Establishing a secure retirement is not one-size-fits-all. With various savings plans as well as contribution minimums and maximums, investment options, and employer benefits like a 401(k) match, retirement funds look different for everyone.

It’s easy to get overwhelmed with the options and benchmarks that pair with retirement planning, but the path to saving for a secure retirement is easier than you may think. Increasing your contributions by a percentage or two will not noticeably impact your take-home pay, but will impact your future nest egg.

To understand where you are today, and where you need to be in the future, using a paycheck calculator can help you establish goals and reassess your budget to ensure you’re taking care of your present and future self.

If you’ve never used a retirement calculator, Slavic401k has a library full of free resources to help you establish and maintain your goals over the years. To view the calculators, click here.

Employer Match

If your employer offers a 401(k) plan as part of their benefits package, you should participate. Not only do 401(k) plans offer great investment options but they are often tied to bonus incentives, such as matching contributions from your employer. These incentives encourage plan participation within the company, and for their employees, that means extra retirement funds with little to no effort.

Employers can match up to a specific percentage each year for each employee. For example, if your employer offers 4% matching, and you’re already contributing 4% every year, then you are saving 8% on an annual basis, which doubles your efforts in the same amount of time. Many employers have caveats to this offering though, and many require employees to stay with the company for a certain number of years before the funds are fully vested. If you’re not sure if you have matching benefits, talk with your employer’s HR team.

How to Use the Paycheck Calculator

Understanding your 401(k) is essential to using a paycheck calculator because it can help you more accurately determine your needs. Make sure you look at your employer-sponsored plan before you start calculating. Do you know how much you’re contributing to the plan each year? Each pay cycle? Do you know the details of your pay-stub and take-home pay? Review your account to get started.

Once you’re ready, find a paycheck calculator you’d like to use. Slavic401k offers a free calculator, which can be accessed here. This calculator will help you understand how much you’re saving today and where that gets you for retirement, as well as plug in different scenarios to understand how future contribution changes will impact your overall retirement savings and goals. The calculator takes a few things into consideration, such as:

- Current 401(k) contribution

- New 401(k) contribution

- Current income and expected annual salary change

- Tax filing status

- State and local taxes

- Pre- and post-tax deductions

- Post-tax reimbursements

- Current 401(k) balance

- Current age and retirement goal age

- Employer match

- And more

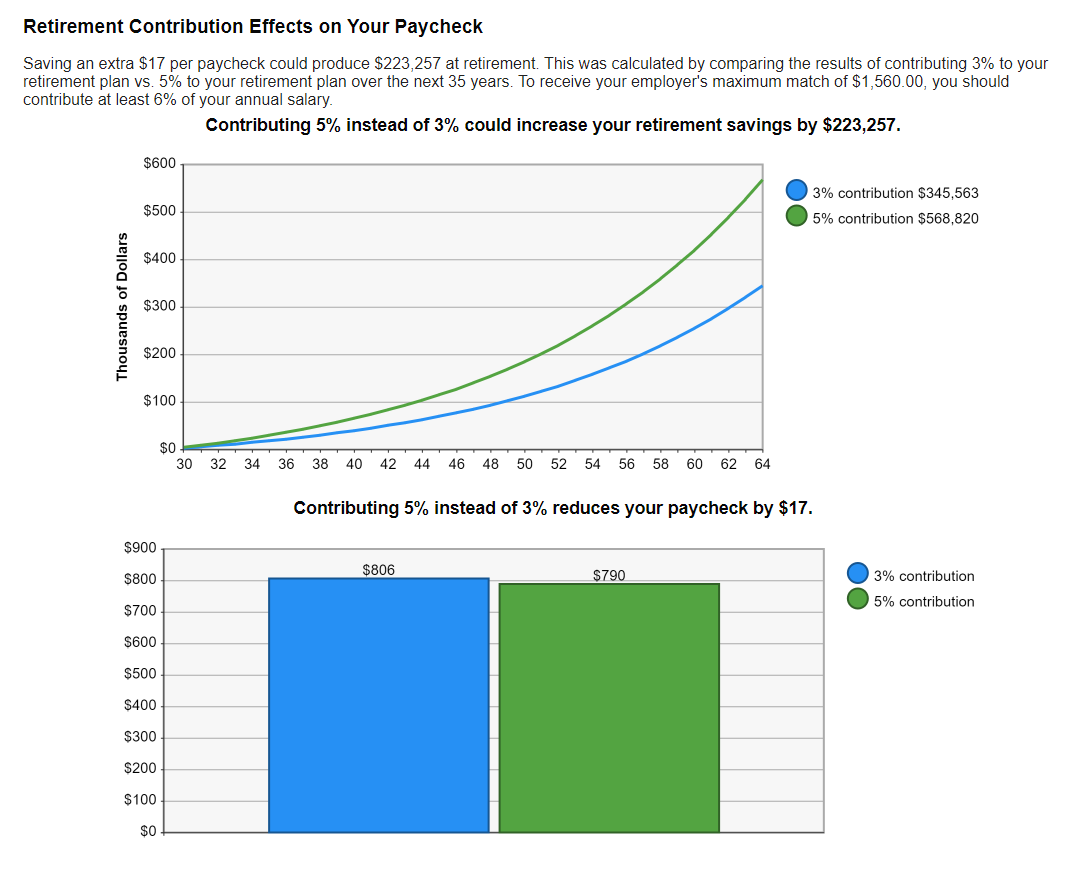

Once you fill in the information, the calculator will produce two graphs – one showing your retirement projections with your current contributions and one showing how a change in contributions impacts your paycheck and your retirement.

Example: If you’re a 30-year-old single person making $50,000 per year, contributing 3% of your salary to a 401(k) plan, and looking to increase your contributions to 5%, then you will be paying an additional $17 per paycheck towards your 401(k). A small change can go a long way. That $17 per paycheck can enhance your retirement savings by ~$223,257.

In this example, we can see that a little goes a long way, and it doesn’t take much to drastically change the course of your retirement nest egg.

Budget, Budget, Budget

Once you review your report from the calculation, it’s time to analyze your budget to see where you can afford to make adjustments. Where can you make changes that can be replaced with 401(k) contributions? Maybe you dine out less or cancel a streaming service you don’t use very often. Regardless of what the change is, you may want to use a budget tracker to keep yourself accountable.

Try using the 50/30/20 method and divide your income into categories: essential spending, wants and desires, and savings and debt payoff. Using this rule challenges you to assign each dollar you make into a category to ensure your bills are paid, retirement funds are saved, emergency funds are growing, and you’re still having fun while doing it.

To learn more about retirement savings strategies, plans, or overall financial information, visit Slavic401k.com.