Volatility may not be going away anytime soon. Wars are inherently long-term events. Fed rate height cycles tend to be the same thing, so I think we have to confront the reality that the next 18 to 24 months are going to be a process of events that need to be digested by the market.

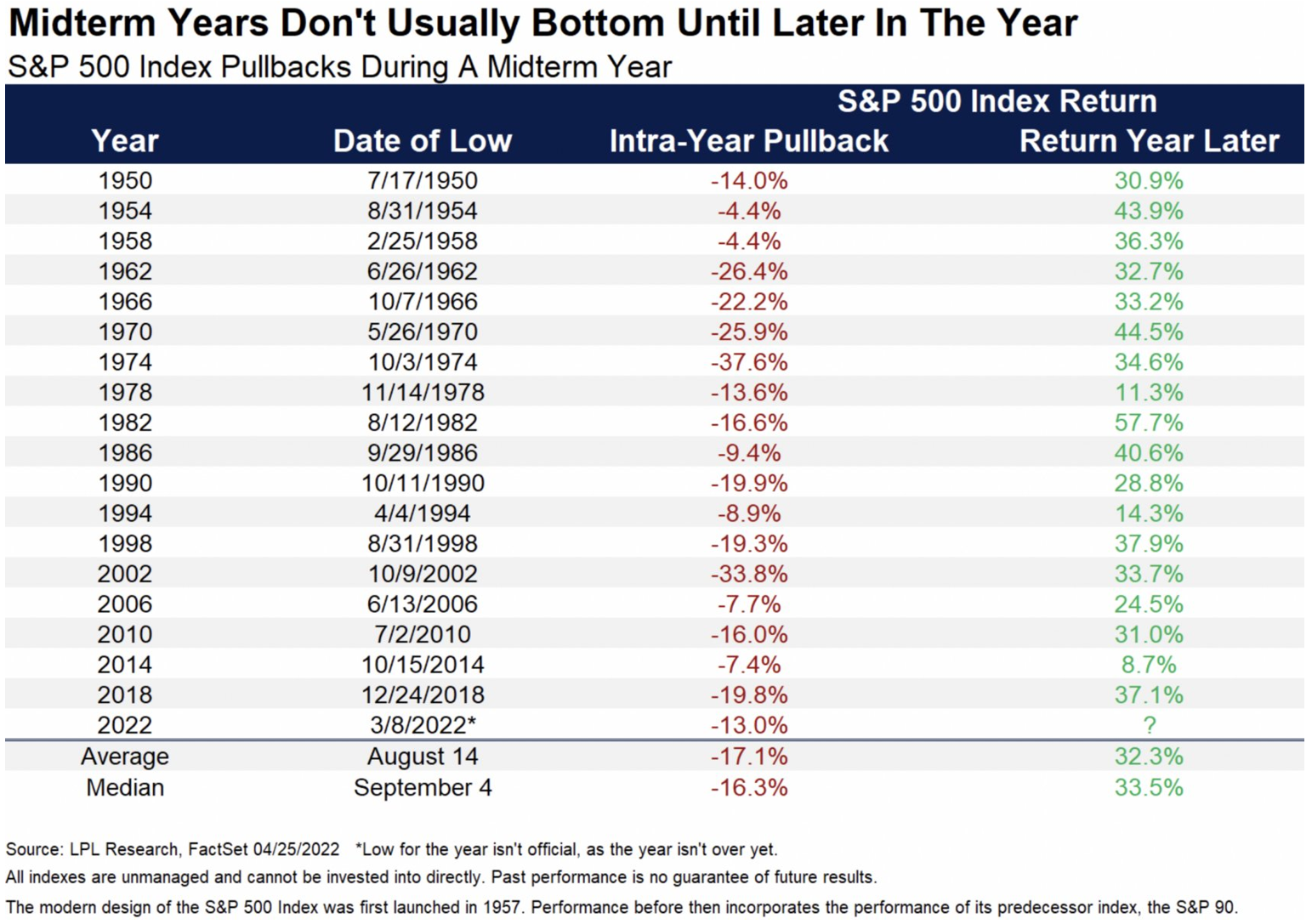

Midterm election years also tend to be particularly volatile for stocks. In such years, the S&P 500 usually doesn’t bottom until well into the third quarter. However, returns from there onward are often stellar, including big gains on average a year after a mid-term election year stock market nadir (see below).

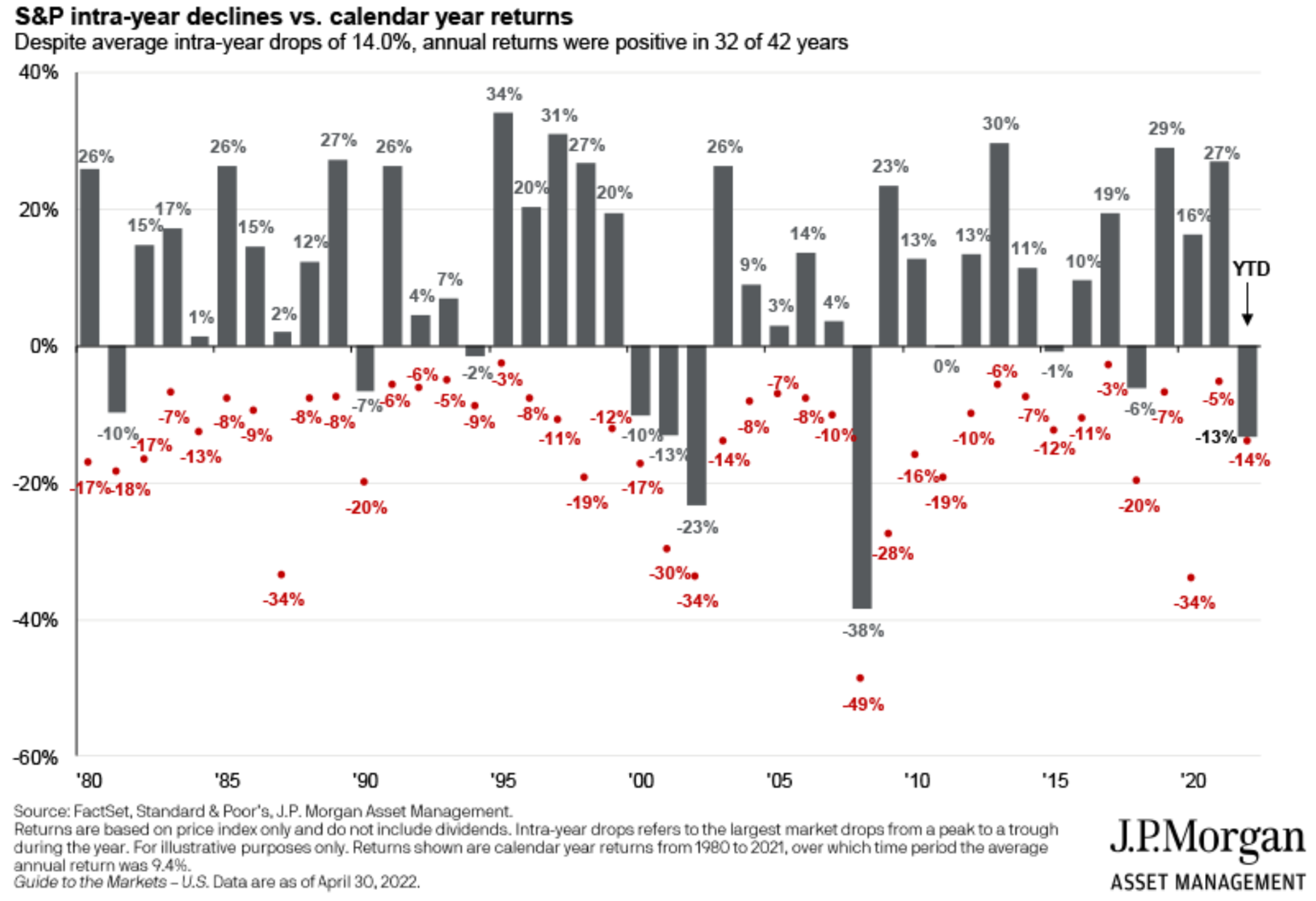

Of course past performance does not guarantee future returns, but there are some things you can keep in mind to try to help you avoid panicking into a downturn. Although the stock market has risen in 32 of the last 42 years, the average intra-year decline is 14 percent and it’s not unusual for the market to fall 30, 40, or even 50 percent.

Figure out your max pain point in your risk profile now because the worst time to figure out your risk profile is when you can least afford to.

We often hear about how important it is to diversify across uncorrelated asset classes but it’s equally important to diversify across time. Influential finance academic Ken French famously said that “risk is uncertainty of lifetime consumption.” What he meant was that the biggest risk you’ll confront in managing your finances is the uncertainty of asset class movements and inflation over time. That creates uncertainty in your ability to predict your future spending needs. Let’s use a simple example to understand this.

Cash is essentially a zero duration (time to maturity) bond. It matures every single day and generates no return which gives you absolute certainty of principle but no inflation protection. Stocks on the other hand are best thought of as a long-term instrument, like a 20- or 30-year bond that’s going to yield something like five to seven percent over long periods of time thereby giving you a lot of inflation protection but very little short-term certainty of principle.

When you diversify across these time horizons through these two asset classes you create greater predictability in your portfolio by reducing the variance in the future returns.

Bonds and other fixed income instruments themselves are another important diversification tool. Retirees with a typically higher allocation to this asset class might be particularly nervous at the moment since they probably haven’t endured such negative returns from both stocks and bonds. The good news: bond yields finally look decent. The yield on the broad U.S. bond market is up to 3.35%. That’s higher than the expected 10-year inflation rate. At 4.19%, high-quality corporate bonds are near their highest yield in a decade.

What To Watch This Week

Monday

- 3-Yr Note Settlement

- 10-Yr Note Settlement

- 30-Yr Bond Settlement

- Empire State Manufacturing Index 8:30 AM ET

- John Williams Speaks 8:55 AM ET

Tuesday

- Retail Sales 8:30 AM ET

- Industrial Production 9:15 AM ET

- Patrick Harker Speaks 9:15 AM ET

- Business Inventories 10:00 AM ET

- Housing Market Index 10:00 AM ET

- Jerome Powell Speaks 2:00 PM ET

- Loretta Mester Speaks 2:30 PM ET

- Charles Evans Speaks 6:45 PM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- Housing Starts and Permits 8:30 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- 20-Yr Bond Auction 1:00 PM ET

- Patrick Harker Speaks 4:00 PM ET

Thursday

- Jobless Claims 8:30 AM ET

- Philadelphia Fed Manufacturing Index 8:30 AM ET

- Existing Home Sales 10:00 AM ET

- Michael Barr Speaks 10:00 AM ET

- E-Commerce Retail Sales 10:00 AM ET

- Leading Indicators 10:00 AM ET

- EIA Natural Gas Report 10:30 AM ET

- 2-Yr Note Announcement 11:00 AM ET

- 5-Yr Note Announcement 11:00 AM ET

- 7-Yr Note Announcement 11:00 AM ET

- 10-Yr TIPS Auction 1:00 PM ET

- Fed Balance Sheet 4:30 PM ET

Friday

- Quarterly Services Survey 10:00 AM ET

- Baker Hughes Rig Count 1:00 PM ET