A Thoughtful Approach to Retirement Income

Planning for retirement is much more than saving diligently throughout your working years. It also requires a well-thought-out strategy for how to withdraw savings in a way that supports your lifestyle while ensuring your funds last for the entirety of your retirement.

Enter the systematic withdrawal strategy—a methodical approach to taking money from your retirement savings that balances income needs with financial longevity.

What Is the Systematic Withdrawal Strategy?

The systematic withdrawal strategy (SWS) is a method where retirees withdraw a set percentage or dollar amount from their retirement savings on a regular basis, typically monthly or annually. In a systematic withdrawal plan, you withdraw only the income (dividends or interest) generated by your investments, keeping the principal intact. This approach helps prevent running out of money and allows for potential growth of your investments, while still providing retirement income. However, the income amount will vary based on market performance.

This disciplined approach is designed to provide a steady stream of income while managing the risk of running out of money too soon. Unlike ad hoc withdrawals, SWS helps retirees avoid impulsive spending, market-timing pitfalls, or overestimating how much they can safely withdraw.

How It Works

Determine a Withdrawal Rate

The first step is to calculate a sustainable withdrawal rate. A common starting point is the “4% rule,” which suggests withdrawing 4% of your savings in the first year of retirement and adjusting for inflation in subsequent years. However, the ideal rate depends on factors like:

- Your total savings

- Expected retirement length

- Investment returns

- Personal risk tolerance

Set a Withdrawal Schedule

Decide how often you want to withdraw—monthly, quarterly, or annually. Regular withdrawals can help align your income with your expenses and reduce financial stress.

Adjust Over Time

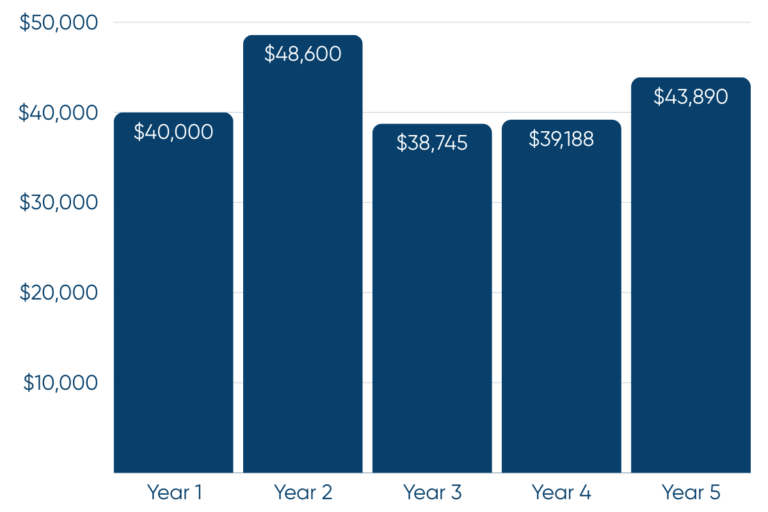

Your withdrawal rate isn’t set in stone. Economic conditions, market performance, and changes in your spending needs might require you to revisit your strategy periodically. Example illustration:

Advantages of Systematic Withdrawals

- Predictable Income: Provides consistent and reliable cash flow, making budgeting easier.

- Longevity Planning: A structured withdrawal strategy minimizes the risk of depleting your savings prematurely.

- Flexibility: You can adjust the amount withdrawn based on life events or changes in the market.

- Investment Growth Potential: By leaving the majority of your portfolio invested, you give your savings the chance to continue growing. It only touches the income – not your principal – so your portfolio maintains the potential to grow.

Potential Challenges

While the systematic withdrawal strategy offers many benefits, it isn’t without risks:

- Market Volatility: Poor market performance early in retirement (sequence-of-returns risk) can significantly impact the longevity of your portfolio.

- Inflation: You won’t withdraw the same amount of money every year, and rising costs over time could erode the purchasing power of your withdrawals.

- Unpredictable Expenses: Healthcare costs or unexpected emergencies may disrupt your planned withdrawals.

Tips for Success

Diversify Your Investments: A well-balanced portfolio can help mitigate risk and improve long-term returns.

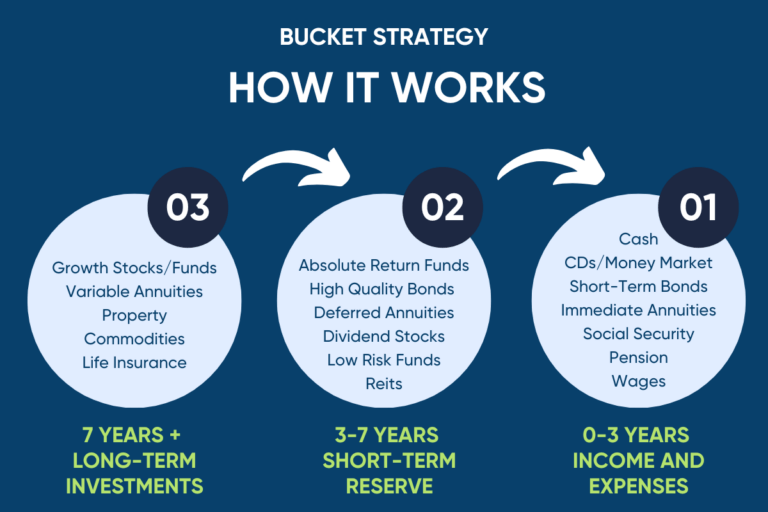

Mix and Match with a Bucketing Approach: Combine SWS with a “bucket strategy,” keeping short-term cash needs in safe investments while letting longer-term funds grow. Investors divide their retirement assets into separate buckets of assets based on periods of time. Those time horizons can be flexible as can be the number of buckets, but three is a common choice:

Work With a Professional: A financial advisor can help customize a withdrawal plan that suits your needs and aligns with your goals.

Keep an Eye on Spending: Regularly review your expenses to ensure your withdrawal rate remains sustainable.

Is SWS Right for You?

The systematic withdrawal strategy works well for retirees who value structure and discipline. However, it may not be the best fit for everyone, particularly those who prefer a more flexible, needs-based approach to withdrawals.

A successful retirement plan doesn’t stop at saving—it evolves into a thoughtful withdrawal strategy that ensures your hard-earned nest egg supports you throughout your golden years. The systematic withdrawal strategy can provide peace of mind by balancing your income needs with financial longevity.

As you approach retirement, take the time to assess your goals and consult a professional to determine whether this strategy aligns with your vision for the future. After all, the ultimate goal is to enjoy retirement with confidence and security.