Despite significant improvements in the average household balance sheet, too many Americans still struggle to regularly set aside money for retirement and other major expenses.

An updated poll conducted by Fidelity Investments, though, suggests that a lot of people are determined to do a better job of saving in 2022.

Source: Fidelity

Specifically, 68 percent of surveyed U.S. adults said that they plan on making at least one financial resolution for the new year, and 43 percent reported that “saving more” is a top goal. Roughly the same proportion of respondents (41 percent) also pledged to reduce their debt load in 2022, and nearly a third (31 percent) said they intend to cut back on discretionary spending. Compared to traditional New Year’s resolutions like exercising more, eating healthy, or some other type of self-improvement, surveyed Americans were significantly more likely to prefer committing to a money-related goal in 2022. When asked what motivates them to prioritize finances in the year ahead, the top responses were achieving a greater peace of mind, being able to live debt-free, and eliminating general financial worry.

Source: Fidelity

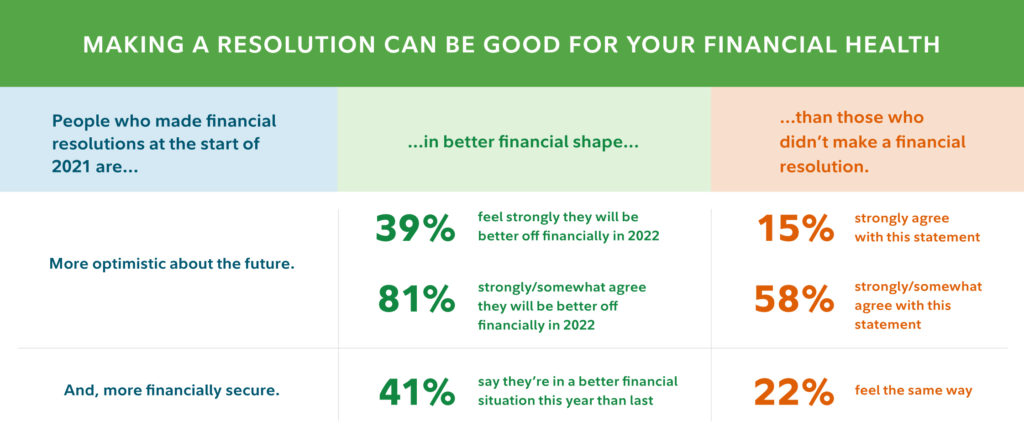

Forty-nine percent of surveyed adults said that they intend to build up their emergency fund in 2022, while the rest cited plans to focus more on saving for long-term financial objectives in the new year, e.g. increasing the amount of money regularly set aside for retirement. In fact, 62 percent of surveyed young adults said that they plan to boost their routine retirement contributions in 2022, an encouraging attitude since the earlier one starts planning and saving for old age the better. Many surveyed Americans did cite inflation is a major concern in the new year, but six in ten respondents still said that they feel optimistic about the future. Actually following through on a financial resolution is of course another issue, but the likelihood of Americans in this poll being able to do so appears high with 72 percent of respondents saying that they are confident they will be in a better financial position in 2022, clearly a reflection of elevated confidence in the labor market and future earnings power.

Source: Fidelity

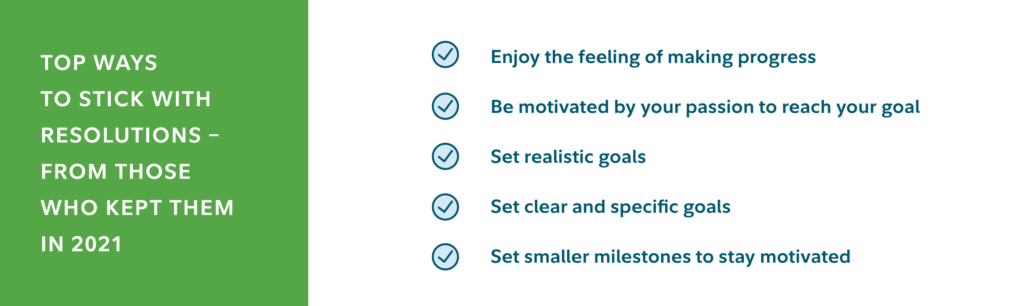

More generally, though, sticking to any New Year’s resolution can be challenging, and several surveyed Americans indeed admitted that they failed to follow through on their financial goals in 2021. As for the resolution setters in past surveys who were successful, one common thing that appeared to help was working with an advisor because more than three-quarters (77 percent) of surveyed Americans in the previous year’s poll who said that they regularly consulted with a financial professional reported being able to stick to their financial resolutions, compared to just 50 percent among those who did not work with an advisor. Other common advice recommended by those who achieved their financial resolutions include making sure that the New Year’s goals are clearly-defined and achievable, along with utilizing small milestones and general progress tracking to stay motivated over the course of the year.

What To Watch This Week:

Monday

- Raphael Bostic Speaks 12:00 PM ET

Tuesday

- NFIB Small Business Optimism Index 6:00 AM ET

- Esther George Speaks 9:30 AM ET

- Jerome Powell Speaks 10:00 AM ET

- 3-Yr Note Auction 1:00 PM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- CPI 8:30 AM ET

- Atlanta Fed Business Inflation Expectations 10:00 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- 10-Yr Note Auction 1:00 PM ET

- Beige Book 2:00 PM ET

Thursday

- Patrick Harker Speaks 8:00 AM ET

- Jobless Claims 8:30 AM ET

- PPI-Final Demand 8:30 AM ET

- Lael Brainard Speaks 10:00 AM ET

- EIA Natural Gas Report 10:30 AM ET

- 10-Yr TIPS Announcement 11:00 AM ET

- 20-Yr Bond Announcement 11:00 AM ET

- Charles Evans Speaks 1:00 PM ET

- 30-Yr Bond Auction 1:00 PM ET

Friday

- Retail Sales 8:30 AM ET

- Import and Export Prices 8:30 AM ET

- Industrial Production 9:15 AM ET

- Business Inventories 10:00 AM ET

- Consumer Sentiment 10:00 AM ET

- John Williams Speaks 11:00 AM ET

- Baker Hughes Rig Count 1:00 PM ET