Saving for retirement can be the difference between financial independence and dependence later in life, which is why it’s important to plan ahead.

By contributing a portion of your income to a 401(k), Roth IRA, Traditional IRA, or other types of retirement savings accounts, you are taking steps to ensure a strong financial foundation for your post-career life.

But how much should you contribute annually? Most financial advisors will encourage you to save at least 15% of your pre-tax income each year for retirement, including employer match. While your personal target may vary, it’s important to reevaluate your savings frequently to ensure you are doing what you can to maximize your contributions.

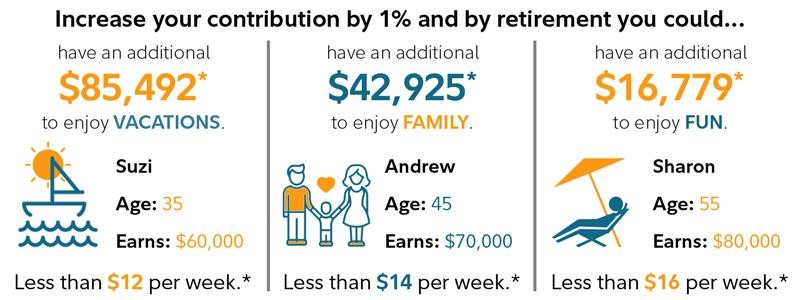

Once you’ve assessed your finances, it’s important to remember that even the smallest increases can make a big difference. Read on to learn how a 1% annual increase can change your retirement path for the better.

The Difference a 1% Increase Can Make

If you’re like most hard-working Americans, you probably have a budget that you maintain each month. You may put money aside for necessities, vacation, your children’s college fund, and more, but another category you should be tracking is your retirement savings.

Even if your budget is tight, a 1% increase to your retirement savings each year can make a difference over the next 20 to 30 years. The small increase compounds over time, and even a $100 contribution each month can grow into thousands for retirement. Review the chart below to visualize the difference.

Source: Fidelity

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

*Approximation based on a 1% increase in contribution rate. Continued employment from current age to retirement age, 67. We assume you are exactly your current age (in whole number of years) and will retire on your birthday at your retirement age. Number of years of savings equals retirement age minus current age. Nominal investment growth rate is assumed to be 5.5%. Hypothetical nominal salary growth rate is assumed to be 4% (2.5% inflation + 1.5% real salary growth rate). All accumulated retirement savings amounts are shown in future (nominal) dollars. This assumes no loans or withdrawals are taken throughout the current age to retirement age.

Your own plan account may earn more or less than this example and income taxes will be due when you withdraw from your account. Investing in this manner does not ensure a profit or guarantee against a loss in declining markets.

Investing involves risk, including the risk of loss.

If your plan allows it, consider signing up for automatic contribution increases each year. As you continue to work and earn income, the account will adjust annually and you won’t feel the difference.

Small Steps Make a Big Difference

As you can see, a little bit goes a long way, and all it takes is a little budget review. Take time to review your finances. Are there any unnecessary items you can eliminate from your monthly spending? Consider the following:

- Reduce subscriptions like Netflix, Disney+, Hulu, Spotify, or other pre-paid monthly services.

- Carpool to and from work or school to save on gas expenses.

- Buy non-perishable items in bulk (toilet paper, paper towels, dish soap, laundry detergent, etc.)

The money you save by slimming down on expenses can be added to your monthly retirement contributions. If you’re unable to make adjustments, consider earning money the following ways:

- Get a part-time job, such as driving for Uber or DoorDash.

- Tutor children or college students in a topic you’re an expert in.

- Sell goods and services online.

- If you receive a tax refund, add it to your retirement savings instead of spending it.

Again, the extra money earned from your side hustle can be contributed to your retirement accounts for additional savings.

Opening an IRA

If you are self-employed or work for a company that doesn’t offer a 401(k) in its benefits package, consider opening an IRA. While there are contribution limits from the IRS, contributing to your account regularly can help you establish a solid retirement fund.

To review the different types of IRA accounts, and to find one that fits your needs, review Investopedia’s blog.

While a 1% increase can make a difference in your overall savings when it’s time to retire, you can review your finances along the way to make sure you’re on track. Use our 401(k) contribution effects calculator to help you determine exactly how much you should be contributing to your accounts to reach your goals.

Additionally, you can utilize resources like the Slavic401k blog for tips on savings, retirement, budgeting, and more.