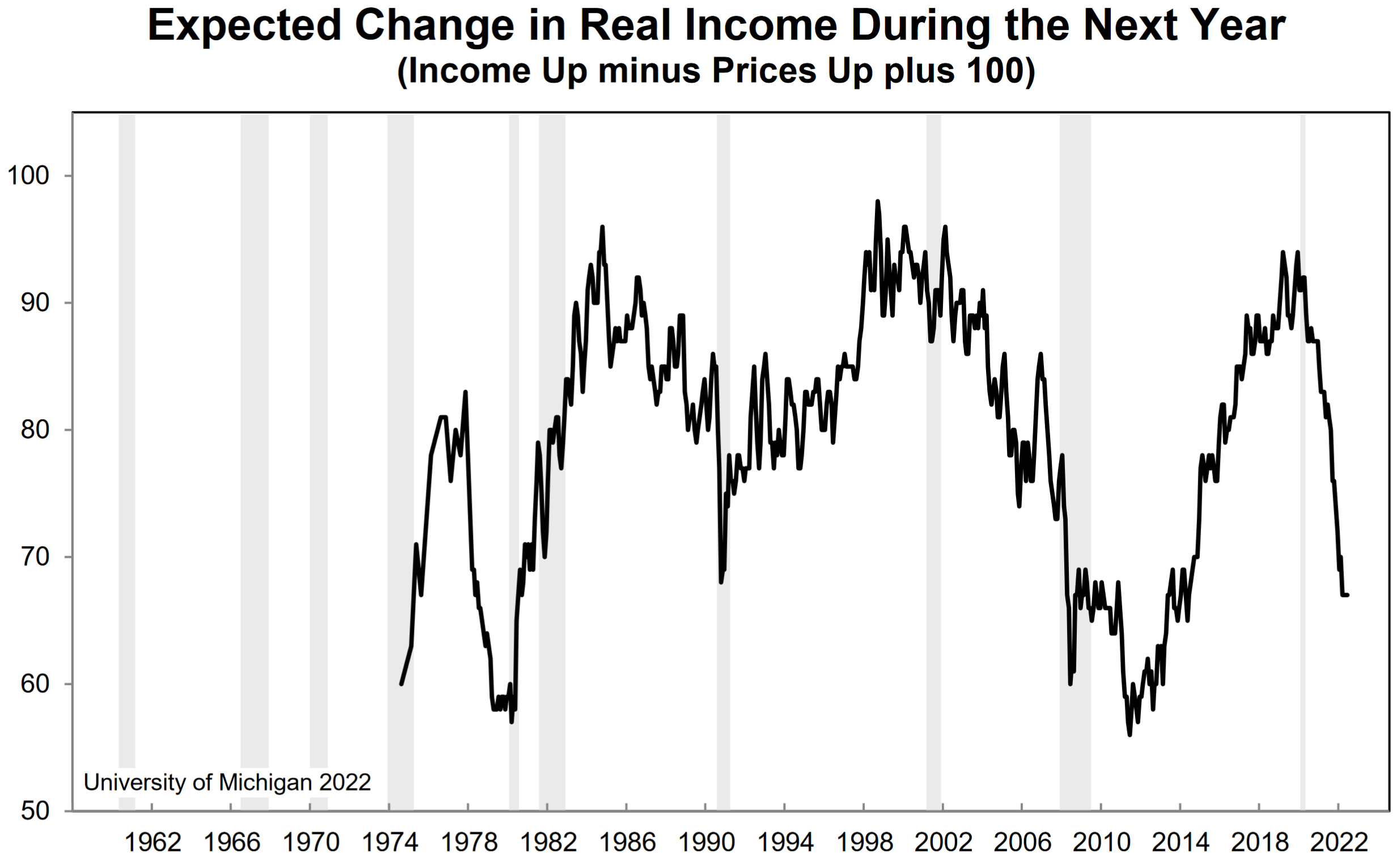

The University of Michigan’s consumer confidence index fell sharply in the first half of June. Deteriorating assessments of personal finances contributed significantly to the headline decrease in the sentiment gauge, and 46 percent of consumer respondents attributed their more pessimistic outlook to inflation.

Since 1981 only the Great Recession has seen a greater share of surveyed Americans citing concerns about rising prices. The recent spike in gasoline costs was responsible for the bulk of respondents’ immediate inflation troubles, and surveyed consumers expect gas prices to continue to rise by a median of 25 cents over the next 12 months, more than double the year-ahead expectations recorded in the May poll. Also of note a majority of respondents spontaneously mentioned supply shortages as a concern, the 9th consecutive month such worries were expressed by surveyed Americans.

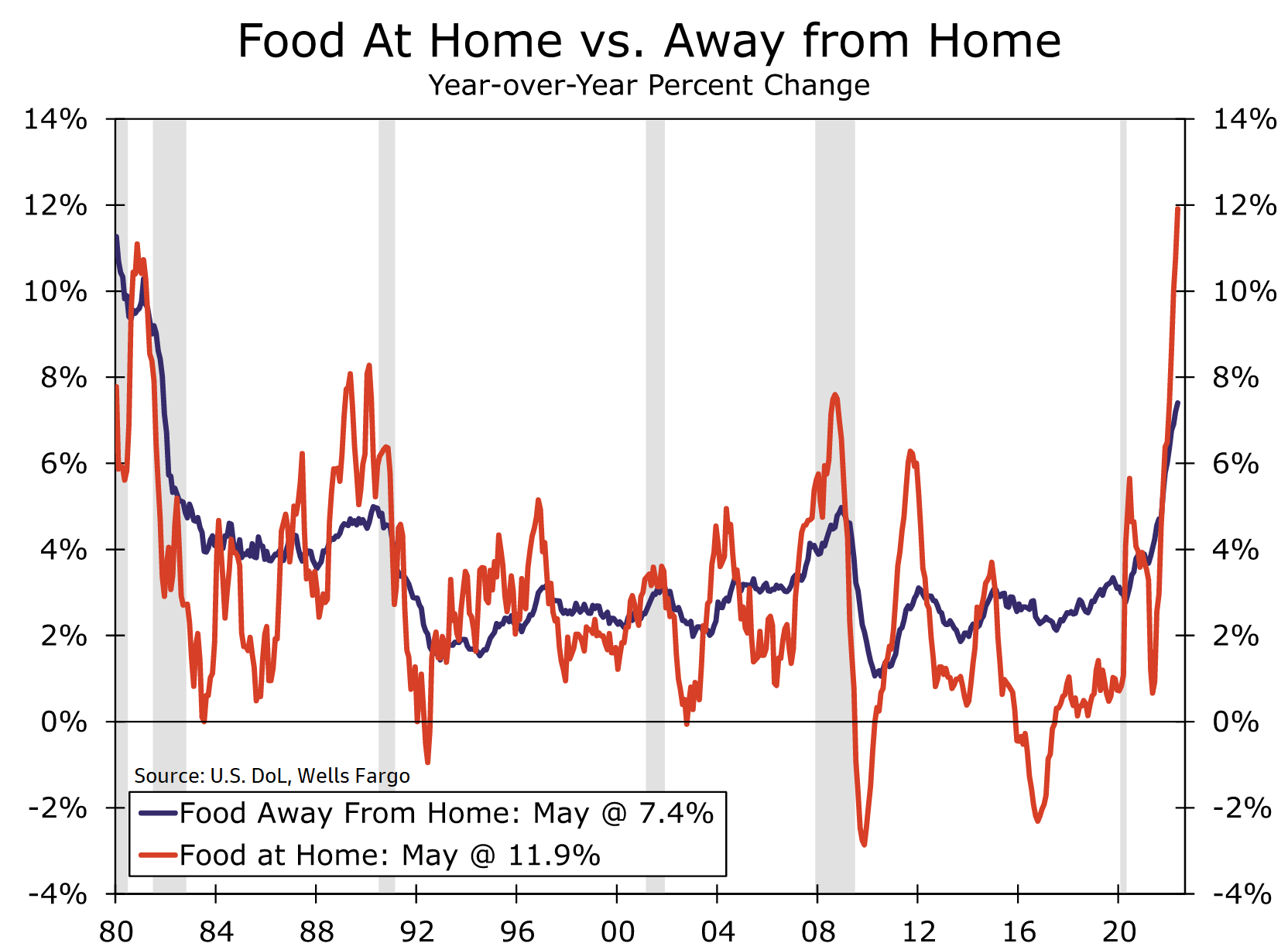

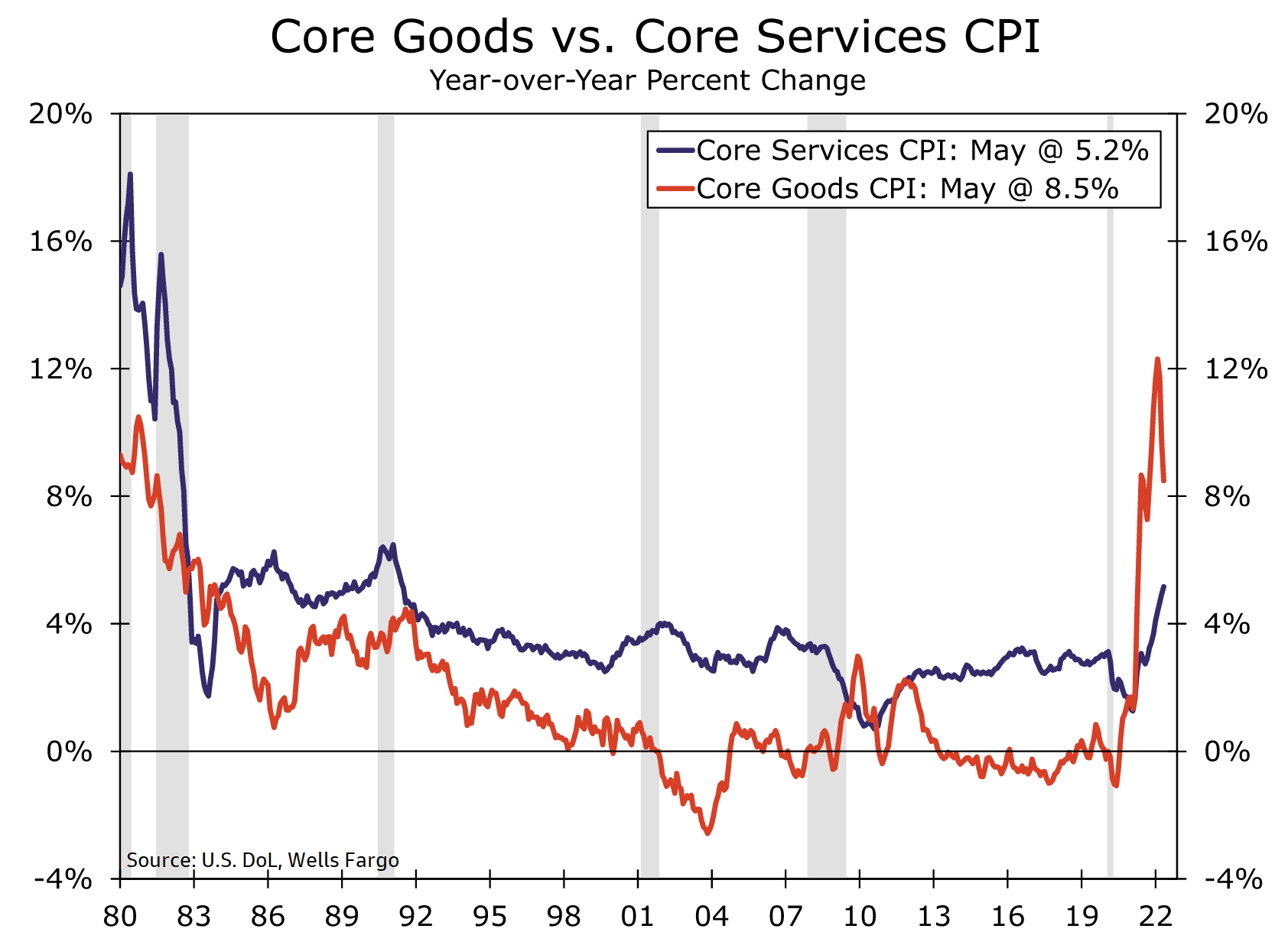

The latest update to the consumer price index from the U.S. Labor Department largely confirms that Americans are not simply imagining the higher prices at the pump, the grocery store, and elsewhere. Specifically, headline CPI rose by 1.0 percent in May, the 24th monthly increase in a row and more than triple the April gain. Under the hood almost every major price component increased during the month of May, but the largest contributors to the rise in the index were the costs for shelter, airline fares, used cars and trucks, and new vehicles. Sizable increases in the prices of medical care, household furnishings, recreation, and apparel were also recorded in May. While the surge in goods costs may be showing signs of slowing, the costs of services as we predicted last year are accelerating and are now rising at their fastest pace since 1991. Further, we suggested that shelter costs would be a big driver of inflation in 2022, and this was confirmed by rents gaining 5.2 percent in May, a record high.

Energy prices have also been on a tear recently, and if the White House had taken a more serious approach to increasing energy production in January the resulting gains in output would likely be coming online right around now. If one wanted to find a “bright spot” in this report it would be core CPI, which excludes the more volatile food and energy components, because this metric rose at the same pace as in April. That lack of an acceleration is a small but welcome positive, and it is worth noting that the PCE price index, the Federal Reserve’s preferred measure of inflation, will be released later this month and based on the way it is calculated should not appear as alarming as the CPI report. Moreover, as the post-pandemic economy continues to normalize we still see economic forces becoming more deflationary going forward. However, we really need to see some improvement over the next few months (reports) or the Fed may get impatient under the pressure and even be forced to get more aggressive with its tightening efforts.

What To Watch This Week

Monday

- S. Holiday: Juneteenth Observed

- Banks and Federal Offices Closed

- Stock Market Open

- Bond Market Closed

Tuesday

- Chicago Fed National Activity Index 8:30 AM ET

- Existing Home Sales 10:00 AM ET

Wednesday

- Jerome Powell Speaks

- MBA Mortgage Applications 7:00 AM ET

- 2-Yr FRN Note Auction 11:30 AM ET

- Charles Evans Speaks 12:50 PM ET

- 20-Yr Bond Auction 1:00 PM ET

- Patrick Harker Speaks 1:30 PM ET

- Thomas Barkin Speaks 1:30 PM ET

Thursday

- Jobless Claims 8:30 AM ET

- PMI Composite Flash 9:45 AM ET

- EIA Natural Gas Report 10:30 AM ET

- EIA Petroleum Status Report 11:00 AM ET

- 2-Yr Note Announcement 11:00 AM ET

- 5-Yr Note Announcement 11:00 AM ET

- 7-Yr Note Announcement 11:00 AM ET

- Kansas City Fed Manufacturing Index 11:00 AM ET

- 5-Yr TIPS Auction 1:00 PM ET

- Fed Balance Sheet 4:30 PM ET

Friday

- 2-Yr FRN Note Settlement

- New Home Sales 10:00 AM ET

- Consumer Sentiment 10:00 AM ET

- Baker Hughes Rig Count 1:00 PM ET