If you have a retirement savings account, chances are you’ve come across the term “vesting.” But what does it really mean for you and your financial future? If you’re scratching your head, don’t worry—Slavic401k has your back. We’ll unravel the mystery of 401(k) vesting, explore the various vesting schedules, and explain why vesting exists.

What is Vesting?

At its core, vesting is all about ownership. When it comes to your retirement funds, being vested means you have earned the right to keep the employer contribution made to your 401(k) plan—but only after you’ve stayed with the company for a certain period. Think of it as a reward for loyalty—a financial carrot designed to keep you committed to your employer.

Employers use vesting to motivate employees to stay with the company longer, as the employer contribution becomes fully yours once a specific timeline is met.

What is a Vesting Schedule?

A vesting schedule is essentially your roadmap to ownership in your retirement plan. It dictates when the money your employer contributes—your employer contribution—officially becomes yours. Most companies don’t hand over the full match immediately; instead, they spread it out over several years, typically between two to five. This timeline ensures that employees remain with the company long enough to earn the full benefit of the employer contribution.

For instance, let’s say your employer matches your retirement contribution dollar-for-dollar up to 3% of your salary. If you contribute 3%, your employer does too, effectively doubling your investment. However, if you leave the company before your contributions are fully vested, you could lose a significant portion of that extra 3%. If employment is terminated for any reason before the retirement funds vest, then the employer will regain their contribution.

But here’s the silver lining: the money you contribute from your own paycheck is always 100% vested and yours to keep, no matter when you decide to move on.

Types of Investing Schedules for Retirement Accounts

Not all vesting schedules are created equal. Depending on your employer, you might encounter one of the following:

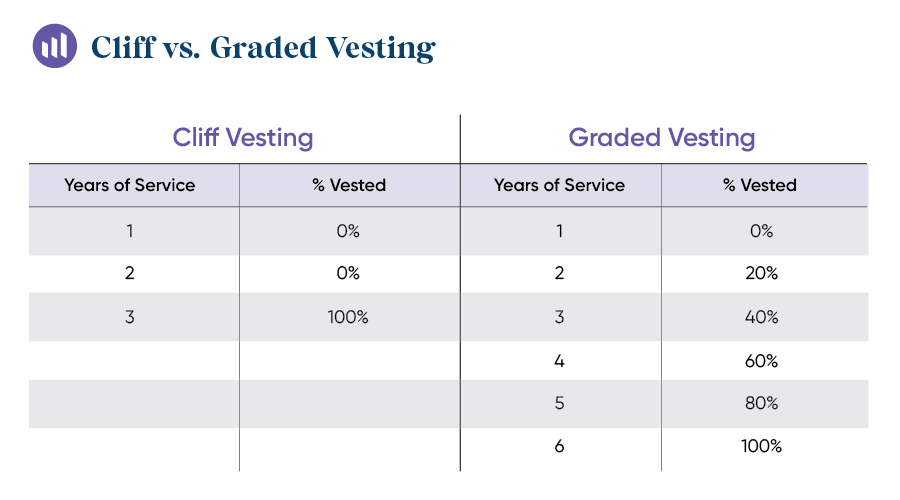

Cliff Vesting: Picture a steep cliff—you either reach the top, or you don’t. With cliff vesting, you get 100% of your employer’s contributions all at once after a set period, say three years. Before that, you get nothing. It’s all or nothing, so if you leave after two years and 11 months, you walk away with only your own contributions.

This type of plan vests 100% of the employer contributions after a specific period of time passes. Until then, the employee has 0% vested contributions from the employer.

Graded Vesting: This type of schedule takes a more gradual approach. Think of it as climbing a hill instead of a cliff. Each year, you gain a bit more of your employer’s contributions. For example, after one year, you might own 20% of those contributions, 40% after two years, and so on until you’re fully vested. This way, if you leave after two years, you still keep 40% of the match.

If an employee leaves the company before 100% of the employer’s contributions have vested, they only miss out on the percentage they have not earned through the graded schedule.

Immediate Vesting: The unicorn of vesting schedules, immediate vesting means you own 100% of your employer’s contributions right from the get-go. It’s rare, but if you’re lucky enough to have this, you can rest easy knowing that all matched funds are yours from day one.

401(k) Vesting Schedules for Stock Options

In addition to retirement accounts, some companies offer stock options as part of your compensation package. Vesting plays a role here too, but with a twist. Stock options allow you to buy company stock at a set price, and the hope is that the stock’s market value will rise above this price, giving you a tidy profit.

Here’s how vesting schedules for stock options typically work:

- Cliff Vesting for Stocks: Employees have access to all stock options at the same time but cannot use any of their options to buy shares until they reach a specific employment period, such as three or five years.

- Graded Vesting for Stocks: This plan allows employees to exercise a portion of their stock options. With a graded schedule, employees can purchase a smaller percentage of shares each year until they are eligible for 100% at a specific employment date, like five years.

401(k) vesting is a way that companies protect their assets, and as an employee, it’s important to note which policy your employer has. Understanding how vesting work influences your retirement plan is key to effective financial planning. The vesting schedule can determine how long you work there, how much you contribute to your retirement fund, and more. If you’re unsure, reach out to your company’s human resource or benefits team for the appropriate information related to your plan. After all, knowledge is power, especially when it comes to your financial future.

For a deeper dive into 401(k) terminology such as “401(k) vesting” for your edification, or for more tips on saving for retirement, check out our comprehensive 401(k) glossary guide or visit the Slavic401k blog. Our blog post on Employer Match 401(k) Plans may be especially helpful.

As always, if you have questions or wish to speak with a Slavic401k expert, we’re here for you. Use our form to get started.