Once again, it’s tax season! Time to gather all your paperwork and file your return. But before you do any of that, you should know a few things about the changes for the 2021 tax year.

Whether you’re a first-time filer or have been doing your taxes for years, it’s crucial to understand how these changes impact you. Things are different this year, so make sure you’re prepared! Here’s what you need to know to get started.

Deadline Change

First and foremost, we now have a few extra days to submit our tax returns. Instead of April 15, 2022, as the deadline, this year, it’s April 18, due to the observance of Emancipation Day on April 15.

Standard Deduction Increase

Standard deductions were increased for inflation and rose for the 2021 tax year.

The usual deduction generally results in more significant tax savings than itemizing does. Most Americans take the standard deduction. In 2022, when you complete your federal income tax forms for income earned in 2021, married couples will get a $25,100 standard deduction and $18,800 for heads of household. For single taxpayers, or a married couple filing separately, the basic exemption amount rises to $12,950 in 2022.

Learn more about standard deductions and what is new for retirement in 2022 in our blog.

Income Brackets Change

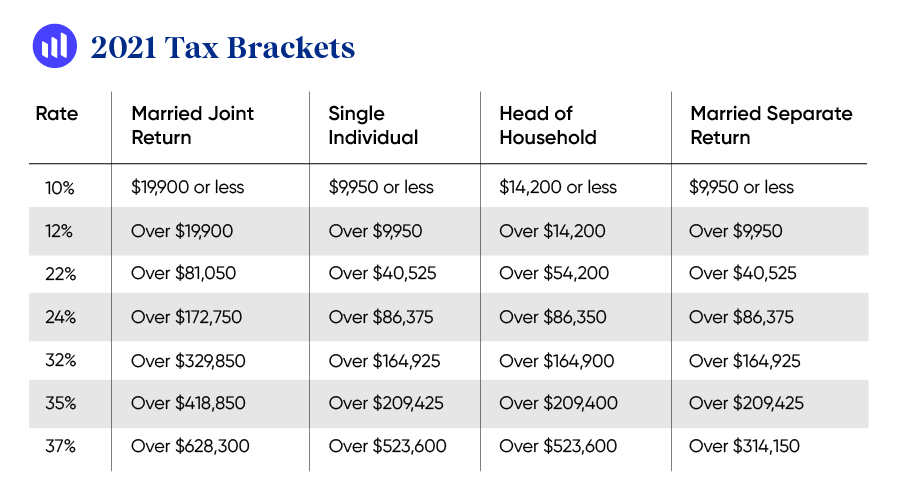

For the 2021 tax year, changes were made to the income brackets to adjust for inflation; however, the tax rates are the same.

The tax rates and brackets for 2021 are provided in the following chart.

Child Tax Credit Changes

If you received an advance payment of the Child Tax Credit in 2021, your monthly payments were either $250 per month; for children between the ages of 6 and 17. Or $300 per month for children under six.

Be sure to look out for a Letter 6419 in your mail. This is the form you’ll need to file for the rest of your child tax income credit for the 2021 tax year.

Earned Income Tax Credit Update

The earned income credit for the 2021 tax year is $1,502 to $6,728, depending on your filing status and the number of children you have. You can use your 2019 or 2021 income to compute your credit; whichever one results in a larger refund is fine.

The American Rescue Plan of 2021 includes a “lookback” option that allows you to utilize your 2019 earned income rather than your 2021 earned income when calculating the Earned Income Credit (EIC) or Additional Child Tax Credit (ACTC) on your 2021 tax return if doing so results in a larger credit.

Stimulus Check Update

Did you get stimulus payments as Economic Impact Payments? If that’s the case, keep an eye out for Letter 6475 in the mail. This letter will assist you in determining whether you qualify for and should claim the Recovery Rebate Credit on your tax year 2021 return.

Most people have already received the payments. However, if you haven’t yet received any stimulus payments, check to see if you’re qualified and whether you need to claim a 2020 or 2021 Recovery Rebate Credit.

Charitable Cash Contributions Deduction Increase

This year, the IRS raised the charitable contribution deduction. So, suppose you donated to a charity in 2021. In that case, you may still take the basic exemption and deduct up to $300 for single taxpayers and $600 for married couples.

To help you stay ahead of the curve, we’ve compiled a list of changes to be aware of before you file your taxes for 2021. However, keep in mind that this is not an exhaustive list, so it’s essential to consult with a qualified accountant or tax specialist to get the most accurate tax advice.

Check out the Slavic401k blog for more information on specific topics – we cover everything from deductions and credits to estate planning and more. We hope this gives you a good starting point – happy filing!