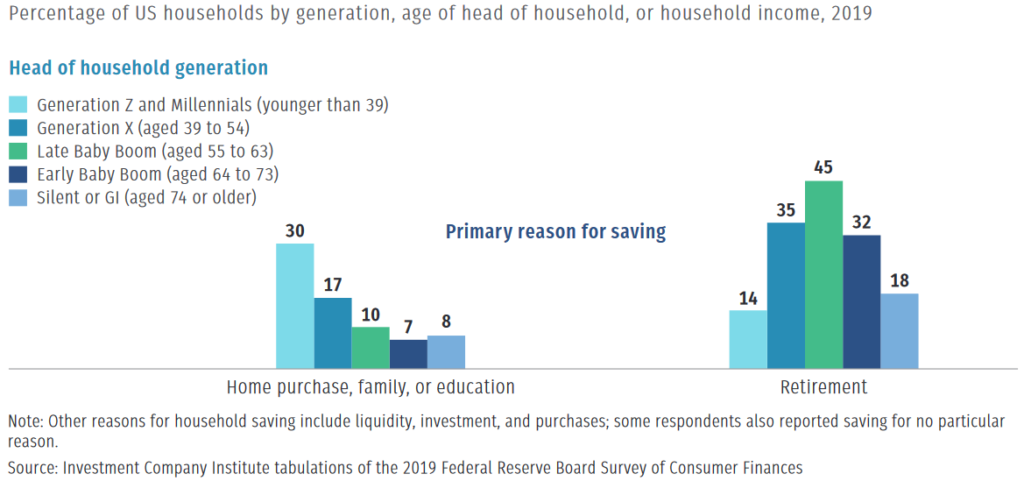

401(k)s are among the most widely used retirement savings vehicles in America, in part because millions of working adults have access to these defined contribution (DC) plans through their employer. However, 401(k)s are also very popular because many Americans can recognize the value inherent to these plans.

At least that is what an updated report from the Investment Company Institute suggests after finding that 75 percent of surveyed U.S. households had favorable impressions of 401(k)s last year.

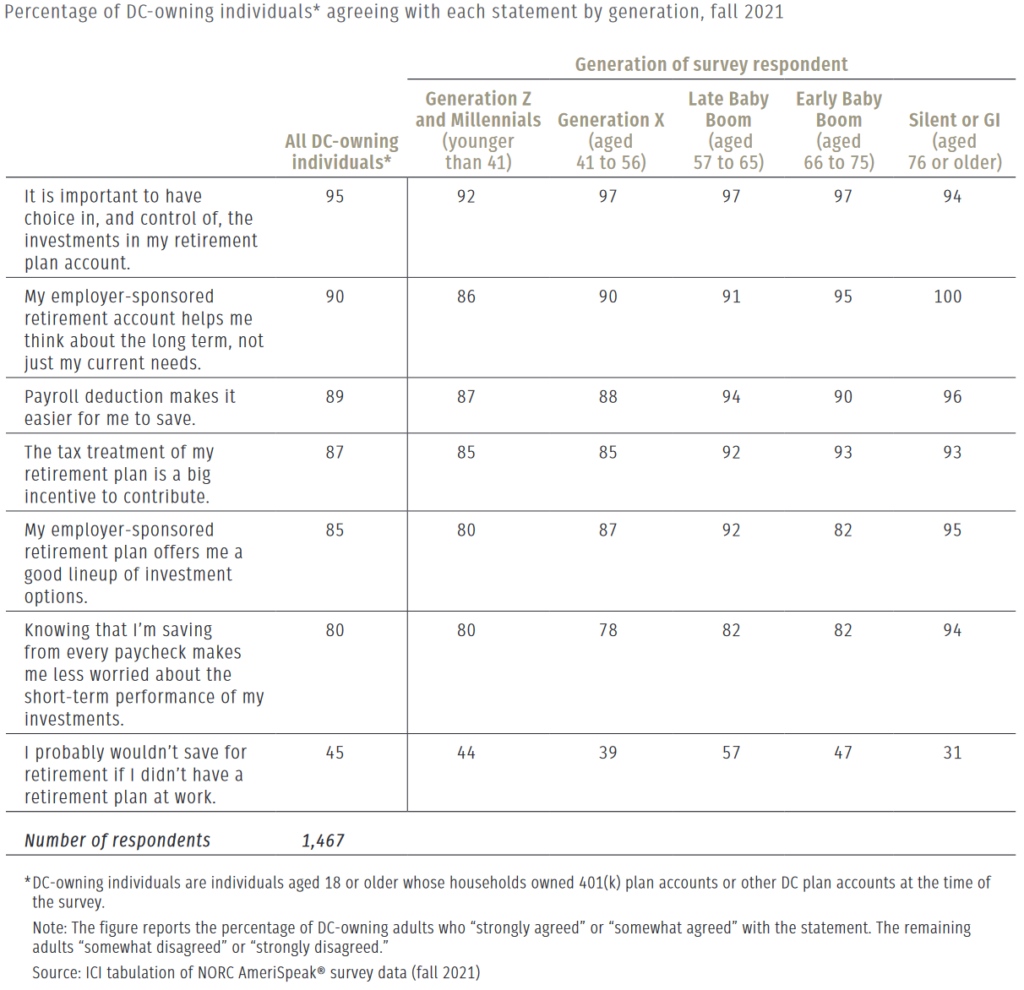

In fact, 43 percent of the households that expressed an opinion on 401(k) plans said that they had a “very favorable” impression. Such positive sentiment is not too surprising considering that nine in ten surveyed households with 401(k) accounts reported that they believe their DC plans have helped them prepare for their financial future and made it easier to set money aside for retirement. Further, nearly half (45 percent) of participants said that they believe they would likely not be saving for retirement currently if they did not have access to a 401(k).

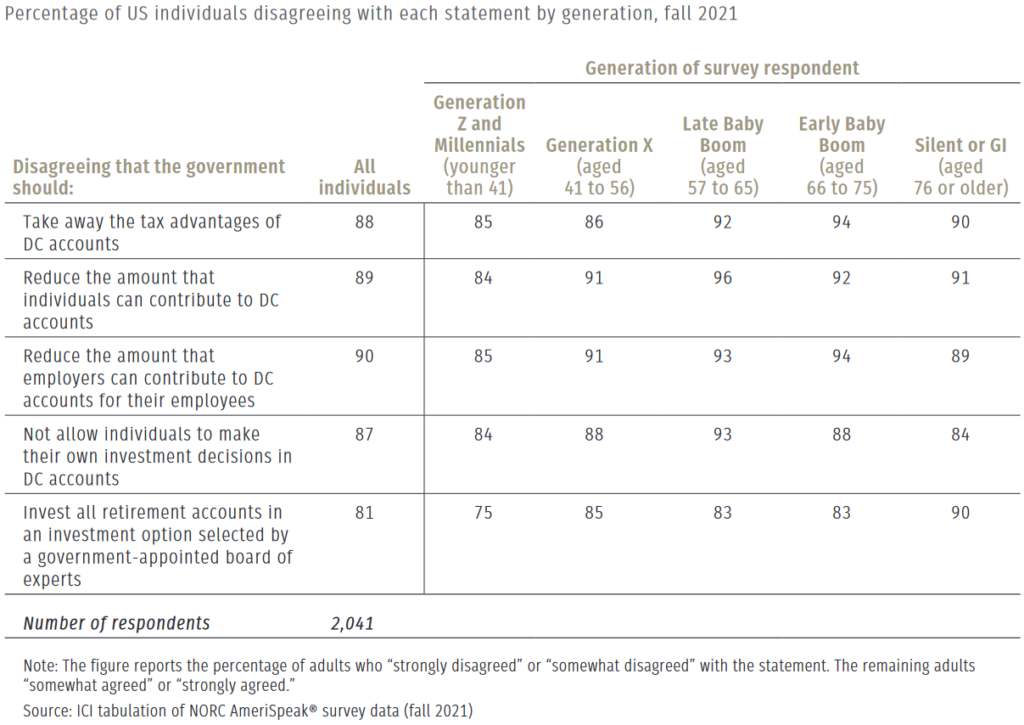

Eighty-four percent of surveyed 401(k)-owning households also reported that they believe their DC plans can help them meet their retirement goals, and 87 percent said that the unique tax treatment of these plans is a big incentive to contribute. As expected, the vast majority (88 percent) of these respondents disagreed with a suggestion that the government should reduce or take away the tax advantages of 401(k)s, and 89 percent similarly reported that they do not want to see Uncle Sam lower the amount of money that individuals can contribute to a DC account each year.

Elsewhere in the report, 80 percent of respondents said that they are less worried about stock market volatility thanks to their paycheck-by-paycheck 401(k) contributions, and 85 percent of surveyed participants indicated that they believe their plan offers a “good lineup” of investment options. The latter is encouraging given that nearly all (95 percent) surveyed households with 401(k) accounts agreed that “having choice in, and control of” the investments in their DC plans is important.

What To Watch This Week:

Monday

- Nothing significant scheduled

Tuesday

- 3-Yr Note Settlement

- 10-Yr Note Settlement

- 30-Yr Bond Settlement

- PPI-Final Demand 8:30 AM ET

- Empire State Manufacturing Index 8:30 AM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- Retail Sales 8:30 AM ET

- Import and Export Prices 8:30 AM ET

- Industrial Production 9:15 AM ET

- Business Inventories 10:00 AM ET

- Housing Market Index 10:00 AM ET

- Atlanta Fed Business Inflation Expectations 10:00 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- 20-Yr Bond Auction 1:00 PM ET

- FOMC Minutes 2:00 PM ET

Thursday

- Housing Starts and Permits 8:30 AM ET

- Jobless Claims 8:30 AM ET

- Philadelphia Fed Manufacturing Index 8:30 AM ET

- EIA Natural Gas Report 10:30 AM ET

- James Bullard Speaks 11:00 AM ET

- 2-Yr Note Announcement 11:00 AM ET

- 5-Yr Note Announcement 11:00 AM ET

- 7-Yr Note Announcement 11:00 AM ET

- 30-Yr TIPS Auction 1:00 PM ET

- Fed Balance Sheet 4:30 PM ET

- Loretta Mester Speaks 5:00 PM ET

Friday

- Existing Home Sales 10:00 AM ET

- E-Commerce Retail Sales 10:00 AM ET

- Leading Indicators 10:00 AM ET

- Quarterly Services Survey 10:00 AM ET

- Charles Evans Speaks 10:15 AM ET

- John Williams Speaks 11:00 AM ET

- Baker Hughes Rig Count 1:00 PM ET