Saving for retirement comes in many different shapes and sizes. From investing in the stock market, pooling finances in a mutual fund, and owning real estate property to opening an individual retirement account (IRA) or participating in a 401(k) – retirement is not one-size-fits-all. The benefit of having so many different options is that you can choose to invest in the best way it makes sense for your financial situation.

401(k) plans are a great way to begin saving for retirement or to catch up later in life. Not only are the plans easy to enroll in through your employer, but many employers also provide incentives for participation, such as 401(k) matching. The plans also provide tax breaks, protection from creditors, and more.

Read below to learn about the benefits of enrolling in your company’s 401(k) plan and how it can help you reach your retirement goals.

Contributions

Every year, the Internal Revenue Service (IRS), determines a maximum contribution limit for retirement accounts, such as 401(k) plans. These increases are a great opportunity to help you plan for future expenses and decrease stress in your post-career life. View the current limits here.

Using a 401(k) calculator can help you determine how much you should contribute from each paycheck in order to determine the maximum amount that fits your budget and provides a great way to map out your financial future. Visit the Slavic401k calculator page for more information.

Employer Match

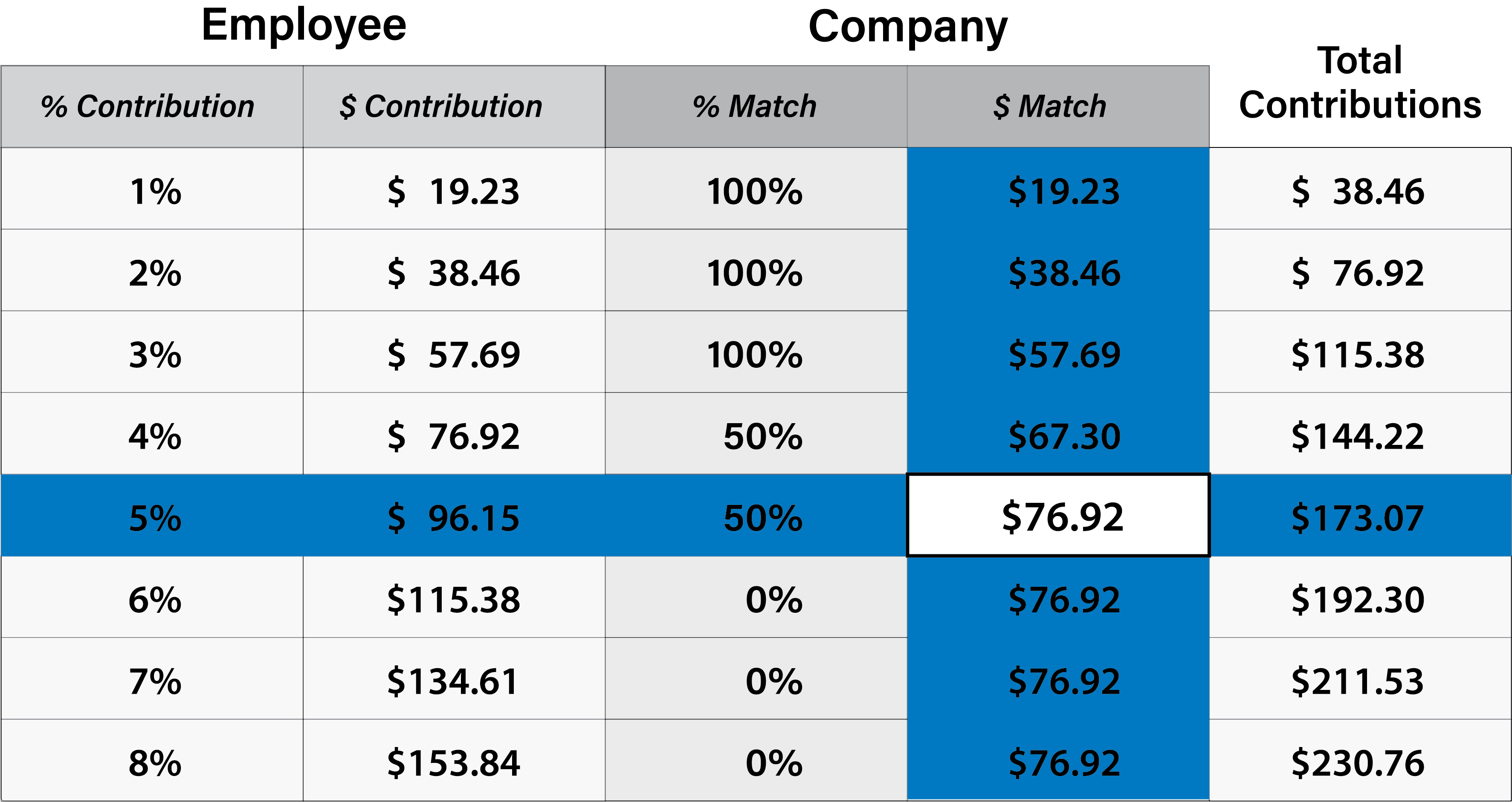

Working for a company that offers a 401(k) match program is a huge benefit because it helps you double down on retirement saving efforts. Employers who offer this incentive will match a specific financial percentage to what the employee contributes annually. Matching contributions can help you reach retirement milestones and goals at a much quicker pace.

For example, if your employer offers 4% matching, they will match up to 4% of what you contribute to your 401(k) plan. That means that if you contribute 4%, and they match that 4%, you are saving 8% of your salary each year for retirement. Many companies, however, have plan stipulations, meaning that if you only contribute 3%, they will only match your 3%. Enrolling in your employer’s 401(k) plan can greatly impact your financial future, with little to no impact on your take-home pay. To visualize contributions, view the Slavic401k chart here.

It’s important to speak with your company’s HR representative to understand the ins and outs of your company’s plan so you can ensure you’re getting the most out of the benefit.

Tax Breaks

In addition to matching contributions, 401(k) plan participants experience tax advantages. Because contributions are made on a pre-tax basis, you can deduct the contributions from your annual income, resulting in a lower taxable income.

Due to the tax-deferred structure of 401(k) plans, the earnings on your contributions accrue over time, meaning that you won’t owe taxes on them until you start withdrawing funds in retirement.

Investopedia notes that the tax benefit can be extremely helpful if you plan to be a in a lower tax bracket in retirement, as you are taxed at your income at the time of withdrawal. This is especially true for participants who are in a high tax bracket during their career, but plan to make less in retirement.

Protection from Creditors

Life happens, and sometimes that means experiencing a stressed financial situation. In those times, you may find yourself needing financial assistance in the form of a loan. If that’s the case, the finances stored in your 401(k) are protected under the Employee Retirement Income Security Act (ERISA) and cannot be judged from creditors investigating your loan request.

In addition, a 401(k) plan can offer protection against federal tax liens because the plan is technically owned by the employer rather than the employee.

Enrolling in your company’s 401(k) plan can help you establish a solid retirement nest egg, making life easier and stress-free in the future. If you’re not sure if your company offers this benefit, speak with a representative from your employer’s HR team.