just the beginning of our commitment to innovation.

As we look to the future, Slavic401k is excited to lead the charge in the technological, constantly enhancing our AI capabilities. We’ll keep you informed as well roll out the next phase of our AI-backed tools.