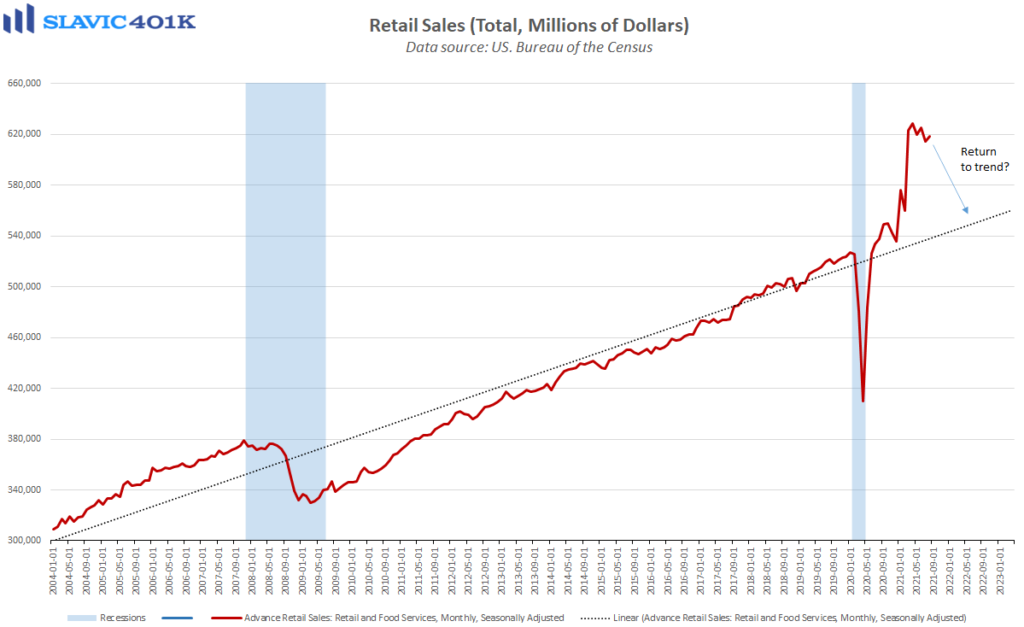

The American consumer remained resilient in the face of heightened uncertainty in August, according to the latest retail sales report from the U.S. Census Bureau.

Specifically, retail and food services sales last month totaled $618.7 billion, a 0.7 percent increase from July and significantly better than the 0.7 percent decline analysts anticipated.

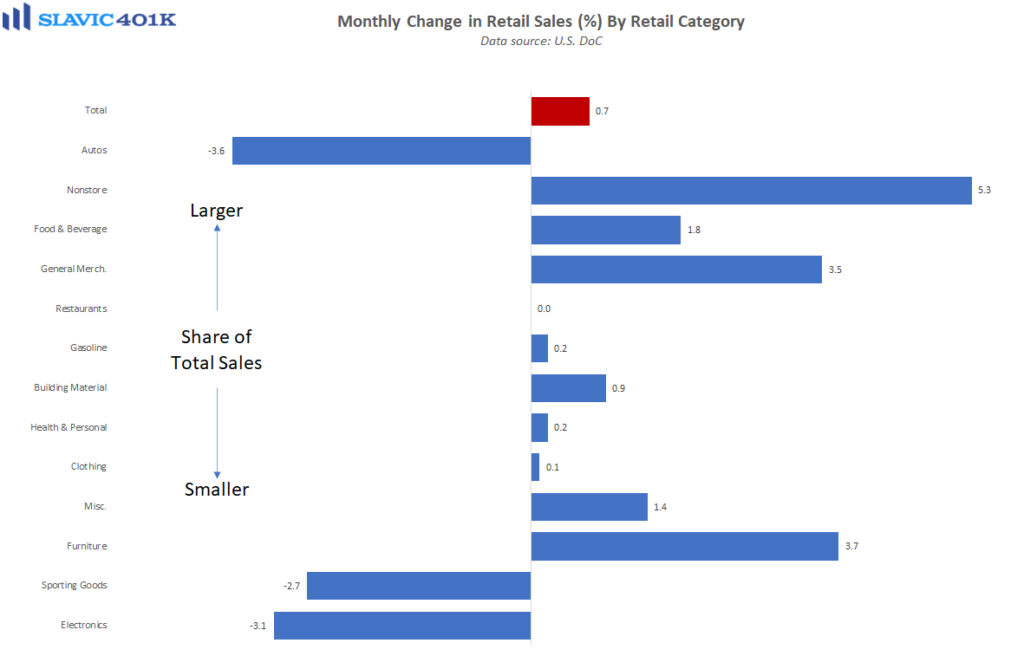

To be fair July’s headline number was revised lower, making the August gain mathematically easier to achieve, but under the hood, there were other encouraging developments. For example, large gains were seen in the categories of e-commerce, groceries, furniture, and department store spending. Solid sales growth at clothing and general merchandise stores alongside weaker electronics spending also stood out and hinted at the return of a more traditional back-to-school shopping season, i.e. a year ago households swapped spending on clothing for computers as most teaching was being conducted remotely at the time. Moreover, this August’s reversal suggests more kids are returning to the classroom this fall, a positive development for their parents and in turn the labor supply heading into the holidays.

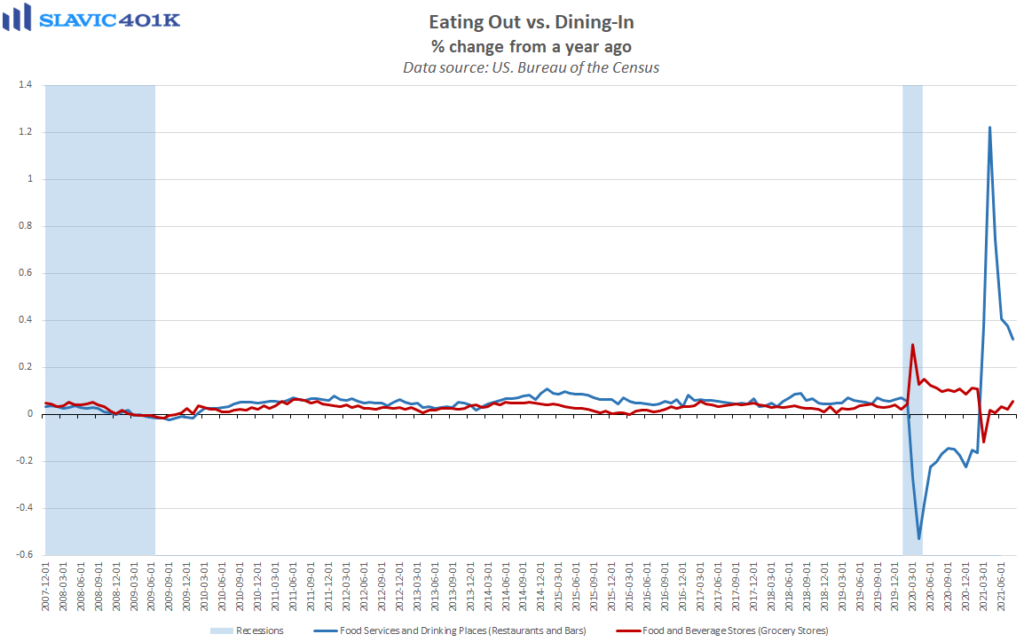

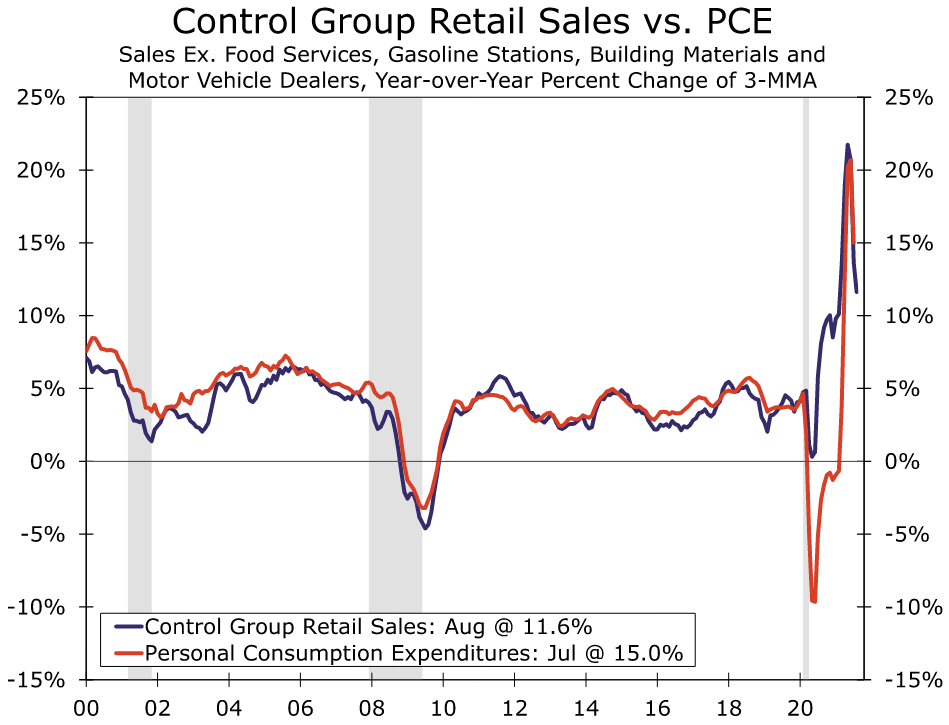

It is noteworthy that the back-to-the-classroom push was so strong even as COVID cases spiked in August due to the delta variant, which appeared to have a much more direct impact on other areas of consumer spending, e.g. restaurant sales (eating out) stalled in August while grocery store (dining in) spending jumped. Elsewhere in the report, control group retail sales, which many economists believe better track consumer demand trends by stripping out sales at food services establishments, car dealers, building-materials stores, and gasoline stations, surged by 2.5 percent in August. That was the largest gain since the final stimulus check from the government was sent out in March, and it should cause many analysts to revise their forecasts for Q3 U.S. gross domestic product (GDP) growth higher.

However, although direct checks to every American were not sent out last month, roughly $16 billion in stimulus did reach many households via the Child Tax Credit, something we alluded to in an earlier blog post and much of which likely directly contributed to the back-to-school spending bump. As a result, a key question remains how will consumption hold up once the government spigot is completely turned off? Financially there is a reason for optimism given that household balance sheets improved considerably over the past year due to a combination of increased savings, wage growth, stimulus checks, and other relief already provided by the government, along with many Americans using disposable income to pay down debt. In the near term the bigger determinants of consumer spending are therefore likely to be sentiment and the pandemic.

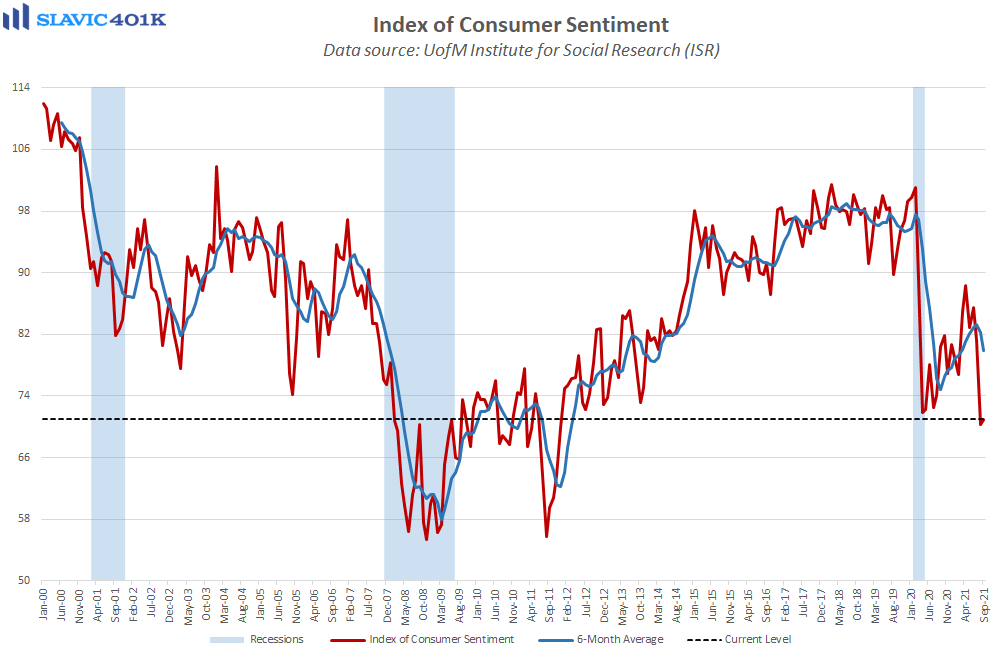

With respect to sentiment, the University of Michigan’s mid-month reading on confidence as expected improved in September after tumbling in August but the gain was minuscule and with the index still, only at 71.0, it implies that consumers are somehow still more downbeat now than they were during the heart of the lockdowns and COVID-related uncertainty in 2020. Encouragingly both the expectations component and consumers’ views of household finances improved this month while perceptions of current conditions continued to deteriorate. This suggests the pandemic remains a key driver of the recent declines in sentiment and that confidence should therefore rebound as the crisis fades. Inflation concerns are another, potentially more lasting, drag on optimism but responses from surveyed consumers suggest that they remain optimistic this too is transitory.

Indeed, surveyed Americans expect inflation to run at 4.7 percent over the next twelve months, while longer-term (5-10 years) outlooks see this retreating to 2.9 percent. The problem is of course that “transitory” can still be a long enough time to meaningfully weigh on spending. Moreover, a separate survey conducted by the Federal Reserve Bank of New York found that 42 percent of consumers believe general inflation will outpace income growth over the next 1-2 years. While a welcome decline from 46 percent in the previous month’s survey it is clear many Americans have grown concerned about the prices of the goods and services they consume. Since the bulk of the recent inflation pressures remain closely tied to COVID-related supply logjams this only strengthens the argument that the sooner the pandemic and its economic disruptions disappear the quicker we can rebuild confidence in the long-term sustainability of consumer spending.

What To Watch This Week:

Monday

- Charles Evans Speaks 8:00 AM ET

- Durable Goods Orders 8:30 AM ET

- John Williams Speaks 9:00 AM ET

- Dallas Fed Manufacturing Survey 10:30 AM ET

- 2-Yr Note Auction 11:30 AM ET

- John Williams Speaks 12:00 PM ET

- 5-Yr Note Auction 1:00 PM ET

Tuesday

- Charles Evans Speaks 9:00 AM ET

- Case-Shiller Home Price Index 9:00 AM ET

- FHFA House Price Index 9:00 AM ET

- Consumer Confidence 10:00 AM ET

- Richmond Fed Manufacturing Index 10:00 AM ET

- 7-Yr Note Auction 1:00 PM ET

- Money Supply 1:00 PM ET

- James Bullard Speaks 1:40 PM ET

- Raphael Bostic Speaks 3:00 PM ET

- James Bullard Speaks 7:00 PM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- Pending Home Sales Index 10:00 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- Survey of Business Uncertainty 11:00 AM ET

- John Williams Speaks 5:00 PM ET

Thursday

- 2-Yr Note Settlement

- 5-Yr Note Settlement

- 7-Yr Note Settlement

- 10-Yr TIPS Settlement

- 20-Yr Bond Settlement

- GDP 8:30 AM ET

- Jobless Claims 8:30 AM ET

- Chicago PMI 9:45 AM ET

- John Williams Speaks 10:00 AM ET

- EIA Natural Gas Report 10:30 AM ET

- Patrick Harker Speaks 11:30 AM ET

- Charles Evans Speaks 12:30 PM ET

- James Bullard Speaks 1:05 PM ET

- Fed Balance Sheet 4:30 PM ET

Friday

- Personal Income and Outlays 8:30 AM ET

- PMI Manufacturing Final 9:45 AM ET

- ISM Manufacturing Index 10:00 AM ET

- Construction Spending 10:00 AM ET

- Consumer Sentiment 10:00 AM ET

- Patrick Harker Speaks 11:00 AM ETBaker Hughes Rig Count 1:00 PM ET