In the previous blog post, we explored recent actions taken by the Federal Reserve in its fight to get inflation under control, while also alluding to the subsequent economic “pain” that may result. This is important because too often the media may present monetary policy tightening as something that will magically make everything better once inflation goes away. Unfortunately, that is not always the case because one must understand that prices rise (inflation) when spending (demand) increases more than the quantities (supply) of goods and services sold, and vice versa (deflation).

The main way that the Federal Reserve can try to address such imbalances is by shifting demand through increasing or decreasing spending power via changes in interest rates, influencing the amounts of debt assets and liabilities being created, and other methods. Put simply, the Fed combats inflation by withdrawing money and credit away from both consumers and businesses, in turn reducing current and future spending until the supply-demand imbalance is brought back into harmony. Such policy adjustments can take a while to have the desired effect. Sometimes the imbalances can “over-correct.” In the meantime, while the process is still working itself out, there can be a big impact on Americans’ consumption behavior — the largest component of U.S. gross domestic product — ultimately influencing capital budgeting decisions, inventory replenishment, and job creation in a negative or positive feedback loop.

So central banks find themselves in the difficult, almost paradoxical, position where they want to prevent damage to the economy that prolonged, elevated inflation would cause. However, the only real way they can do so is by weakening the economy. In order to lift living standards (inflation-adjusted income and purchasing power) over the long run without sustained damage to spending and the labor market is by raising productivity, and central banks simply don’t do that. Productivity can rise from business investments, technological innovations, and the implementation of other efficiencies. Yes, the Fed can financially incentivize such actions by making credit more available, but any resulting productivity gains are far from a direct and immediate response to monetary policy adjustments. We will explore productivity in greater detail in the future. For now, we will shift the focus back to the real-time side effects of Fed tightening.

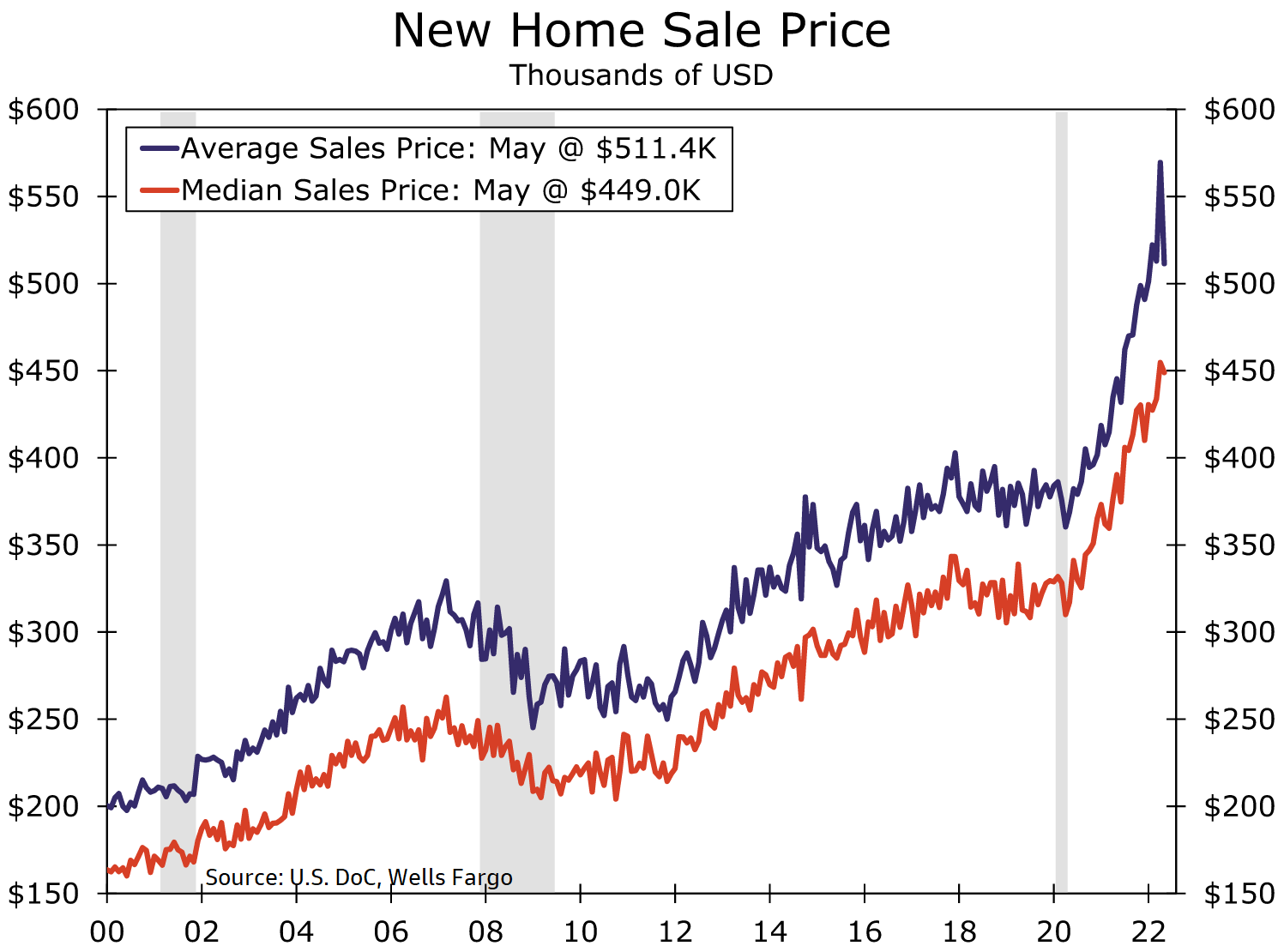

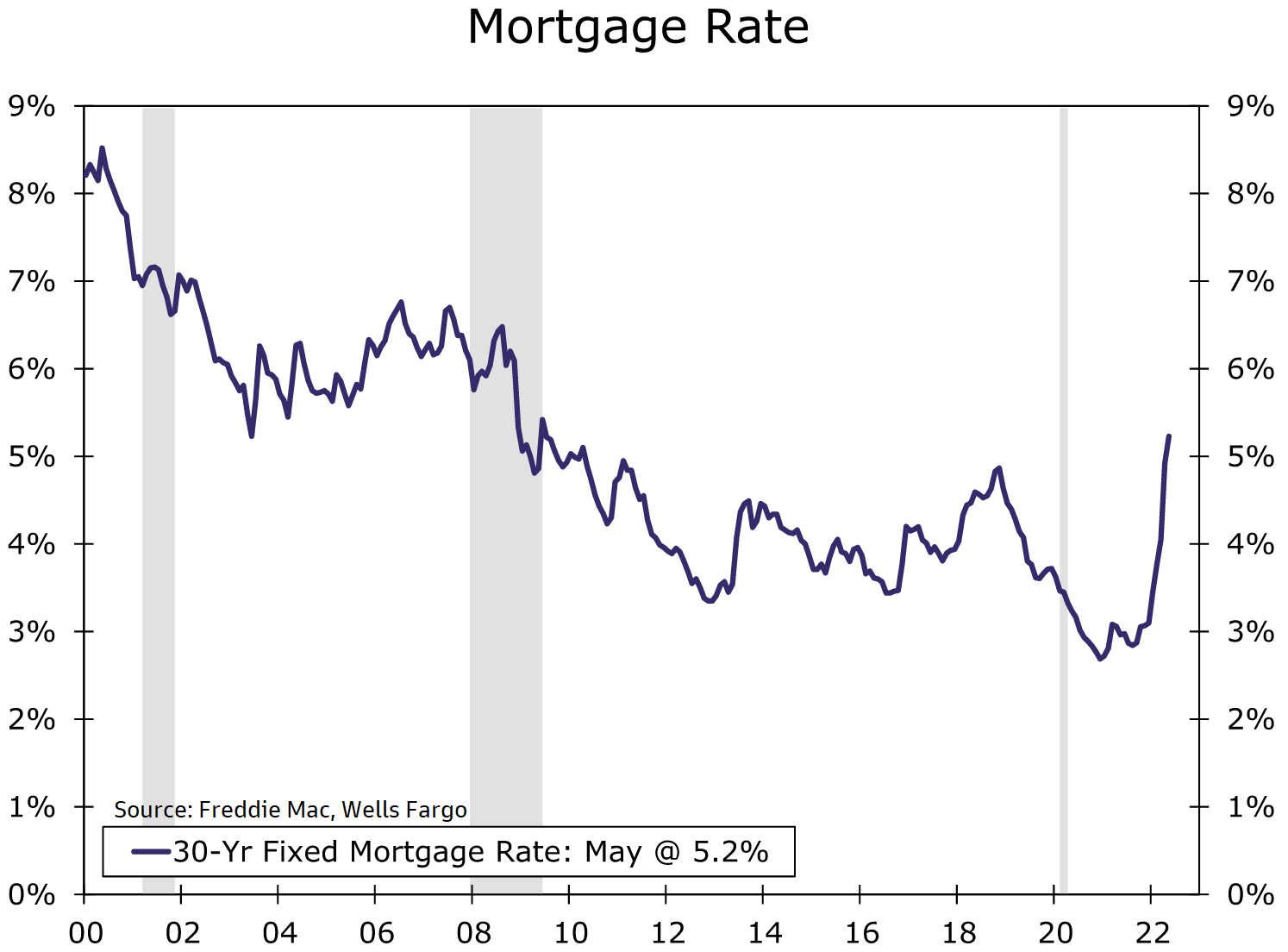

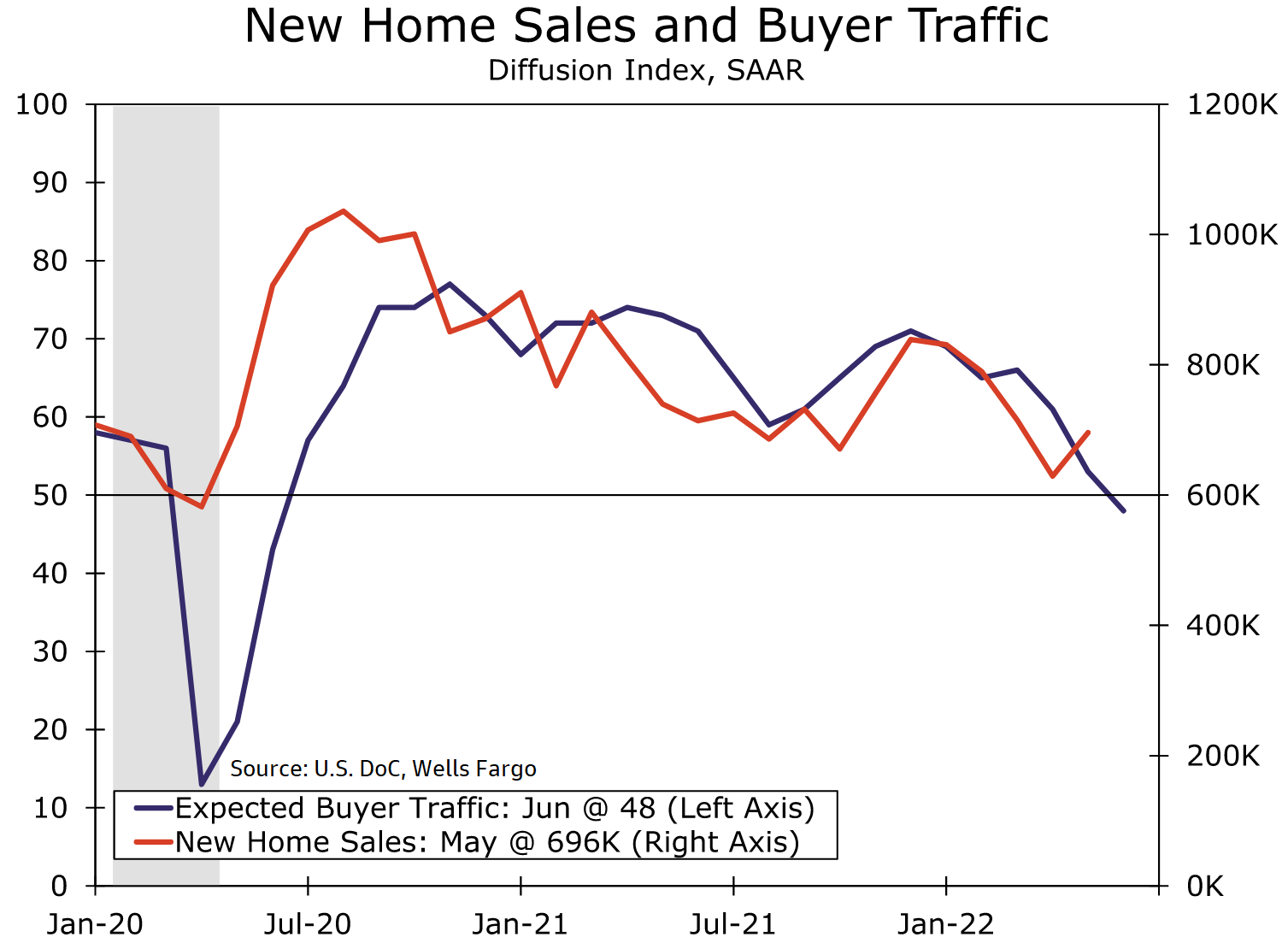

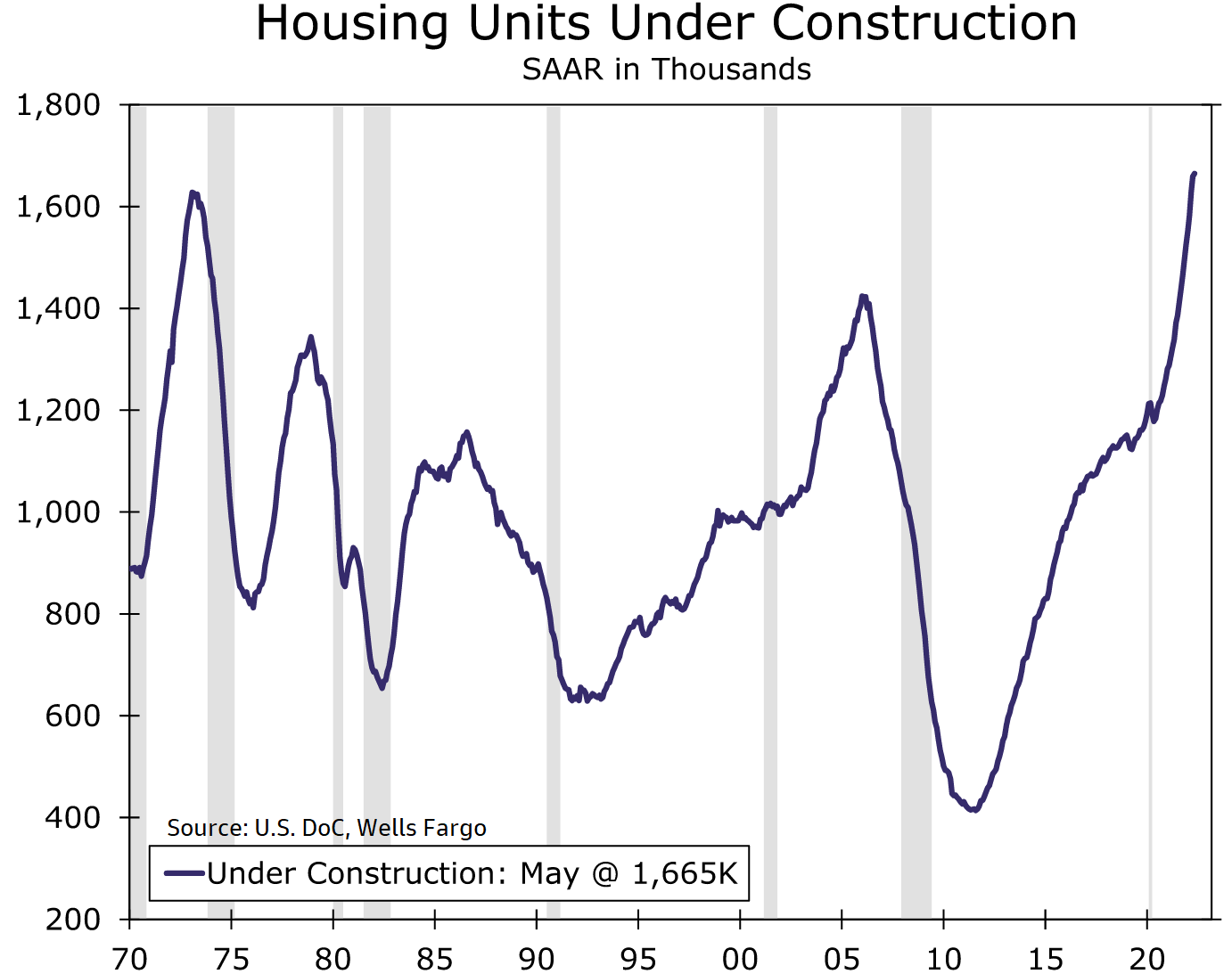

Specifically, we will look at one example of the “pain” mentioned earlier that is already starting to show up in the housing market. Indeed, sales of existing homes fell 3.4 percent in May and have now already fallen back to the pre-pandemic pace of growth due to a combination of higher prices and rising interest rates that reduced affordability. Admittedly new home sales did handily beat expectations in May, but this could be one of the “last hurrahs” for the current real estate bubble. Moreover, there was a surge in completions of single-family homes last month which may be a sign of buyers rushing to lock in mortgage rates before they rise even higher. Altogether, any apparent strength (upside surprises) in the housing data in the near term may simply be a side effect of hesitant buyers still on the sidelines being nudged by Fed tightening to finally pull the trigger on a purchase. After this transitory boost, the affordability challenges should start to show up increasingly in the data.

What To Watch Next Week

Monday

- US Holiday: Independence Day (Markets Closed)

Tuesday

- Factory Orders 10:00 AM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- PMI Composite Final 9:45 AM ET

- ISM Services Index 10:00 AM ET

- JOLTS 10:00 AM ET

- FOMC Minutes 2:00 PM ET

Thursday

- Challenger Job-Cut Report 7:30 AM ET

- ADP Employment Report 8:15 AM ET

- International Trade in Goods and Services 8:30 AM ET

- Jobless Claims 8:30 AM ET

- EIA Natural Gas Report 10:30 AM ET

- EIA Petroleum Status Report 11:00 AM ET

- 3-Yr Note Announcement 11:00 AM ET

- 10-Yr Note Announcement 11:00 AM ET

- 30-Yr Bond Announcement 11:00 AM ET

- Fed Balance Sheet 4:30 PM ET

Friday

- Employment Situation 8:30 AM ET

- Wholesale Inventories (Preliminary) 10:00 AM ET

- John Williams Speaks 11:00 AM ET

- Baker Hughes Rig Count 1:00 PM ET

- Consumer Credit 3:00 PM ET