Disruptive Innovations and Market Dynamics

2024 was a very eventful and complex year characterized by a few key themes. The first theme centered on disruptive innovations, particularly in healthcare and technology. GLP-1 weight loss drugs captured significant market attention and drove pharmaceutical sector performance. Meanwhile, artificial intelligence technology continued its rapid advancement, influencing market dynamics and raising questions about market concentration and capital expenditure requirements. This was especially evident in the dominance of the “Magnificent 7” tech stocks, which drove much of the market’s overall performance through the year.

Central Bank Policies, Resilient Economies, and Pivotal Elections

The second major theme focused on central bank policy shifts. While many G10 central banks began cutting rates in 2024, their timing varied significantly. This divergence sparked debate about whether the Federal Reserve had waited too long to begin easing monetary policy. However, despite earlier warnings of recession, the economy proved remarkably resilient, casting doubt on more pessimistic forecasts.

The final theme revolved around elections, as 2024 saw over 70 nations, representing more than half of the world’s population, go to the polls. The U.S. election stood out as particularly consequential with the resounding victory by Donald Trump, and Republicans in both houses of Congress, being interpreted as a clear vote for change by Americans. The change that is expected from the incoming administration resulted in record-breaking surges in CEO and small business owner confidence, and helped kickstart another significant leg of growth in the stock market, which makes sense since stocks are often viewed as one of the best real-time predictors of where the economy is believed to be headed.

Challenges Ahead for the Incoming Administration

Despite the bright outlook for the year ahead stemming from the recent election results, it is important to point out that President-elect Trump will be inheriting an economy with a handful of challenges. Indeed, numerous headwinds have been building that could curtail some of the progress the new administration hopes to achieve right out of the gate.

For example, the labor market is clearly cooling because despite relatively low unemployment, the recent rate of increase in joblessness on the national and state level is concerning. Further, the rates of hiring and quits are declining, wage growth is slowing, and the duration of unemployment, i.e., how long it takes for someone to find a new job, has increased.

Similarly, the housing market is likely to face continued struggles in the year ahead stemming from high mortgage rates, even after the recent Fed cuts, along with tightening lending standards. There is also manufacturing sector weakness to watch out for, as overall US factory production has at best remained flat of late, and global manufacturing is largely already in contraction.

Navigating Complex Challenges with Optimism

The new administration may also have more limited policy options at their disposal versus Trump’s first term because of high government debt, elevated interest rates, a risk of renewed inflation, and having only a thin GOP majority in the House. Put simply, the headline low unemployment and strong GDP growth figures mask what is really going on under the hood in the economy, and clearly Americans have felt frustrated with this too based on how they voted in November. However, just because Trump faces various challenges that make the situation more complex than the start of his first term in 2017, optimism remains high that the new administration will still be able to get a lot done and that the economy and its citizens will ultimately benefit greatly as a result.

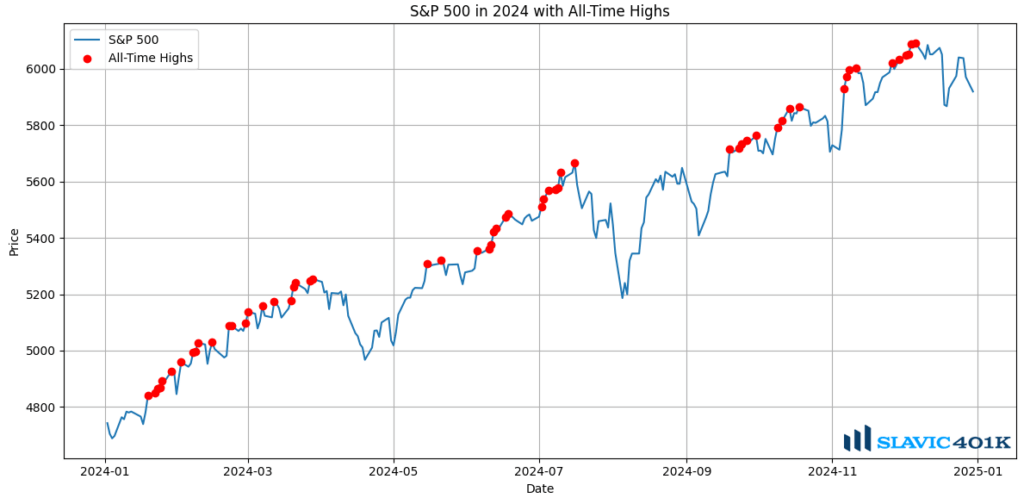

This leads into what is perhaps the biggest takeaway of the past year, i.e., that 2024 was a year that rewarded optimism. Twelve months ago, the “consensus” on Wall Street was for a slowing economy and modest gains in the stock market. Throughout the year, though, numerous economic data points repeatedly surprised to the upside, and the benchmark S&P 500 climbed to a new record high over 50 times.

No content published here constitutes a recommendation of any particular investment, security, a portfolio of securities, transaction or investment strategy. To the extent any of the content published may be deemed to be investment advise, such information is impersonal and not tailored to the investment needs of any specific person. The material presented is not intended to be complete in all material respects. Consult your advisor about what is best for you.

The Wealth Effect and Consumer Sentiment in 2024

Sentiment matters because although consumers were much more dour about the general economy throughout much of 2024, the stock market repeatedly hit record high after record high all year. Moreover, with the number of Americans with a 401(k) account at a record high, this meant that more consumers’ perceived wealth was buoyed all year by rising retirement account balances. In fact, Fidelity reported that there was a 9.5% increase in Q3 alone in the number of 401(k) accounts with a balance of at least $1 million.

Clearly all of this has more than offset any concerns about the broader economy based on spending behavior. Consider the dramatic shift in consumer activity related to wealth changes seen in recent years. According to a recent Visa analysis, the wealth effect has quadrupled from its pre-pandemic levels, i.e., where consumers once spent 9 cents for every dollar increase in wealth (2002-2017), they now spend 34 cents. This dramatic shift in consumption patterns has helped explain the solid GDP growth figures that have kept coming in despite a softening labor market and other traditional economic headwinds.

Cautious Optimism for 2025: Navigating Uncharted Territory

Looking ahead, the market is currently pricing in an unprecedented combination: accelerating profit growth alongside Fed rate cuts. This combination, while theoretically bullish, has no historical precedent, which may be setting investors up for disappointment. Put another way, 2025 is unlikely to see another +20 percent gain, at least based on history.

Moreover, the S&P closed every trading day of this year above its 200-day moving average, essentially meaning the index trended higher all year with no significant corrections. There have been 11 other similarly bullish years for the S&P 500 since 1952, and the average next-year change following such years has been a gain of just 4.6 percent, still positive but only about half the historical average annual gain of 9.2 percent.

The last two such occurrences were 2017 and 2021 and following each of those strong up years the S&P 500 took a breather in the following year, the latter of which included the start of a bear market. Another large gain is of course still possible for 2025, but a lot of things all have to go right for this to occur, and therefore altogether our base case is for volatility to at the very least pick up from the unusually low range we were spoiled with in 2024.

The Case for Long-Term Investing Over Speculative Trading

It is important to mention the potential for such market conditions because after back-to-back years of +20 percent gains in the S&P 500 it may be easy for complacency to set in, or even worse overconfidence that lures one to more speculative trading as opposed to tried-and-true long-term investing.

Indeed, the evidence in favor of why it is much smarter to be a long-term investor rather than a short-term trader is stark. On any given trading day throughout the stock market’s history, the odds of the S&P 500 being up on the day are roughly 53 percent. That beats any odds you could find in Vegas or a sportsbook, but it is still only slightly better than a coin flip.

Even more discouraging for any would-be day traders is a recent study which showed that many finance-trained adults struggled to make money timing the market even when they were provided the next day’s financial headlines in advance. Fortunately, most retirement-focused investors avoid the speculative allure and for them the odds of success improve substantially.

For all one-year time horizons, for instance, the likelihood of the stock market trading higher increases to 75 percent, and that goes up to nearly 90 percent over all five-year periods.

2025 Market Outlook: A Year for Strategic Growth and Optimism

Put simply, the longer you are willing to wait before checking the performance of your investments, the better your odds become of seeing a gain. So altogether it is easy to go into 2025 optimistic if one sticks to the basics: 1) history tells us that the stock market trends higher over time, 2) we are more likely to have another up year than a down year, and 3) if we do get a down year, investors should use it as a chance to add to exposure rather than trim it.

Of course, each investor’s unique personal situation, risk tolerance, and other factors may warrant a bit more nuance and customization for how to handle their investments in the year ahead, but as always that is exactly what we are here to help with. Make managing money more efficient and profitable with Slavic401’s financial resources. Click here to explore!

Now onto 2025; here’s to a happy and healthy new year!