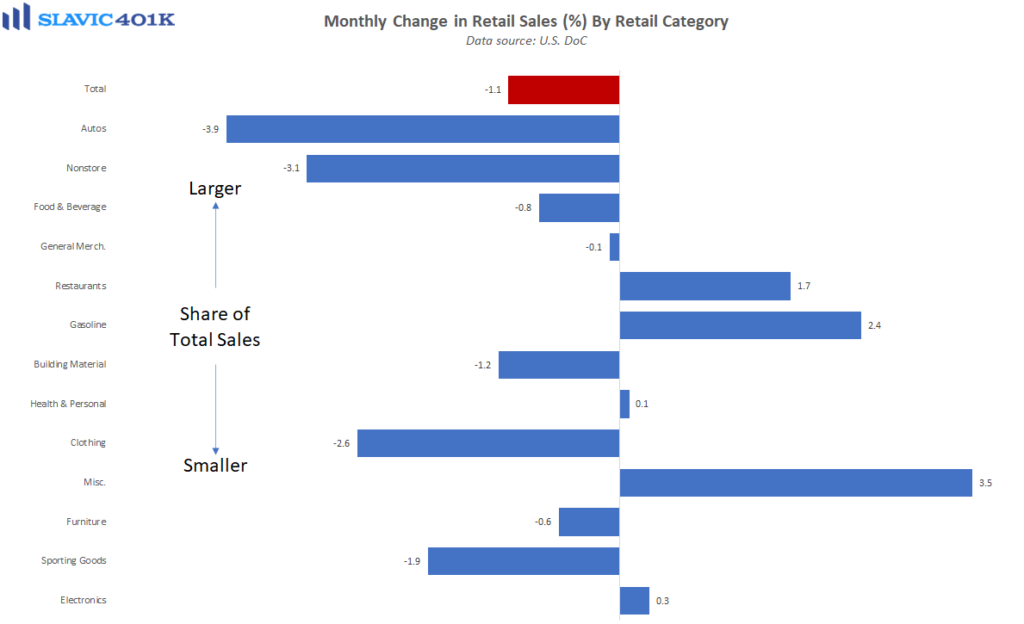

Consumer spending has cooled recently, according to new data from the U.S. Census Bureau. Specifically, retail and food services sales totaled $617.7 billion in July, down 1.1 percent from the previous month and much worse than the 0.2 percent decline analysts anticipated.

The weakness was driven by another large pullback in auto sales, which remain weighed down more by supply than demand. The rest of the report was full of mixed results but notably restaurant spending held up, a good sign for the service sector recovery that we said needs to accelerate.

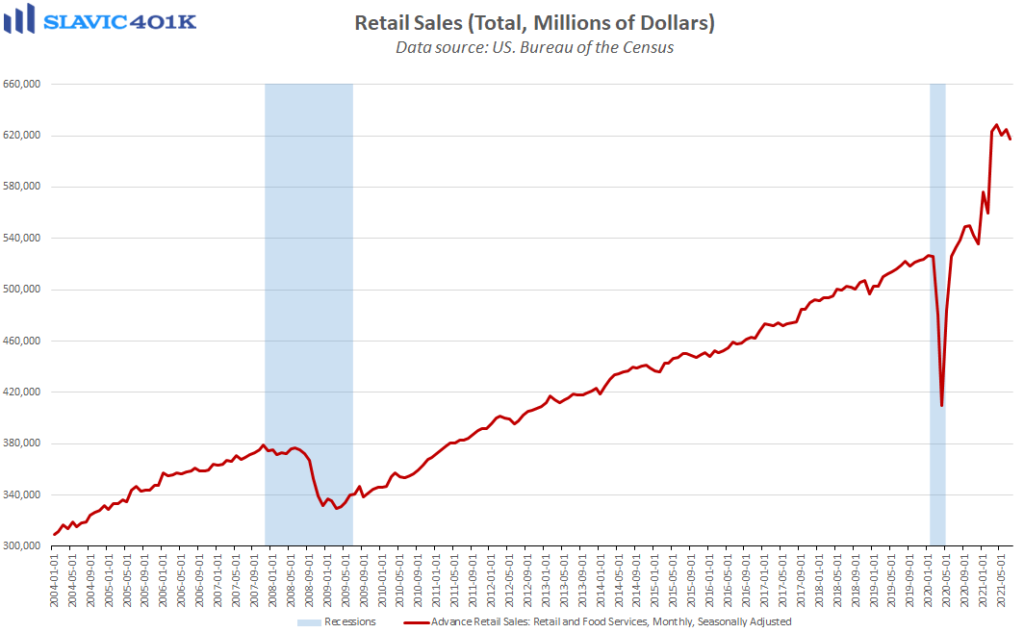

However, some of this positive momentum could fade in the near-term due to the Delta variant and related uptick in COVID cases. Indeed, higher-frequency data show that there has already been a sharp drop in consumer foot traffic at retail stores, grocery stores, restaurants, and gyms over the past month. This means when the retail sales report for August is released we could see some additional weakness in these categories alongside stabilization in online spending. Regardless, in terms of total spending dollars consumption is basically still at a record level, above the pre-pandemic baseline in every category, and sales could continue slowing for a while and remain comfortably above the 2009-2019 trend.

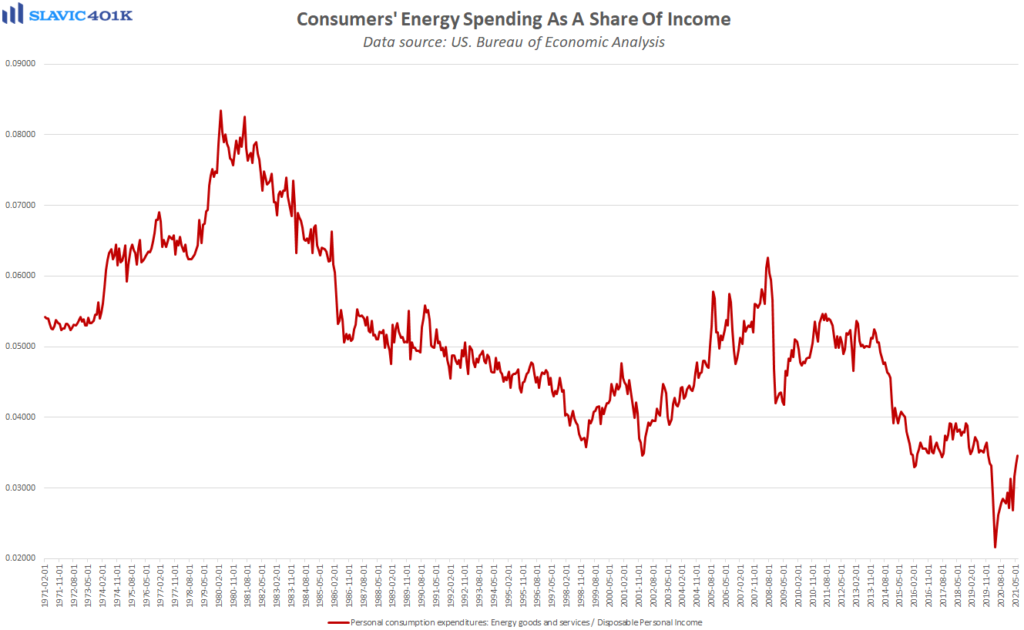

What about 2021’s uptick in inflation, could this also be a cause for consumer spending to slow going forward? Perhaps in some areas, such as driving because gasoline prices have already soared back to the highest level since 2014, although energy spending as a share of overall expenditures is still historically low. Further, it is hard to argue that inflation is already materially weighing on aggregate consumption behavior because various measures of retailer pricing power continue to suggest that businesses are able to increase prices without much pushback from customers.

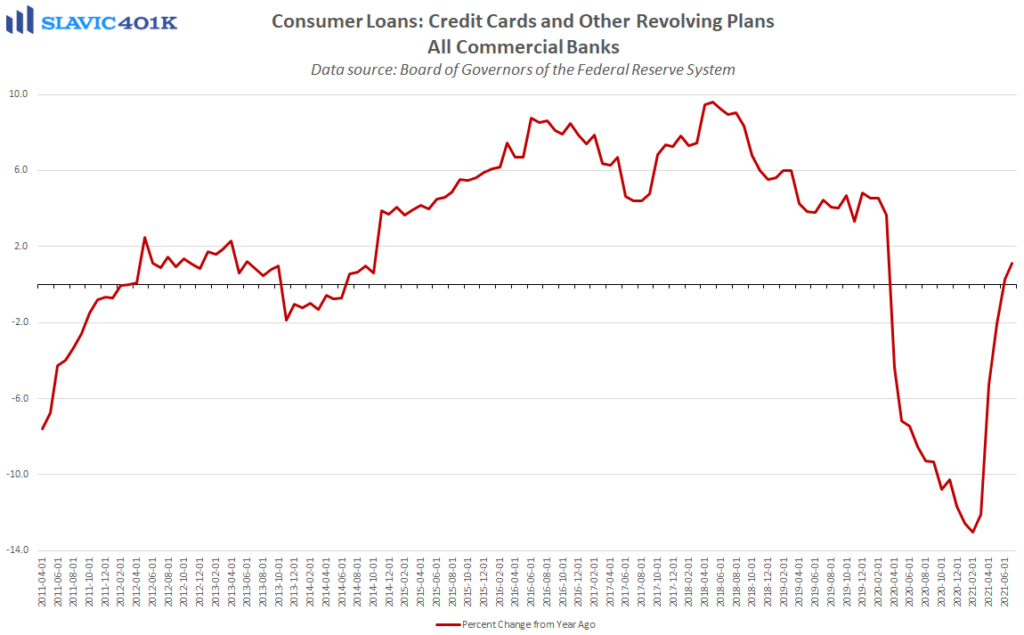

This could of course change going forward should household balance sheets start to weaken a bit. In fact, the personal savings rate has fallen considerably since the start of the year, and consumer credit utilization has jumped in recent months. Together this may imply that sustaining consumption growth will be more difficult without an accompanying pickup in income growth. However, personal savings remain elevated compared to pre-pandemic levels, and credit is by most measures still widely available, so any consumer spending slowdown resulting from these particular factors is likely still a ways off.

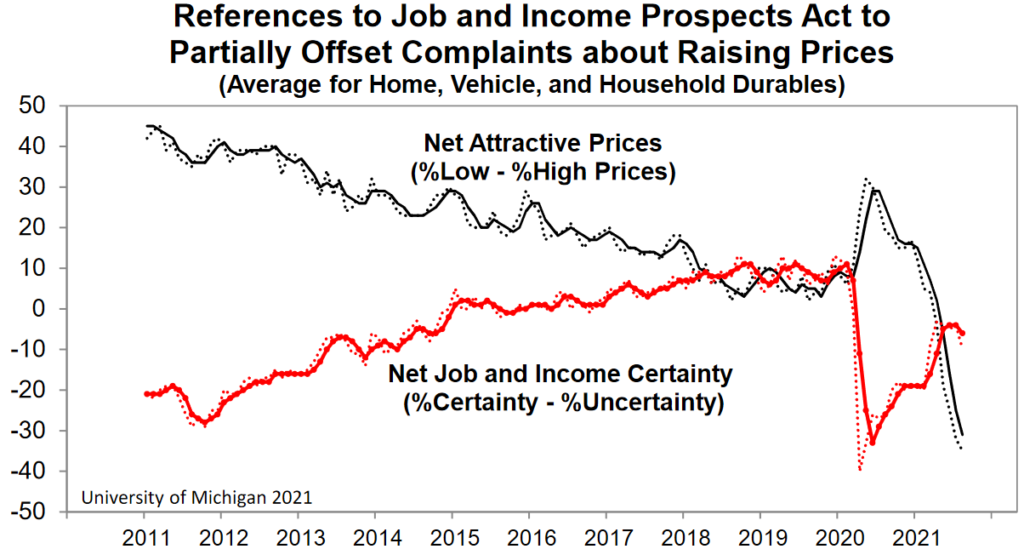

Just because consumers have yet to significantly adjust their spending behavior in response to rising prices that does not necessarily mean Americans have not noticed any increases in what they pay for goods and services. In fact, a record percentage of consumers surveyed this month by the University of Michigan said that they believe it is currently a bad time to purchase a car, home, or other expensive durable, and looking ahead consumers’ inflation expectations are now at the highest level in roughly a decade. Such concerns have offset some of the recent gains in employment and income certainty.

When considered along with the culmination of the Delta variant, a waning stimulus boost, and expiring federal unemployment benefits and eviction moratoriums, it is no surprise why headline consumer confidence plummeted this month. The decline, though, was probably overdone and overstates pessimism considering that the level the headline sentiment gauge fell to this month implies that Americans are actually less confident now than they were in April 2020 when the COVID crisis was at its peak and the entire U.S. economy was effectively shut down.

What To Watch This Week:

Monday

- Chicago Fed National Activity Index 8:30 AM ET

- PMI Composite Flash 9:45 AM ET

- Existing Home Sales 10:00 AM ET

Tuesday

- New Home Sales 10:00 AM ET

- Richmond Fed Manufacturing Index 10:00 AM ET

- 2-Yr Note Auction 1:00 PM ET

- Money Supply 1:00 PM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- Durable Goods Orders 8:30 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- Survey of Business Uncertainty 11:00 AM ET

- 2-Yr FRN Note Auction 11:30 AM ET

- 5-Yr Note Auction 1:00 PM ET

Thursday

- GDP 8:30 AM ET

- Jobless Claims 8:30 AM ET

- EIA Natural Gas Report 10:30 AM ET

- Kansas City Fed Manufacturing Index 11:00 AM ET

- 7-Yr Note Auction 1:00 PM ET

- Fed Balance Sheet 4:30 PM ET

Friday

- International Trade in Goods 8:30 AM ET

- Personal Income and Outlays 8:30 AM ET

- Retail Inventories 8:30 AM ET

- Wholesale Inventories 8:30 AM ET

- Consumer Sentiment 10:00 AM ET

- Baker Hughes Rig Count 1:00 PM ET