As summer winds down, families nationwide are gearing up for the back-to-school season. Balancing the dual challenge of managing back-to-school expenses while continuing to save for your children’s education and your own retirement requires careful planning and prioritization. Here are some strategies to help you manage both effectively without compromising your long-term financial goals.

Prioritize Retirement Savings

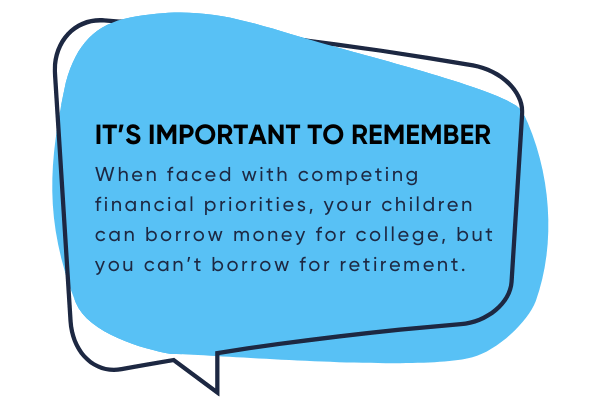

Financial experts often recommend prioritizing retirement savings over education funds. When juggling financial priorities, many parents instinctively put their children’s needs first. According to Sallie Mae’s How America Pays for College, about 53% of families have a plan to pay for college, and 61% of those families expect to borrow money to help cover costs.

It’s tempting to tap into retirement savings to pay for education expenses, but this can jeopardize your financial security in retirement. Pausing your retirement contributions can significantly impact your long-term financial health, disrupting the growth of compound interest and potentially costing you thousands in taxes and lost earnings over time. Use tools like the 401(k) Spend It or Save It Calculator to understand how your investment account balance is impacted.

Utilize Tax-Advantaged Accounts

Explore all funding sources to maximize your savings and find a balance between saving for retirement and education. You don’t have to choose one over the other.

For retirement, consider contributing to a 401(k) or IRA. These accounts offer tax benefits that can help your savings grow more quickly. For example, Traditional 401(k) contributions are made pre-tax, reducing your taxable income now, while Roth IRAs offer tax-free withdrawals in retirement.

For education, 529 plans and Coverdell Education Savings Accounts (ESAs) offer tax-free growth and withdrawals for qualified expenses. These accounts can help your savings grow faster by reducing your tax burden, allowing you to manage education costs without compromising your retirement savings. In addition to federal tax benefits, many states offer tax deductions or credits for contributions to their own 529 plans. This makes 529 plans a powerful tool for college savings.

Budget for Essential Purchases

Establish clear savings goals for both retirement and education. Determine how much you need to save for each goal and create a budget that allocates funds to both. By planning ahead, you can avoid the stress of last-minute expenses and better allocate your resources.

Start by listing all anticipated back-to-school expenses, including supplies, clothes, fees for extracurricular activities, and technology needs. Compare these against your monthly income and fixed expenses to see where adjustments can be made. A detailed budget helps you see where your money is going and where you can cut back. Using financial tracking apps like Mint or Spendee will help you categorize where you are spending and help you redirect your money to ensure you have enough allocated to each month’s anticipated expenses.

Take Advantage of Sales and Discounts

Back-to-school season is synonymous with sales and discounts. Whether your kids are in middle school or a college student heading to the dorm, sending your kids back to class can be expensive. Make the most of tax-free weekends, coupons, and promotional offers. Online shopping can also provide price comparisons and access to deals that might not be available in stores.

Tax-free weekends (if they exist in your state), typically held in the late summer, offer significant savings on school supplies, clothing, shoes, dorm room essentials, and even computers in some states. Costs can really add up when you are furnishing a dorm room on top of school supplies, so you will want to be on the lookout for sales. Also, many stores offer discounts for signing up for their email newsletters or loyalty programs.

Every dollar saved here is a dollar that can be redirected toward your retirement savings.

Involve the Whole Family

Teach your children about budgeting and saving by involving them in the back-to-school shopping process. Discuss needs versus wants and set spending limits together. Setting spending limits encourages them to make thoughtful decisions and understand the value of money.

Consider giving older children a set amount of money for school shopping. This can teach them to budget their funds and make decisions about what to buy. Younger children can be involved in making shopping lists and looking for deals.

Finding Your Balance

Balancing retirement savings with back-to-school and education expenses requires careful planning, prioritization, and sometimes, a bit of flexibility. By taking a proactive approach, you can ensure that your immediate needs are met without jeopardizing your long-term financial security.

Remember, the key to financial wellness is finding a balance that works for you and your family, starting early, staying consistent, and seeking professional guidance when necessary.