2022 was a dismal year for the stock market led by the tech-heavy NASDAQ at -33.1%, the S&P 500 at -19.44% and the Dow Jones Industrial average down only 8.8%. The stock market reflected the overall economy as it was dealing with the inflationary aftermath of the Covid shutdowns across the country and the subsequent fiscal and monetary over-stimulus by the Federal government and the Federal Reserve Board, the central Bank of America. The fiscal stimulus consisted of three relief packages that were passed and signed into law by two presidential administrations. The monetary stimulus from the Federal Reserve came in the form of zero percent interest rates and adding about $150B per month to the banking system for two years. Fiscal and monetary stimulus together injected $6T into the economy. Just to provide some perspective, if one dollar equals one second, it would take 31,709 years to reach $1 trillion; that’s much longer than recorded history. Six trillion was the stimulus for the stalled economy and the source of double-digit inflation at the beginning of 2022. The market, along with all Americans grappled with this strong inflationary trend. Lower income Americans were hit the hardest by higher gasoline and grocery prices taking a greater percentage of a weekly budget, leaving many strapped from paycheck to paycheck.

In grappling with inflation, the market fell, but at different rates from the relatively small decline of the Dow and the big decline of the NASDAQ. The differences can be accounted for by two primary factors. First, the technology-based NASDAQ is much more sensitive to interest rates than the 30 big companies of the Dow Jones. Usually, technology companies have a lot of debt to finance the development of their products. In many cases, these types of companies have little or no profit. In some cases, little or no revenue either. The rise in interest rates last year was the fastest pace in the history of the Fed which shocked parts of the economy and stock market. The second factor, and perhaps the most important, was how the market reassessed the method it used in valuing a company, particularly speculative technology companies. Many companies in the early days of the pandemic shot up in value because so many workers worked from home rather than going to the office or the workplace. Some of these bets paid off handsomely while others didn’t. But, as the reality of working from home became not just a temporary measure, but a permanent arrangement, the valuation models of the market adjusted to the new reality of the workplace and the economy in general. In the end, the self-generated inflation, rapidly rising interest rates, and a reassessment of valuation models account for the dismal performance of stocks last year. In fact, 2022 was one of the four worst years of the market since the end of World War II (1945).

My explanation of what unfolded last year should help us anticipate what 2023 might hold. First, there is a strong likelihood that some type of recession will occur this year. There are a few key indicators. When interest rates rise rapidly, short term-interest rates are higher than long-term rates (an inverted yield curve), or there has been a commodity price shock like gasoline and groceries, 100% of the time a recession has followed. We have had all three occur last year! There is still a fair amount of the $6T sloshing around the economy, so it might not be severe, but it will probably happen. The market has anticipated this, because generally it looks six-to-nine months into the future. In part, this accounts for last year’s losses. Also, there is increasing evidence that inflation is declining rather than climbing as it did for much of last year. Consequently, the Federal Reserve will also slow the rapid pace of rate increases and may even lower rates toward the end of the year as inflation moves in the direction of its historical range of +/-2% from its current 6.5% rate. The current rate is about half of what it was at its peak, so it is moving in the right direction.

The most stubborn area of inflation is wages. It is very difficult to reduce pay once an increase is granted. Usually, wage cuts are most painful, because it doesn’t take place gradually like increases, but suddenly in the form of layoffs. The old saying has some truth in it, “if your neighbor loses his job, it’s a recession, if you lose your job, it’s a depression.” Companies can reduce costs quickly with layoffs. We have already seen this with strained technology companies involving large layoffs over the past six months. Recently, the iconic Wall Street banking firm Goldman Sachs reported revenues in line with expectations but shocked the market when its earnings dropped by 66%, almost entirely due to high wages among its workforce. It is likely that workers will stay put rather than quickly change jobs for a little higher pay, because layoffs typically occur with recently hired employees (last in, first out); so, there is risk to the worker in a fragile economy. I think the Fed will look to job destruction as a key element in continuing to raise rates, or even pivot to lowering rates, once it is satisfied that inflation is back to its targeted +/-2% range.

I think it is fair to say that the worst is behind us for the markets. The economy may continue to struggle. Real Estate could struggle with high interest rate mortgages. Also, high rent office space could struggle as more people work remotely on a permanent basis. Some regions of the country are going to do better than others. There is a substantial domestic migration from the Northeast to the South. There is a re-shoring movement underway, as international uncertainty is bringing back critical industries from overseas, such as pharmaceuticals and high-tech products. China is very much in view as international tensions continue to build.

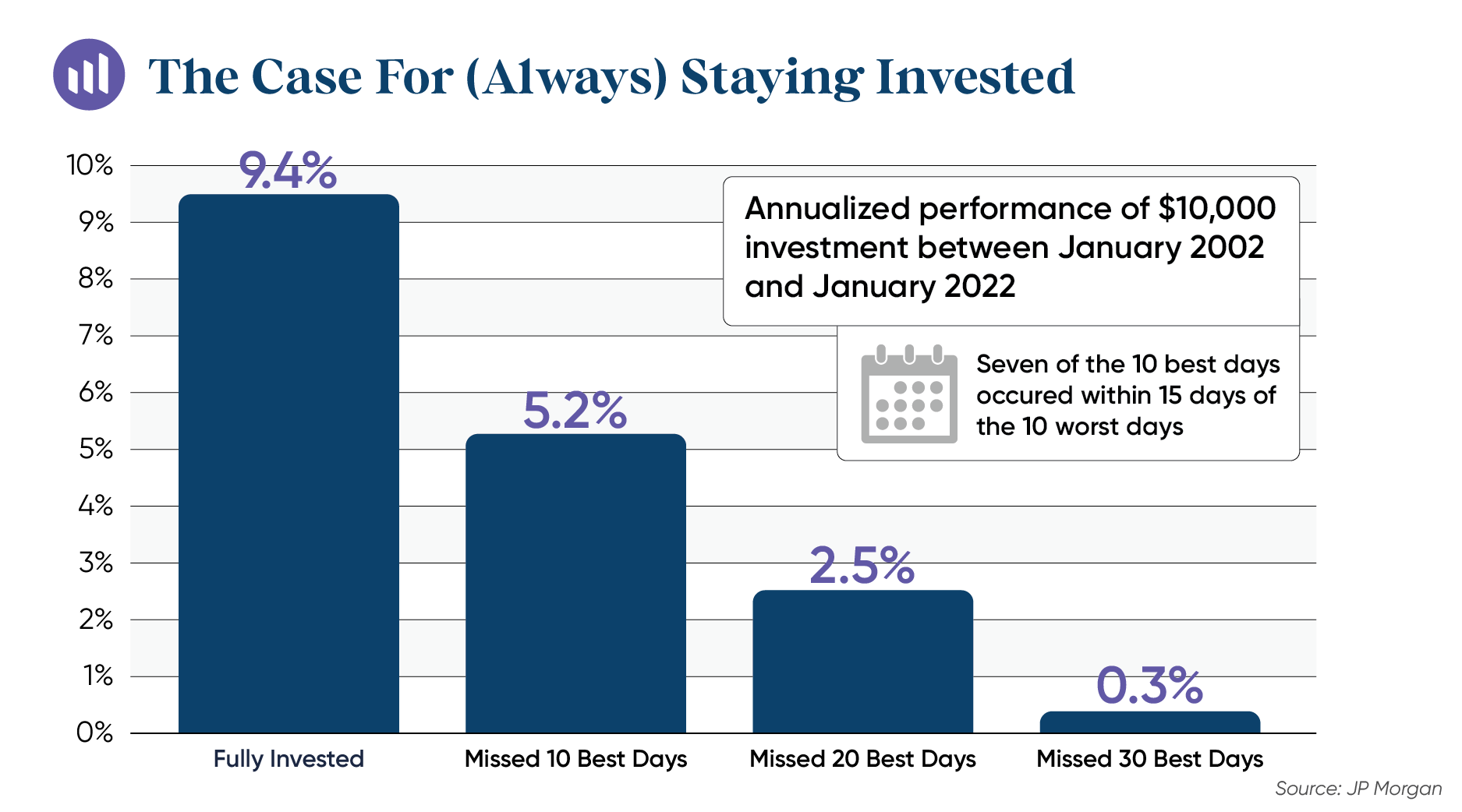

The best course of action for almost all investors, but especially the long-term 401(k) investor, is to have a risk adjusted asset allocation in their account, and simply stay-the-course. This JP Morgan bar chart tells the story at-a-glance.

Miss just few of the best days of the market in a 20-year period, you substantially slash your total return. What this tells you is that a free-market sorts itself out over time and the market anticipates that sorting. So, in the end, the market wins.

Source: JP Morgan

The commentary and market insights provided by John Slavic are for informational purposes only and do not guarantee future results.