When inflation occurs, the price of goods and services rise, meaning that money can’t purchase as much as it used to. So, whether you’re buying groceries and gas or paying your dog’s grooming fees, inflation affects the entire economy.

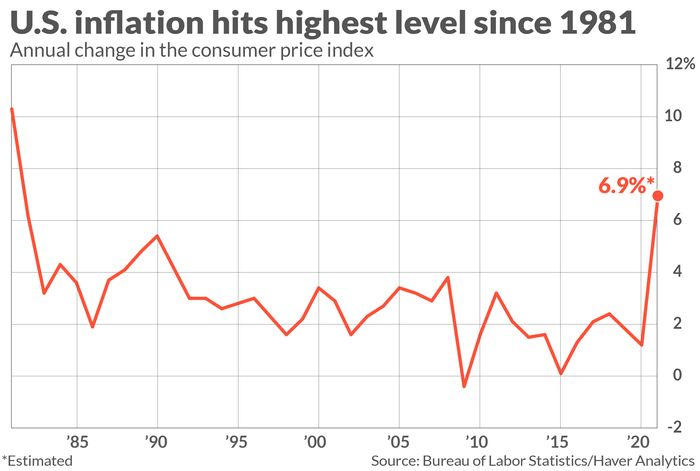

This week, the Consumer Price Index reported by the U.S. Bureau of Labor Statistics noted an 8.3% increase in the price of goods and services for the month of April. While down from 8.5% in March, we are still at record levels since the early 1980s. Affected areas of the increased cost-of-living include energy, food, apparel, vehicles, medical costs, and more. You can view a breakdown of the April 2022 report here.

Keep reading to learn about what causes inflation, how it affects retirement and answers to more inflation-related concerns you may have.

What Causes Inflation?

Inflation is caused by two factors: increased consumer demand for goods and services, and the supply-chain, which is affected by increased material prices, wages, and production costs.

As the economy begins to recover from the COVID-19 pandemic, companies are experiencing a higher demand for goods and services, including dining out, salon visits, vacations, and more. The increased demand causes inflation because more consumers are demanding a specific product or service, resulting in increased costs to provide to the consumer.

While some companies may reap the benefits of inflation by charging more for goods and services, inflation generally affects the way consumers purchase. For example, if prices increase, they may have less money that affords them the luxury of discretionary spending, i.e., dining out, going on vacation, and shopping.

Why Inflation Is So High In 2022

As a consumer, you may have noticed how inflation has affected your everyday expenses, and if you’re wondering why it’s so high, there is no simple answer. Inflation typically rises 2-3% annually, but other events can cause it to increase or decrease.

In early 2022, inflation began to rise as consumers became more comfortable with spending money post-pandemic. Because of the new demand, businesses had to increase prices to keep up with production and supply-chain costs.

Furthermore, economic disruptions were made because of the war in Ukraine. Ukraine and Russia combined supply important raw materials for the global economy, such as energy, metals, and agricultural products. As the conflict brought on sanctions and higher costs, it became increasingly harder for countries to obtain supplies, resulting in higher shipping and transportation costs.

Another factor that continues to affect inflation nationwide is interest rates. When the COVID-19 pandemic spread across North America, the Federal Reserve lowered interest rates affecting rates for credit cards, mortgages, car loans, and more as a result of reduced spending from consumers. Now, as consumers begin to spend money again and demand increases, the interest rate follows.

How Inflation Affects Retirement

Inflation affects more than the price of consumer goods and services. It can also determine how much your retirement savings is really worth.

The federal government uses inflation as a tool to determine retirement contribution limits and Social Security benefits, but on an individual level, that can change how retirement looks for you.

With increasing inflation, your retirement funds will decrease in value. According to a study conducted by the LIMRA Secure Retirement Institute, an inflation increase as low as 1% annually can reduce the amount of money retirees will have post-retirement by thousands. When paired with even higher inflation rates, the risk of losing additional funds is heightened.

Additionally, purchasing power becomes a major concern for retirees who spend more money on costs that continually rise despite low or high inflation, like healthcare. By having to spend more money on medical expenses, like surgeries and medications, than younger, working consumers, the value of funds that retirees have accessible doesn’t go as far.

Retirees receiving Social Security benefits may also be affected if the Social Security Administration doesn’t issue an annual cost-of-living increase for beneficiaries.

Whether you’re a working consumer or a retiree, there are ways to help curb inflation in your household, including:

- Use the 50/30/20 budget rule to help keep your finances and budget in order

- Reduce discretionary spending

- Leverage investments

- Look for a better-paying job (remote or hybrid work will help you reduce gasoline expenses)

As of now, the Fed continues to track the economy, monitor and adjust interest rates, and determine fair wages for the current cost-of-living.

While the increasing price of goods and services may feel like a big burden, if you’re strategic with your finances and budget, you may be able to reduce some of the financial pressure associated with rising inflation.

Stay up to date on financial trends, advice, and more by visiting the Slavic401k blog.