The value of all goods and services produced in America in the second quarter of 2022, i.e. U.S. gross domestic product (GDP), declined by 0.9 percent.

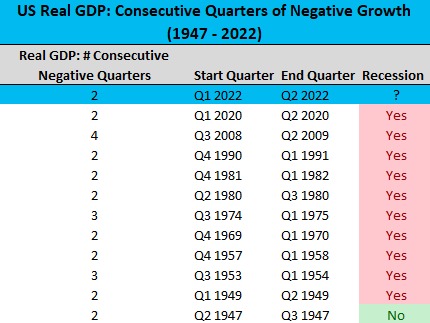

That was worse than expected and the second consecutive negative print, which naturally has rekindled the debate as to whether or not we are in a recession. Indeed, although two straight quarterly declines in GDP is not the official definition of recession, as determined by the National Bureau of Economic Research (NBER), it is still a useful heuristic because the last 10 times the U.S. had two or more consecutive quarters of negative real GDP growth, the economy was in fact ultimately deemed to be in a recession. You have to go all the way back to 1947 to find an exception.

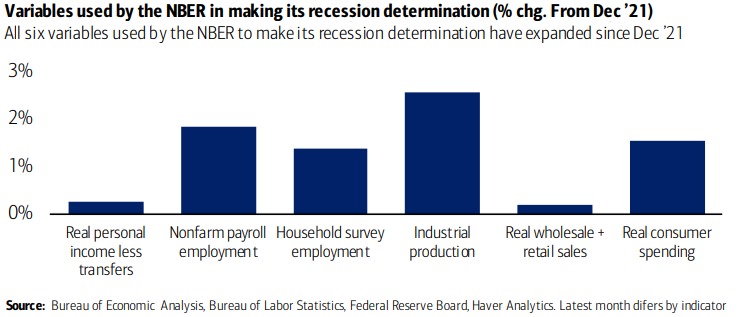

Further, most of the people (at least those in the media) arguing whether or not we are in a “true” recession right now are likely just trying to score political points, but at the same time each side has some valid points. For example, the “we are not in a recession yet” camp can point to the labor market, which is still historically strong, especially when viewed from the perspective of Americans’ confidence in job availability as reflected by the still very elevated quits rate. Further, real consumer spending continued to forge ahead in Q2, and even as it starts to moderate going forward it still has a long way to go before reaching any traditional recessionary levels. And even more straight forward, the NBER, which is responsible for officially dating economic cycles, does not actually look at quarterly GDP growth rates but instead monitors six key variables as a gauge of economic strength, and all six of these actually expanded in the first half of 2022 (see below).

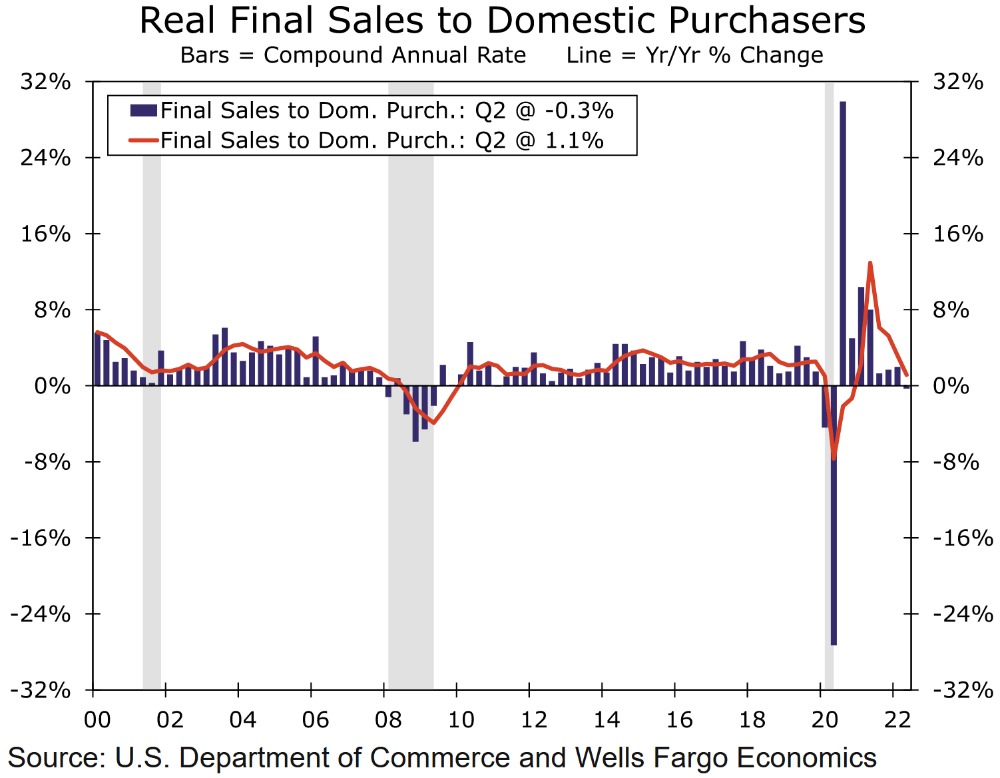

In the other camp, though, the latest GDP report cannot be as easily written off as the Q1 data release. Real final sales to domestic purchasers, for instance, was positive in Q1 but contracted by 0.3 percent in Q2, a partial indication of softer underlying demand. Growth was also a bit weaker than many had anticipated in the residential sector as the growing affordability concerns continue to weigh on housing demand. The latest durable goods report also hints at further weakness in equipment spending and other capital expenditures down the road. However, all these things together still do not suggest we are in a traditional recession, and again the strength of the labor market remains the best argument against those saying otherwise. Having said that, it is important to remember that all recessions start with a slowdown, but not all slowdowns end in a recession.

So regardless of what people arguing about technical definitions on television may be saying, growth has clearly already slowed down compared to earlier in the recovery, and likely to continue slowing going forward, and many Americans, from consumers to business owners, are already starting to feel it in one way or another.

What To Watch Next Week

Monday

- 3-Yr Note Settlement

- 10-Yr Note Settlement

- 30-Yr Bond Settlement

- Empire State Manufacturing Index 8:30 AM ET

- Housing Market Index 10:00 AM ET

- Christopher Waller Speaks 10:50 AM ET

Tuesday

- Housing Starts and Permits 8:30 AM ET

- Industrial Production 9:15 AM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- Retail Sales 8:30 AM ET

- Business Inventories 10:00 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- 20-Yr Bond Auction 1:00 PM ET

- FOMC Minutes 2:00 PM ET

Thursday

- Jobless Claims 8:30 AM ET

- Philadelphia Fed Manufacturing Index 8:30 AM ET

- Existing Home Sales 10:00 AM ET

- Leading Indicators 10:00 AM ET

- EIA Natural Gas Report 10:30 AM ET

- 2-Yr Note Announcement 11:00 AM ET

- 5-Yr Note Announcement 11:00 AM ET

- 7-Yr Note Announcement 11:00 AM ET

- 30-Yr TIPS Auction 1:00 PM ET

- Fed Balance Sheet 4:30 PM ET

Friday

- E-Commerce Retail Sales 10:00 AM ET

- Quarterly Services Survey 10:00 AM ET

- Baker Hughes Rig Count 1:00 PM ET