It was widely accepted that the Federal Reserve would start raising interest rates at some point in 2022, but the tightening timetable has been shifted forward dramatically in recent months.

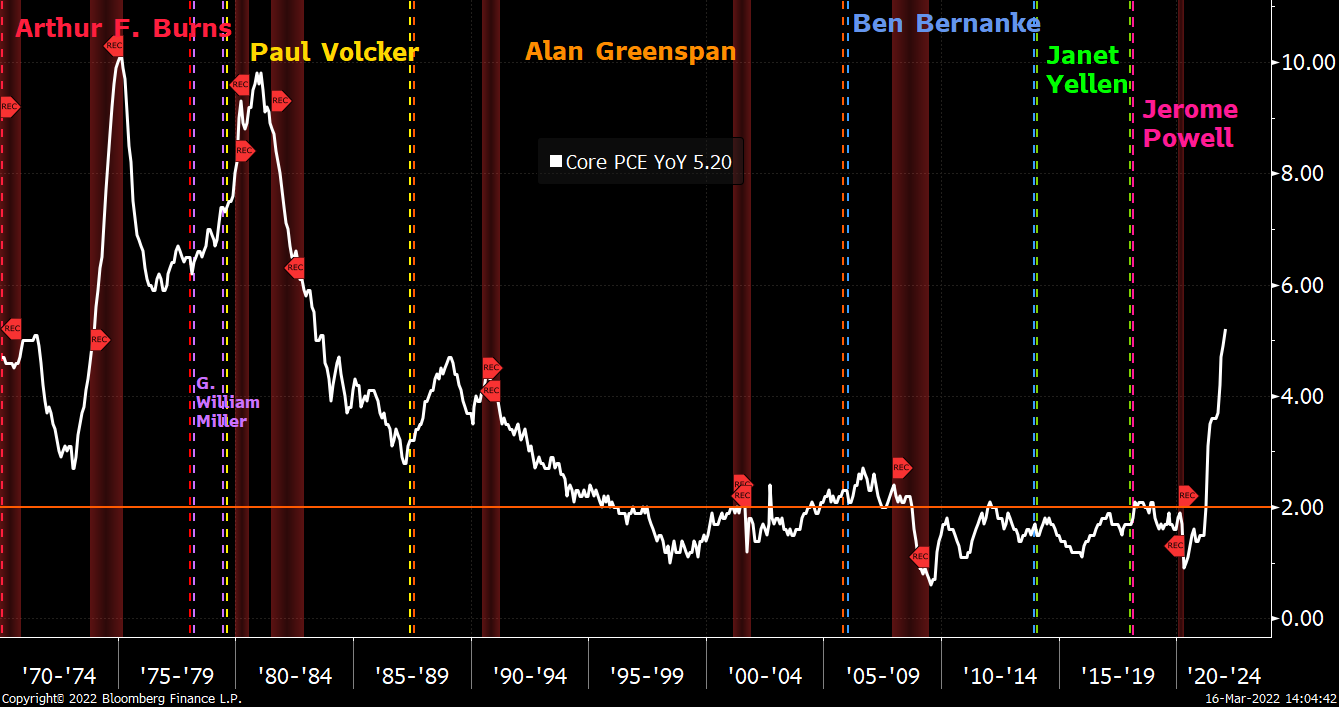

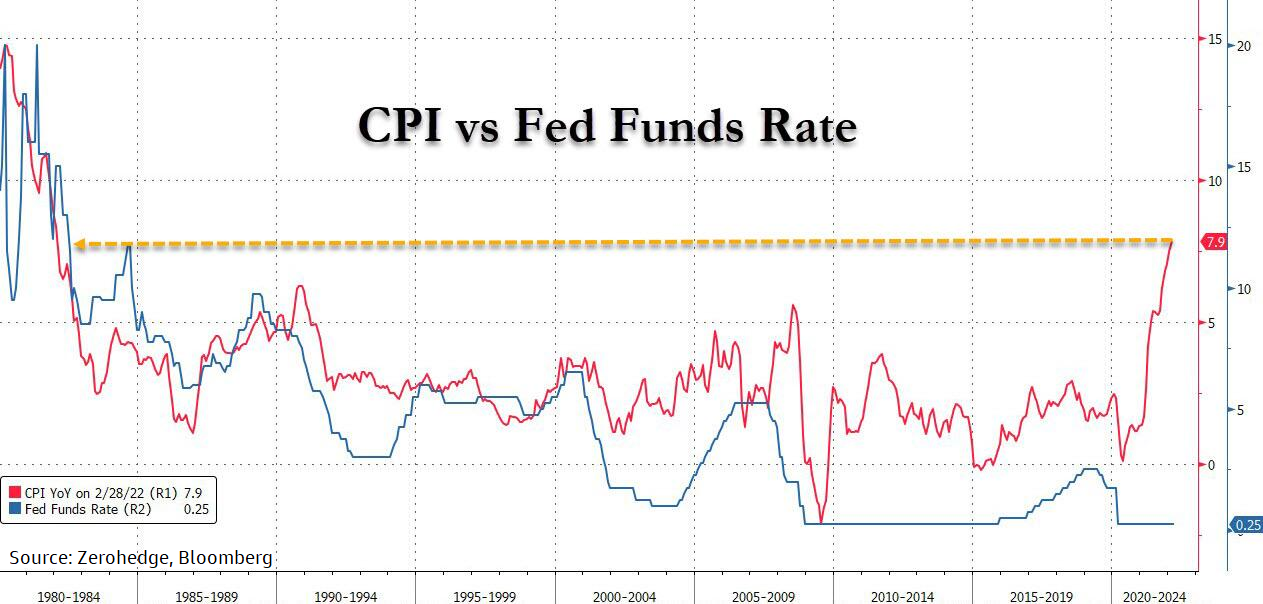

Indeed, the labor market is already close to returning to full employment, and most measures of household inflation are already at multi-decade highs before the recent energy price surge has even started to show up in the data.

With such a backdrop the Fed risks losing credibility if it tries to keep monetary policy so accommodative, and even worse letting inflation run “hot” for too long that much more significant (potentially economically disruptive) tightening measures are needed. Unsurprisingly the Federal Open Market Committee (FOMC) on Wednesday voted 8-1 to raise the Fed funds rate by 0.25 percent to 0.50 percent. That was the first interest rate hike since 2018, and the only dissenting vote was James Bullard, who would have preferred a larger 50 basis points increase. Ahead of the meeting many market participants expected a 50 basis points hike but given recent equities weakness it could be argued that the deep selloff and wild volatility have tightened financial conditions a bit and in turn helped take some pressure off of the Fed, i.e. the smaller rate increase.

The FOMC also released at this policy meeting its quarterly economic projections update. Notable highlights include that officials see gross domestic product (GDP) growth remaining positive through 2024, i.e. no recession, and the headline inflation rate cooling to 2.3 percent over the next two-and-a-half years. It may take a lot of tightening to actually hit that target and altogether policymakers currently see a total of seven rate hikes in 2022, meaning another six before yearend after last week’s 25 basis points increase. This basically implies another hike at every scheduled FOMC meeting left this year, but despite this the committee still sees median inflation ending 2022 at 4.3 percent. This is in part because the pandemic and supply difficulties are still having a lingering influence on consumer price pressures, and recent geopolitical events will only further complicate matters going forward.

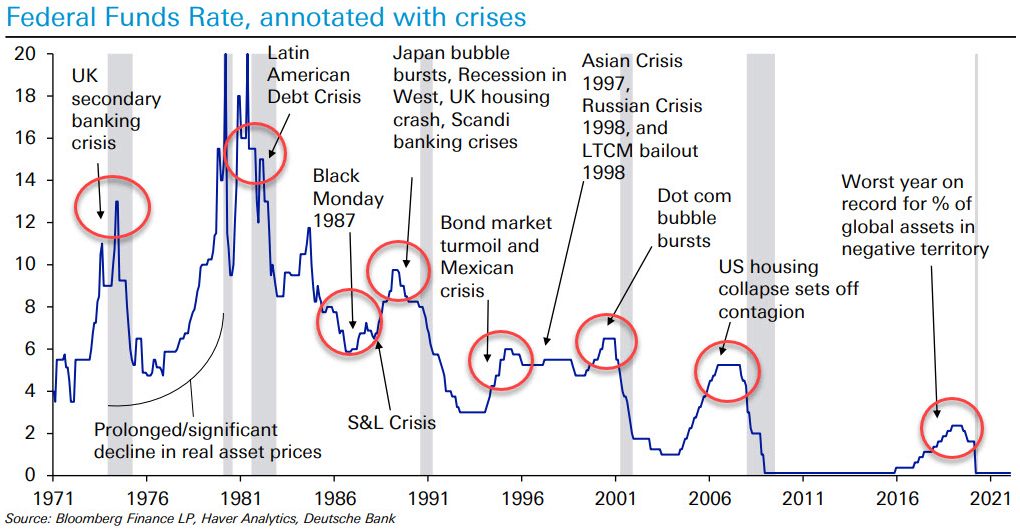

As for what to expect following the start of a new Fed tightening cycle, which will also include a shift from quantitative easing (QE) to outright quantitative tightening (QT), more market volatility, on average, would not be surprising (a theme we have outlined since last fall). As for the economic impact, this can depend in part on how quickly inflation can be brought under control, and things are further complicated by how interconnected global financial markets have become, e.g. every Fed hiking cycle in the past fifty years has led to some kind of financial crisis somewhere across the world (see above). Shifting the focus back to equities, though, the U.S. stock market’s resiliency is undeniable because despite all these tightening cycles and subsequent crises, the S&P 500 every time eventually returned to and even eclipsed prior record highs, yet another reason for retirement investors to focus on their long-term objectives rather than the day-to-day fluctuations in stock prices.

What To Watch This Week:

Monday

- Raphael Bostic Speaks 8:00 AM ET

- Chicago Fed National Activity Index 8:30 AM ET

Tuesday

- Richmond Fed Manufacturing Index 10:00 AM ET

- John Williams Speaks 10:30 AM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- New Home Sales 10:00 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- 2-Yr FRN Note Auction 11:30 AM ET

- Mary Daly Speaks 11:45 AM ET

- 20-Yr Bond Auction 1:00 PM ET

Thursday

- Durable Goods Orders 8:30 AM ET

- Jobless Claims 8:30 AM ET

- Charles Evans Speaks 9:50 AM ET

- EIA Natural Gas Report 10:30 AM ET

- Raphael Bostic Speaks 11:00 AM ET

- 2-Yr Note Announcement 11:00 AM ET

- 5-Yr Note Announcement 11:00 AM ET

- 7-Yr Note Announcement 11:00 AM ET

- Kansas City Fed Manufacturing Index 11:00 AM ET

- 10-Yr TIPS Auction 1:00 PM ET

Friday

- Consumer Sentiment 10:00 AM ET

- John Williams Speaks 10:00 AM ET

- Pending Home Sales Index 10:00 AM ET

- Baker Hughes Rig Count 1:00 PM ET