Does your company offer a 401(k) plan? If so, you are in luck because there are many benefits to participating in your company’s 401(k) plan. However, realizing your retirement goals won’t just happen by chance. To live the retirement lifestyle you’re dreaming of you must begin saving early or as soon as it’s financially viable for you.

Your company’s retirement plan may be one of the most valuable tools for growing your financial future, especially if you are new to saving for retirement. Let’s explore some of the financial reasons you should participate in your company’s 401(k) plan.

Tax Advantages

First off, when you participate in your company’s 401(k) plan, the money that is deducted from your paycheck for retirement savings will be taken out before taxes are calculated. This means that any amount of money invested today will grow tax-deferred until it is withdrawn during retirement.

Because the contributions are pre-tax, your taxable income will be reduced, regardless of whether you itemize or take the standard deduction. It may even put you in a lower tax bracket! Your pre-tax contributions are tax-deferred until you decide to withdraw them in retirement. The idea is that if you’re forced to cash out your accounts before retirement, you’ll be in a lower tax bracket than if you were taxed on the funds immediately after contributing.

Easy Payroll Deductions

With instant payroll deductions, you can set it and forget it! Your employer will automatically take a predetermined percentage of your wages and place it in your 401(k) plan. It makes saving for retirement straightforward and easy. And because the deduction is taken before you receive your compensation, you won’t miss out on the money. Talk to your company’s Human Resources department to learn about the options available to you.

Employer Matching

Many companies provide their employees with a matching contribution for their 401(k) plan, up to a specified dollar amount or percentage. This means that if you contribute the maximum percentage or dollar amount from each paycheck that your employer will match, your employer will also contribute an equal amount to your retirement account.

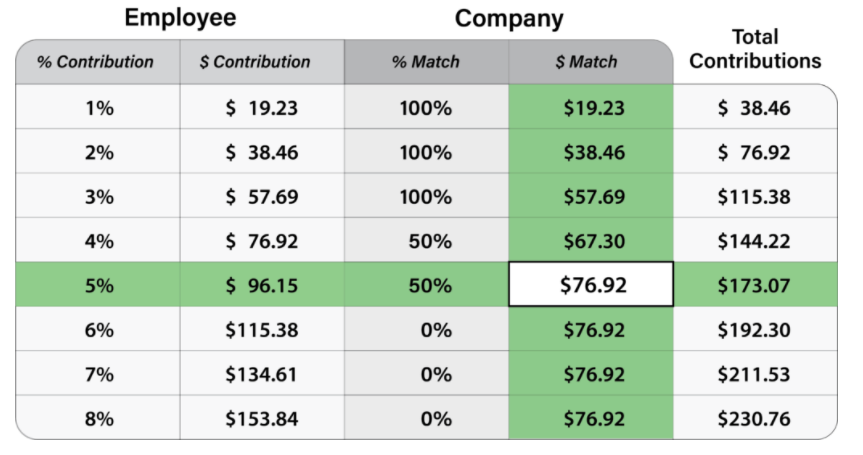

The scenario below shows a range of employee contributions made on a bi-weekly basis using a $50,000 annual salary ($1,923.07 pre-tax, per-pay):

In this case, a 5% contribution rate equates to approximately $2,000/year in match dollars alone.

Not maximizing your company match means you are walking away from free money which will cost you in the long run. You can learn more about employer match benefits and how you can quickly increase your retirement nest egg in our blog.

Take Your Money with You!

If you change jobs or retire and leave an employer who offers a 401(k), all of the money you have saved in your 401(k) can be rolled into another employer’s plan. This is called the “rule of rollovers” and offers flexibility for future changes to your life or career.

When a new career door has opened, it’s essential to evaluate your 401(k) options as you are closing the door with your previous employer. You can read more about what to do with your 401(k) when you change jobs here. While changing jobs is always an exciting adventure, it’s crucial to handle the big financial decisions that come with it so you can continue to maximize your retirement savings efforts.

401(k) plans offer many advantages and can be a great tool for growing your future savings when used correctly – the vast difference contributing one percent more annually can be huge. If you don’t already have a 401(k), consider asking your company about creating one or contributing to an existing plan if they are available in some capacity.

It may seem like such a small amount now, but years down the line this could add up to thousands of dollars! Be sure to speak with someone knowledgeable before making any big financial decisions regarding retirement plans because there are penalties associated with withdrawing funds early without meeting certain requirements.