We are now halfway through 2024 and by many measures it appears to have been a great six months for the economy, the stock market, and in turn your 401(k) balance.

With Respect to the Market and Economy

The labor market has been the key bright spot as headline monthly payroll gains have been extremely resilient for this stage in the business cycle. In fact, headline job gains have so far this year averaged 248,000 per month, unchanged from 2023’s 251,000 average and well above the pre-pandemic average of 166,000. Headlines, though, rarely tell the whole story, especially in an election year. Indeed, although headline payroll gains this year have routinely come in better than consensus forecasts each month at the time of release, the prior months’ gains have also been repeatedly revised lower, essentially lowering the hurdle for a “beat.”

And while headline job gains have been seemingly little changed this year, the composition of job growth has definitely been in flux. More Americans, for instance, are now being forced to work more than one job, and over the past year 1.2 million full-time jobs were lost and replaced with 1.5 million part-time jobs, indicating a significant change in the nature of employment. Immigration has also played a crucial role in labor market dynamics. Since 2019, the U.S. labor force has grown by 2 million, largely due to an increase in the foreign-born population, which filled the gap left by a declining native-born labor force (primarily retiring Baby Boomers).

This Has Sparked Political Debate

Particularly concerning the role of illegal immigrants in the labor market. Recent analyses suggest that job growth has predominantly benefited foreign-born workers, with no net job creation for native-born workers since 2018. The labor market is clearly affected by broader economic policies and trends. Even Federal Reserve Chair Jerome Powell recently acknowledged the role of immigration in employment and wage dynamics, hinting that the increase in employment and the drop in wage-related inflation were at least partly due to illegal immigration. He also suggested that payroll numbers might be overstated, casting further doubt on the narrative of a strong labor market.

More cracks appear when we look beyond the monthly job reports, as other data releases have shown that the total number of job openings has decreased markedly, as has the willingness of Americans to quit their current job in search of a better opportunity, highlighting less confidence in the labor market than the strong headline payrolls figures would imply. Consumer confidence measures in general have been deteriorating lately, with the University of Michigan’s popular sentiment gauge falling to a 7-month low in June and posting its largest 3-month drop since the COVID lockdowns. Unsurprisingly retail sales have also started to show some signs of weakness, particularly among lower-income households.

Restaurant visits are down, reflecting reduced discretionary spending. Inflation has remained the major issue, with prices for essentials like food, gasoline, and rent rising substantially. Moreover, despite low unemployment and some wage growth, the high cumulative inflation since 2021 has left many feeling financially strained. Since January 2021, the CPI has risen by 19%, reducing purchasing power. Basic necessities have seen even steeper increases, with groceries up 21%, gasoline prices up 47%, shelter costs up 20%, and electricity up nearly 30%. Consequently, average hourly earnings after inflation have fallen by over 2.5%, forcing a typical American family to pay $12,000 more annually to maintain their previous standard of living.

I want to stress, though, that despite all the above-mentioned economic red flags, we are not in a recession currently, and by many measures the U.S. economy is doing much better at the moment than other developed nations. However, while every growth slowdown is not necessarily followed by a recession, every recession is preceded by a growth slowdown and growth is clearly slowing. An “official” recession, roughly defined as two consecutive quarters of negative GDP growth, occurring over the next 6-12 months is now more likely than it was a year ago, but a recession is also still avoidable. The Federal Reserve is well aware of this, and it is currently trying to walk a tightrope with its policy decisions and messaging in order to achieve such an objective.

The Challenges for the Fed Are Myriad

For example, easing monetary policy, or even just signaling intentions to do so, too soon risks the economy heating up again and bringing about another bout of devastating inflation. At the same time, there is a delayed effect on monetary policy changes, so waiting too long to cut rates could alternatively deepen the eventual recession. Things are further complicated by the national debt, which has soared to an unprecedented $34.7 trillion recently. That amount, if laid end-to-end in $1 bills, would wrap around the Earth 134,599 times, or stretch to the sun and back nearly twice. Simply servicing the nation’s debt has become a major challenge that now already exceeds expenditures on national defense and Medicare.

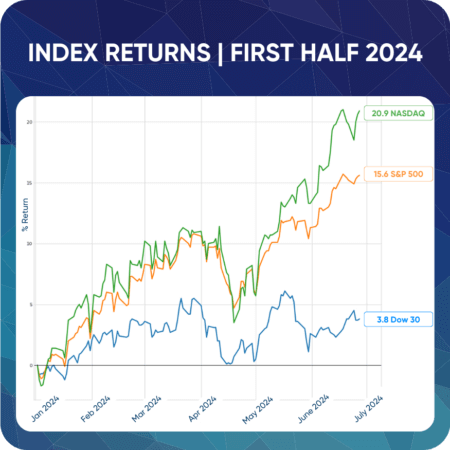

The debt is a problem for the Fed (and all Americans) because if the economy, and in turn inflation, heat back up, rates will have to rise once again, further exacerbating the debt servicing (interest) cost. Alternatively, with the debt already so high it potentially limits the size of fiscal stimulus and other support Congress could provide during another sharp economic downturn. Altogether it is clear why the Fed is being so cautious and taking its time with monetary policy actions. Despite all of this uncertainty, the stock market has appeared little fazed this year. Indeed, the benchmark S&P 500 has hit a new all-time high over two dozen times in the first half of 2024, as have the 401(k) balances for a majority of Americans.

One reason for this is a combination of the forward-looking nature of the stock market and the artificial intelligence (AI) boom that kicked off with the launch of ChatGPT a little over a year and a half ago. Specifically, although some may still find it difficult to see current AI capabilities directly benefiting their life in a significant capacity at this very moment, many investors see the corporate profit-boosting potential down the road of AI-related innovation, including the related productivity gains that will help keep inflation in check. AI-adjacent sectors have also benefited from the recent boom, such as utilities stocks which will need substantial investment in the years ahead to meet the rapidly ballooning power generation needs of AI data centers. The tactical moves we made around the start of 2024 in this area have already benefited our managed funds markedly.

Market Summary

In conclusion, the economy is still expanding, and the long-term future of America remains bright. Still the risk of a downturn over the next 6-12 months is undeniably more elevated now than it has been in quite some time. Similarly, the stock market is at record levels, but growth has been concentrated in a small handful of names and sectors, and volatility has been unusually low this year. Add to this that we are now nearing the upcoming Presidential election and it would not be surprising if the next six months of 2024 for the stock market are choppier than the past six months. The best approach to an uncertain future is to save, defer into your 401(k) account, and measure your risk exposure carefully. As always, we are here to help with these and any other issues you may have.

Like this content? Read more of John’s market commentary and market wrap-ups.