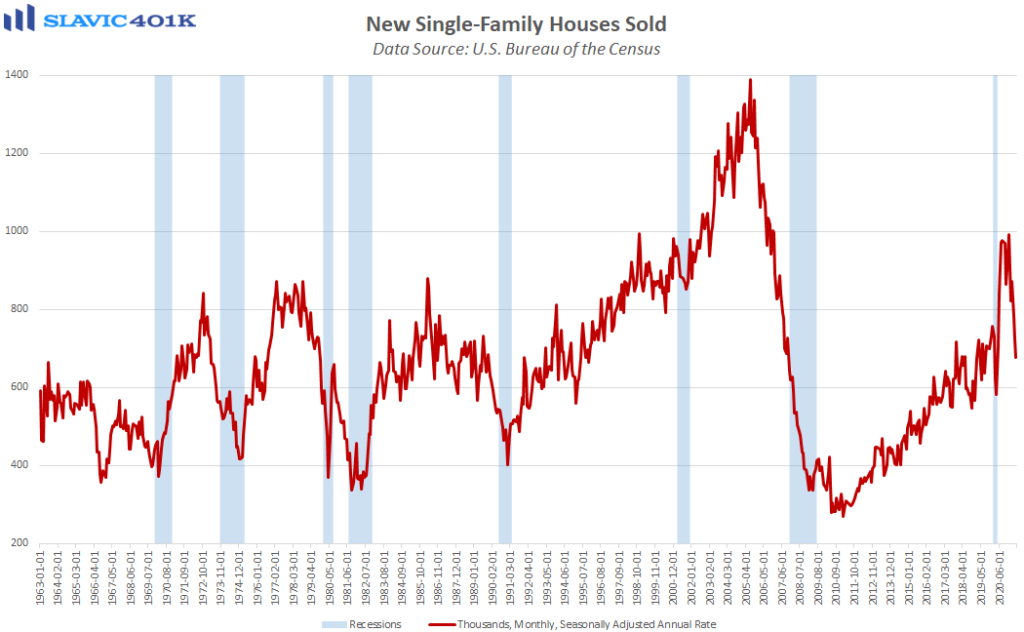

There were several important reports on the U.S. economy released last week. Among the key takeaways, incoming housing data continue to point to a needed moderation in the real estate market. New home sales, for instance, totaled 676K in June, a significant decline from the prior month but to be expected after spiking recently to levels not seen since the bursting of the housing bubble more than a decade ago.

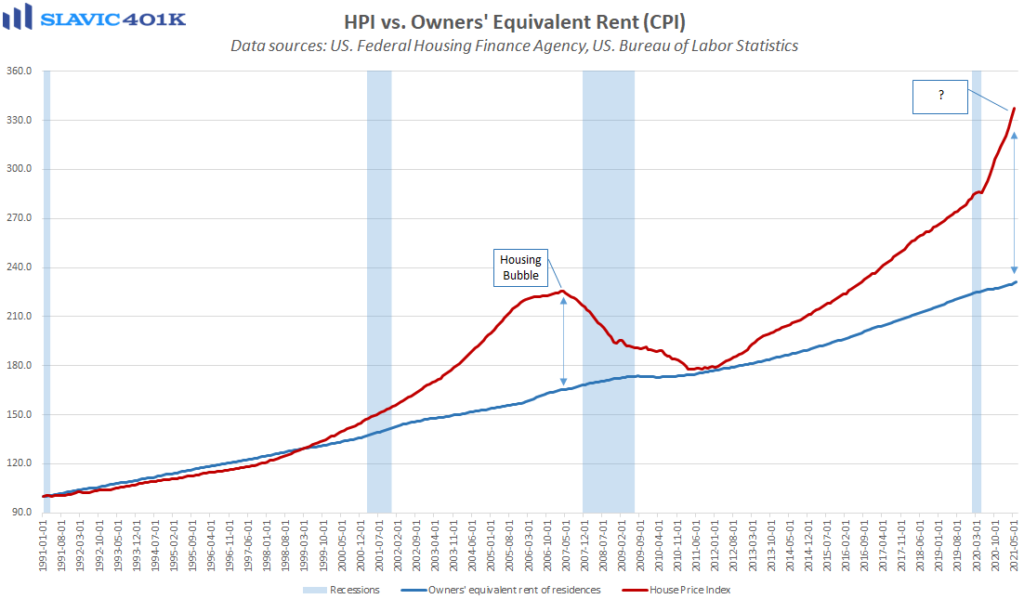

Speaking of bubbles, data from Case-Shiller and the U.S. FHFA show that the annual rate of growth in home prices continues to challenge or even exceed some of the extremes seen back in the mid-2000s. Help is on the way, though, in terms of additional supply as single-family construction authorized but not started has climbed to the highest level since 2006, and the recent renormalization in building material costs (lumber) should enable even more projects to proceed going forward. It is of course possible that the housing market experiences additional “weakness” in the near-term but for now this still appears more like a healthy correction, especially since many of the problems underlying the prior housing bubble are not an issue currently.

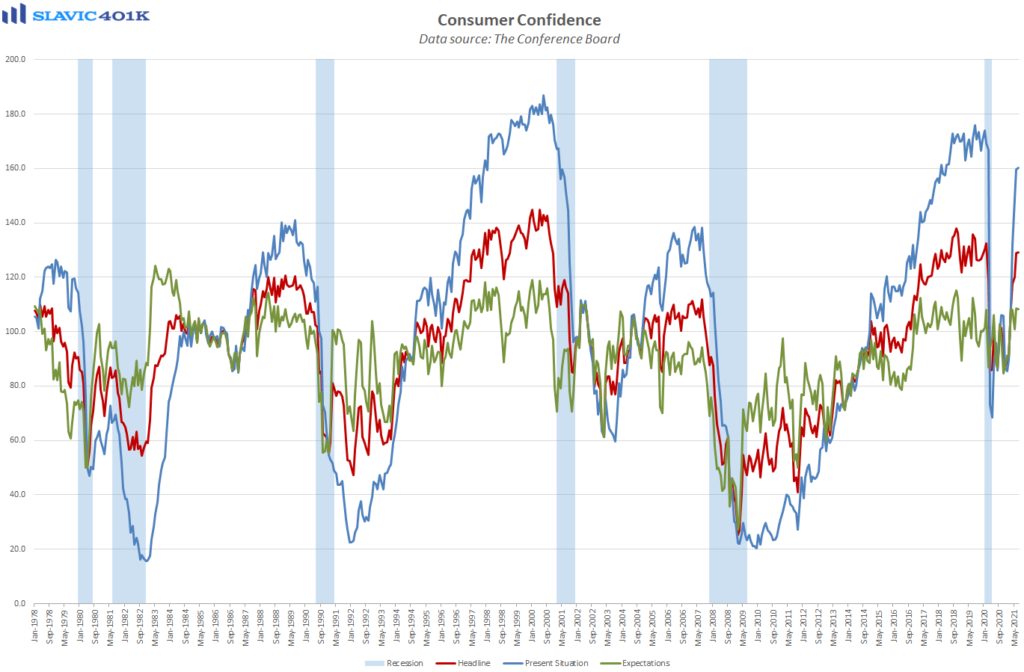

Moreover, homebuilder sentiment has cooled recently but it is still at levels that prior to 2021 would be considered a record high. This would not be happening if demand was not holding up well. Mortgage rates also remain supportive of real estate transactions, but perhaps more importantly borrowing costs have again fallen below the rate on much of the mortgage debt outstanding, meaning refinancing activity could pick up again in the coming weeks and in turn put more cash in Americans’ pockets. The willingness to spend that will in part depend on consumer confidence and encouragingly sentiment measures have help up rather well recently, especially with the constant deluge of negative “delta variant” headlines in the media.

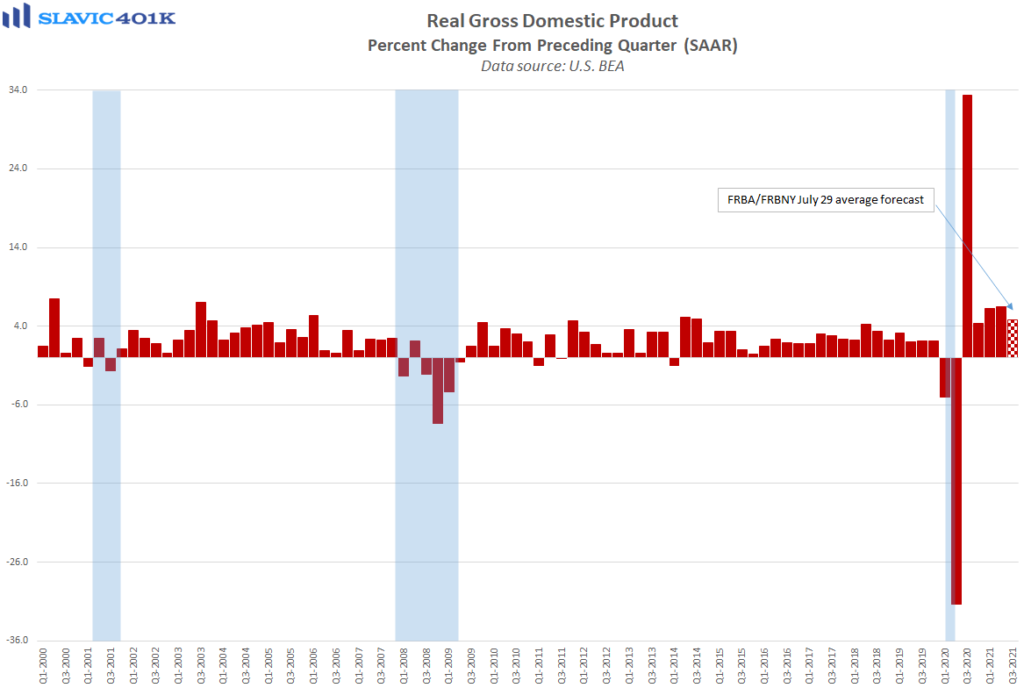

In fact, The Conference Board’s labor differential , i.e. the number of surveyed Americans saying jobs are “plentiful” versus those who believe jobs are “hard to get” surged yet again in July to the highest reading since 2000. This points to a continued rapid turnaround in the labor market and suggests more declines in the unemployment rate can be expected in the months ahead. Elsewhere, the first official estimate of U.S. gross domestic product (GDP) growth for the second quarter of 2021 was released and showed that the economy expanded at a rate of 6.5 percent in Q2. That is up from 6.3 percent in Q1 but well below the 8.0 percent median forecast (likely due to inventory distortions).

Looking ahead GDP should continue to grow in the second half of 2021 but the variability in forecasts remains substantial due to all the pandemic-related “noise” still clouding the situation. Moreover, any slowdown in growth during the next two quarters is likely to be more a reflection of extreme base effects than any actual underlying weakness in the economy. More “reliable” data may therefore not even start to show up until 2022, which could actually be good news for officials at the Federal Reserve who based on last week’s monetary policy statement remain eager for excuses to avoid the inevitable rates “liftoff.”

What To Watch This Week :

Monday

- 2-Yr Note Settlement

- 5-Yr Note Settlement

- 7-Yr Note Settlement

- 20-Yr Bond Settlement

- PMI Manufacturing Final 9:45 AM ET

- ISM Manufacturing Index 10:00 AM ET

- Construction Spending 10:00 AM ET

Tuesday

- Factory Orders 10:00 AM ET

- Michelle Bowman Speaks 2:00 PM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- ADP Employment Report 8:15 AM ET

- Treasury Refunding Announcement 8:30 AM ET

- PMI Composite Final 9:45 AM ET

- Richard Clarida Speaks 10:00 AM ET

- ISM Services Index 10:00 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- 3-Yr Note Announcement 11:00 AM ET

- 10-Yr Note Announcement 11:00 AM ET

- 30-Yr Bond Announcement 11:00 AM ET

Thursday

- Challenger Job-Cut Report 7:30 AM ET

- International Trade in Goods and Services 8:30 AM ET

- Jobless Claims 8:30 AM ET

- Christopher Waller Speaks 10:00 AM ET

- EIA Natural Gas Report 10:30 AM ET

- Fed Balance Sheet 4:30 PM ET

Friday

- Employment Situation 8:30 AM ET

- Consumer Credit 3:00 PM ET

Sources: Econoday, FRBG, U.S. DoL, U.S. DoC, NAHB, FRBSL

Post author: Charles Couch