Stock market volatility has picked up significantly recently. For example, the tech-heavy NASDAQ, which has outperformed since the start of the pandemic, at one point fell by at least 1 percent on five consecutive trading days in January, something that has happened only seven other times in history.

Similarly, the benchmark S&P 500 last month experienced one of its fastest 10 percent corrections on record. The good news is that the other times it took the broad index such a short period of time to fall by this amount the S&P 500 was positive every single time six months later and up nearly 15 percent on average, and already equities have rallied significantly from the January lows.

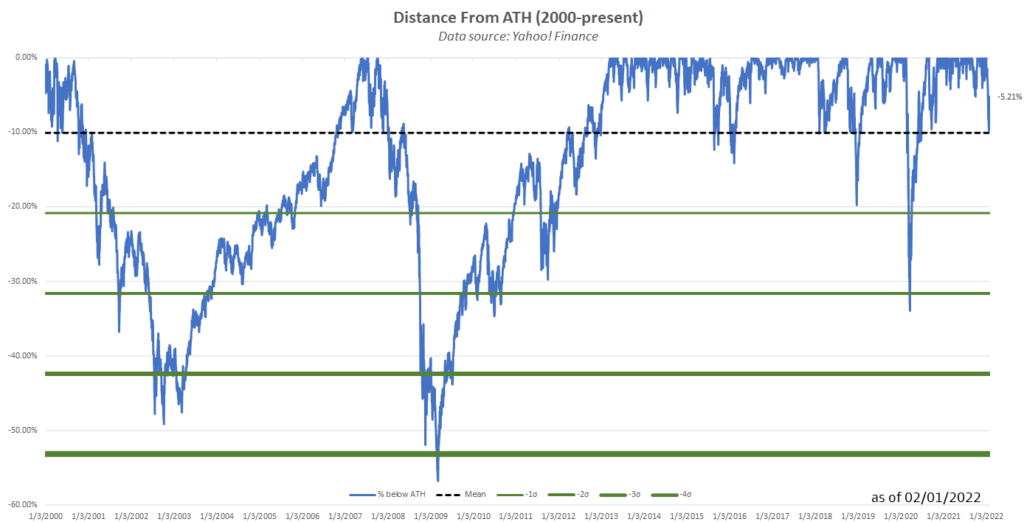

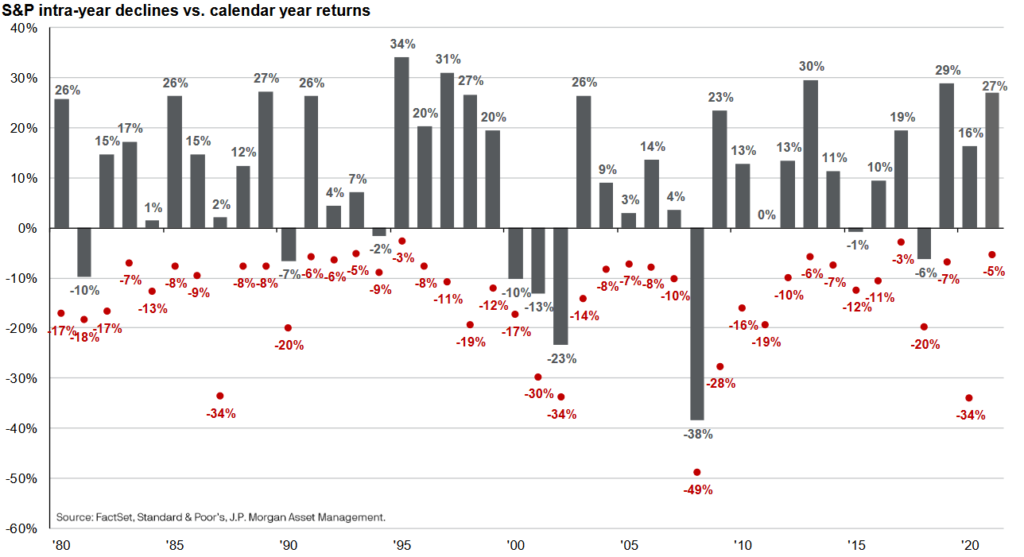

Perhaps more important is to remember that such drawdowns are far from uncommon in the stock market. Indeed, the S&P 500 since 1980 has experienced an average intrayear peak-to-trough decline of 14 percent (2022-to-date currently just -9.8 percent), but still managed to end the year with a positive return more than three-quarters of the time during these past four decades. And even if the recent selling resumed and intensified enough for us to eventually enter bear market territory, i.e. a 20 percent decline, the following statistics in such an event may prove comforting. Specifically, since 1929 the typical bear market has lasted 19.5 months, with an average max drawdown of 38.9 percent. That means even as severe as 2020’s selling pressure was at peak pandemic uncertainty, additional declines would not have been historically unusual.

However, what is more important is that during this same sample period the typical bull market in the S&P 500 has lasted for 62.5 months and experienced an average gain of 182.7 percent. Altogether this implies that over the past century stocks have not only spent significantly more time in a bull market than a bear market, but also that the gains often greatly exceeded the declines. This is another example of why regular investors are generally told to focus on the long-term rather than the day-to-day fluctuations in the market. Of course given how violent the declines have been lately it is easy to understand why some investors may have a hard time remaining calm when markets are plunging even though historically refraining from panic selling has tended to be a smarter course of action.

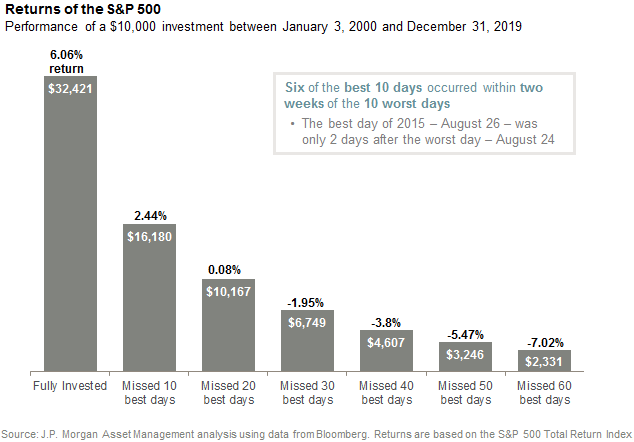

For example, from January 2000 to the end of 2019 (to exclude pandemic-related outliers), 24 of the 25 worst trading days occurred within a single month of the 25 best trading days, and 6 of the 10 best days occurred within two weeks of the 10 worst days. It is worth pointing out, though, that despite these reassuring statistics it is important to remember that past performance does not guarantee future returns, and there is still a lot of uncertainty surrounding the coronavirus, the economic rebound, and the upcoming Federal Reserve meeting that could keep market volatility elevated in the near-term. Any investors unsure how to navigate this environment may want to consult with a professional financial advisor and make sure their positioning is properly aligned with their risk tolerance, retirement goals, and other unique variables. As always, we are here to help with any questions you may have.

What To Watch This Week:

Monday

- Consumer Credit 3:00 PM ET

Tuesday

- NFIB Small Business Optimism Index 6:00 AM ET

- International Trade in Goods and Services 8:30 AM ET

- 3-Yr Note Auction 1:00 PM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- Loretta Mester Speaks 12:00 PM ET

- 10-Yr Note Auction 1:00 PM ET

Thursday

- CPI 8:30 AM ET

- Jobless Claims 8:30 AM ET

- EIA Natural Gas Report 10:30 AM ET

- 20-Yr Bond Announcement 11:00 AM ET

- 30-Yr Bond Auction 1:00 PM ET

- Fed Balance Sheet 4:30 PM ET

Friday

- Consumer Sentiment 10:00 AM ET

- Baker Hughes Rig Count 1:00 PM ET