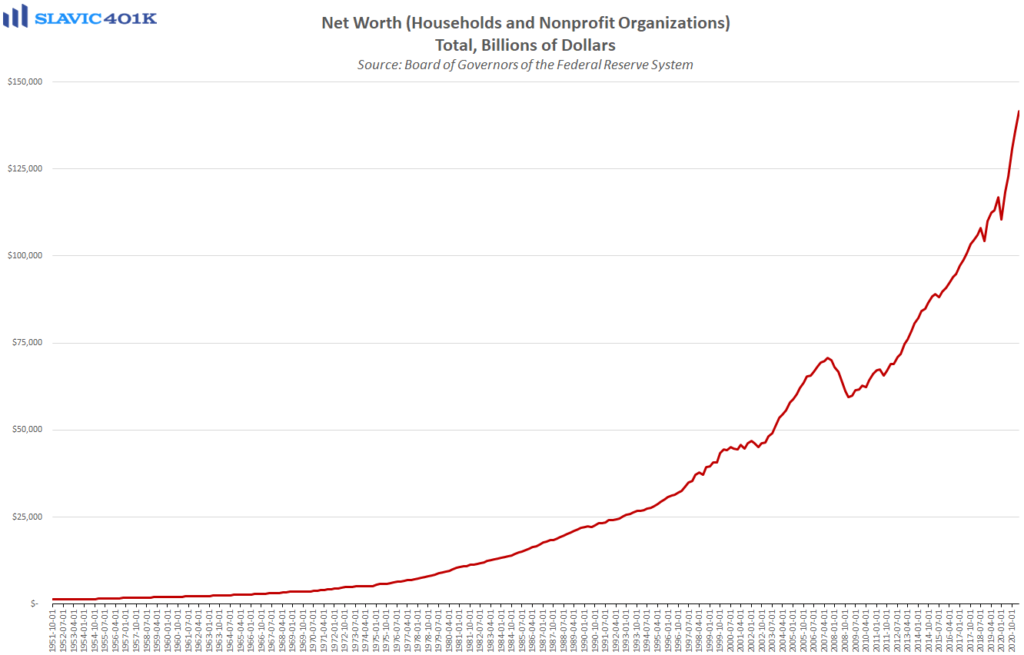

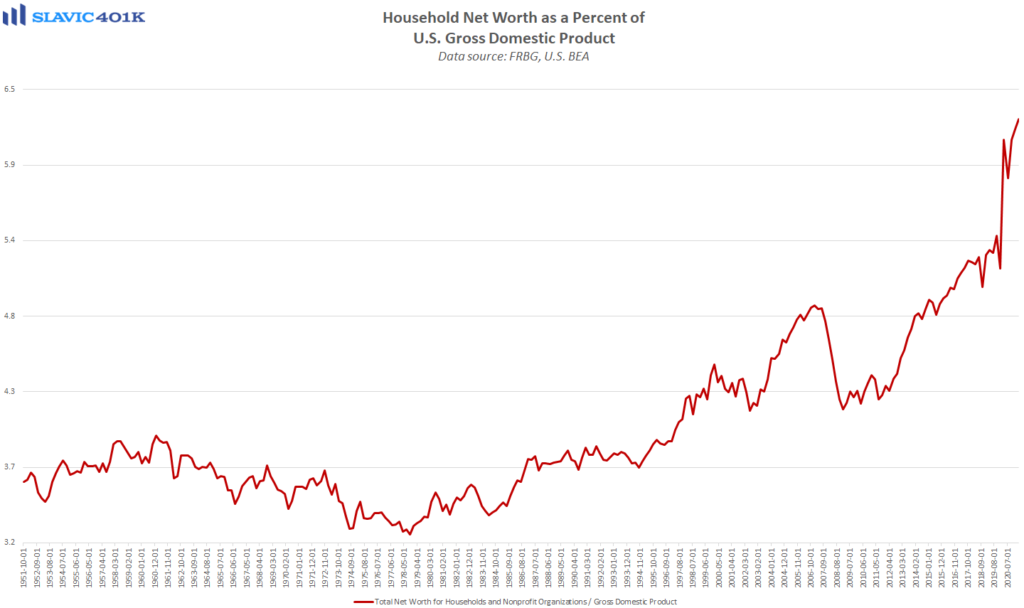

The Federal Reserve recently released the Flow of Funds (Z.1) data for the second quarter of 2021. Among the many things contained within the report, the Fed revealed that U.S. household (and non-profit group) net worth rose by $5.8 trillion in Q2 to a total of $141.7 trillion, a 4.3 percent quarter-over-quarter jump and a new all-time high.

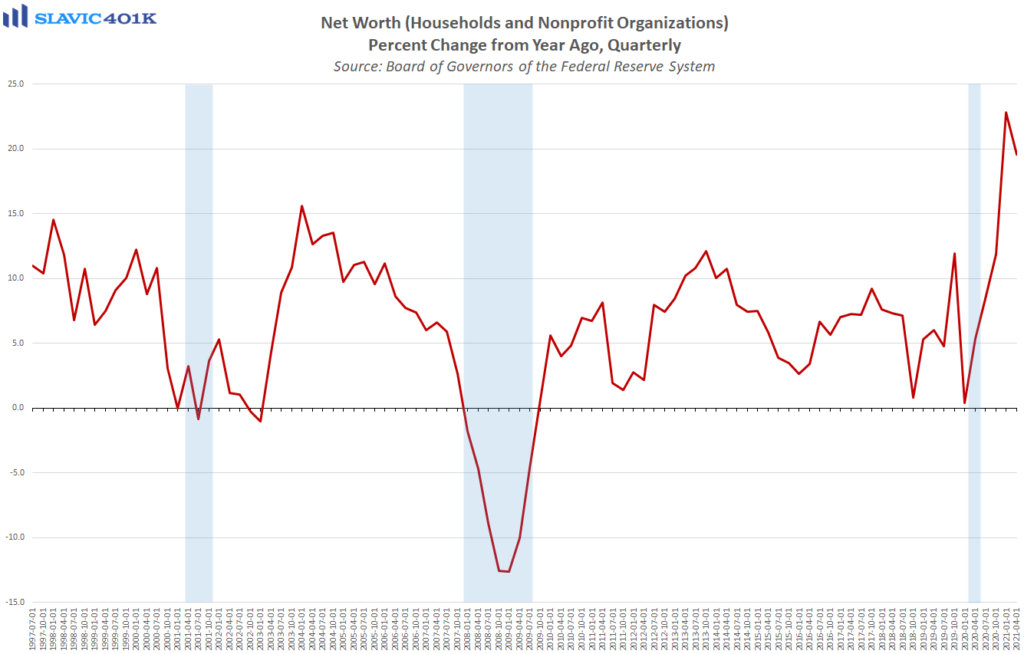

Compared to this same period last year total net worth surged by 19.6 percent in Q2, a big rebound after nearly grinding to a halt in Q1 2020. The second quarter’s gain was in part driven by real estate, which expanded by a record $1.2 trillion as residential real estate, the biggest asset for many Americans, benefited from home values continuing to appreciate at an accelerating rate.

An even larger driver of the second quarter’s significant increase in net worth was the $3.5 trillion rise in the value of corporate equities, not surprising considering the benchmark S&P 500 index rose by 8.2 percent in Q2, the 5th quarterly gain in a row since the Q1 2020 market crash. The second quarter increase also helped lift the equity share as a percentage of total household assets to 29.5 percent, up from 25.6 percent in 2019 (pre-pandemic) and therefore a sign that more Americans are participating in the market rally. This number will likely be shown to have improved once again after the Q3 2021 Z.1 data is released because despite the September spike in volatility the S&P 500 still managed to end the third quarter with a 0.23 percent gain.

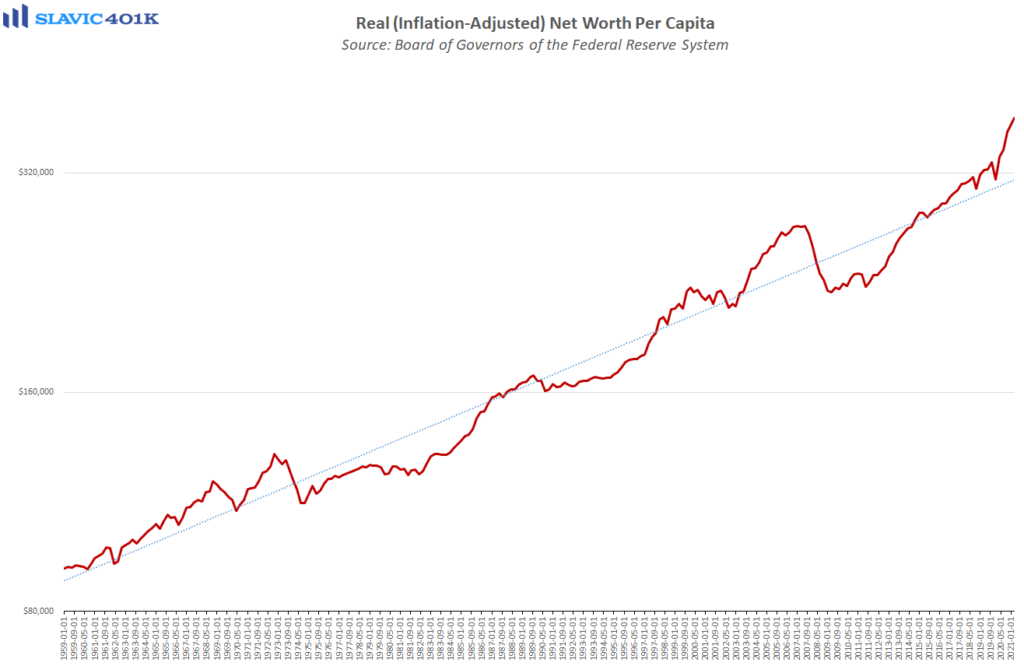

Worrying about such short-term changes in stock valuations, though, is unproductive because real wealth creation typically occurs over a much longer time horizon since this allows investors to therefore benefit from decades of growth, via diversified exposure to stocks, and capitalize on the resiliency of the market. One of the best ways to participate is through the use of a 401(k) retirement plan, which provides a variety of tax advantages and in many cases can be augmented by an employer’s matching contributions. Moreover, consistent participation in such a plan, especially when combined with dollar-cost averaging and regularly working with a professional financial advisor, can help investors navigate volatile markets and in some cases even turn large drawdowns into opportunities.

Perhaps more importantly, the sooner one can start saving and investing for retirement the better. This is evidenced by an earlier J.P. Morgan analysis which estimated that a hypothetical 25-year-old with an income of $50,000 will need to set aside 9 percent of his or her annual pay every year in order to be financially prepared for retirement. The required savings rate jumps to 20 percent if the person waits until age 40 to start setting money aside, and 41 percent if procrastination continues until age 50. For higher income individuals even greater percentages of their income will need to be saved each year if they intend to maintain a retirement lifestyle equivalent to when they were working.

What To Watch This Week:

Monday

- James Bullard Speaks 10:00 AM ET

- Eric Rosengren Speaks 10:00 AM ET

- Factory Orders 10:00 AM ET

Tuesday

- International Trade in Goods and Services 8:30 AM ET

- PMI Composite Final 9:45 AM ET

- ISM Services Index 10:00 AM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- ADP Employment Report 8:15 AM ET

- Raphael Bostic Speaks 9:00 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- Raphael Bostic Speaks 11:30 AM ET

Thursday

- Challenger Job-Cut Report 7:30 AM ET

- Jobless Claims 8:30 AM ET

- EIA Natural Gas Report 10:30 AM ET

- 3-Yr Note Announcement 11:00 AM ET

- 10-Yr Note Announcement 11:00 AM ET

- 30-Yr Bond Announcement 11:00 AM ET

- Consumer Credit 3:00 PM ET

Friday

- Employment Situation 8:30 AM ET

- Baker Hughes Rig Count 1:00 PM ET