When stretching your paycheck, your location can make a substantial difference. Beyond just federal taxes, factors like state income taxes, sales tax, cost of living, and housing costs can heavily influence how far your income goes. While moving to a state with no income tax might sound appealing, there’s more to the equation. Slavic401k explores where your paycheck goes the furthest by analyzing key financial metrics across the United States.

Understanding the Chart: How Each State Measures Up

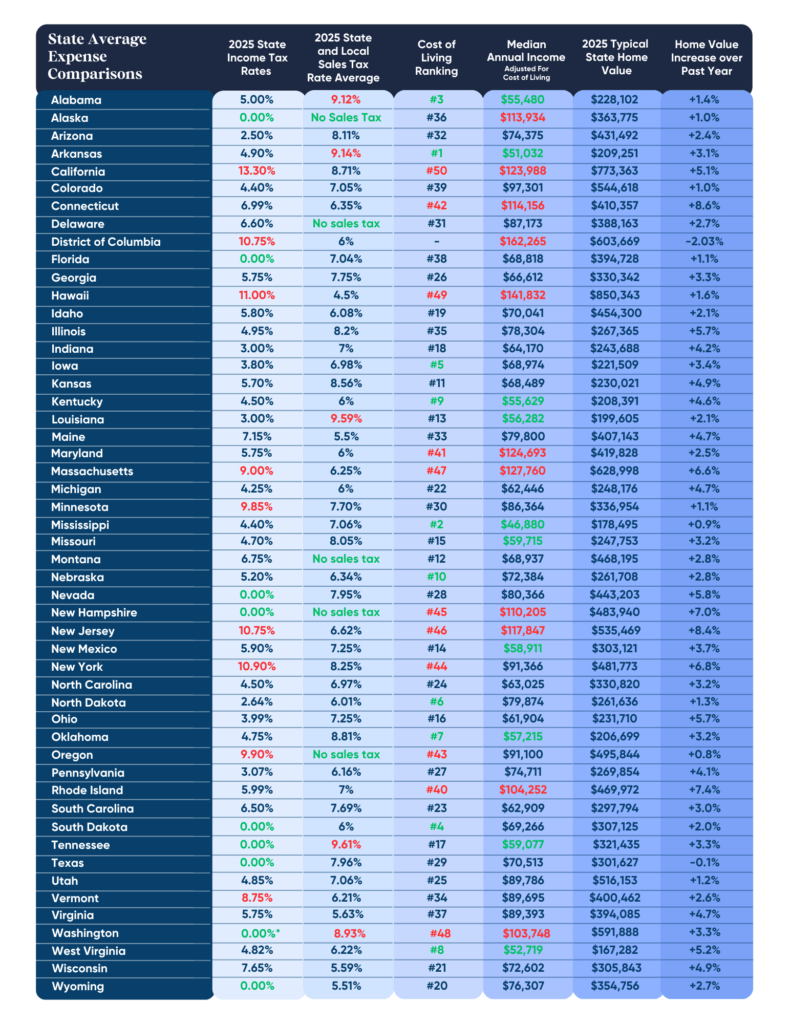

To help you make informed decisions, we’ve compiled a comprehensive chart of financial metrics across all 50 states. Here’s what the chart reveals:

State Income Tax Rates: How much of your income will be taxed at the state level. States vary significantly in how much they tax income, ranging from no state income tax to rates exceeding 10%.

Combined Local and State Sales Tax Rates: Get a clear picture of the combined sales tax burden. Some states with no income tax make up for it with higher sales tax, affecting your overall financial picture.

Cost of Living: This metric highlights how affordable it is to live in each state, factoring in housing, healthcare, transportation, and everyday expenses.

Median Annual Income: Understand the typical earnings in each state. Higher incomes in some states may offset higher taxes or living costs, helping residents maintain purchasing power.

Average Home Values and Year-Over-Year Growth: Housing affordability can be a deciding factor when evaluating your paycheck’s impact. States with rapidly increasing home values may signal strong real estate investments but higher living costs.

Sources: State Income Tax Rates of 2025 – https://www.investopedia.com/state-income-tax-rate-changes-for-this-year-8764186

* Washington does not have a typical individual income tax but does levy a 7.0 percent tax on capital gains income.

2025 State and Local Sales Tax Rate Average – https://www.salestaxhandbook.com/pdf/datasheets/SalesTaxRatesByState.pdf

Median Annual Income Adjusted For the Cost of Living – https://www.voronoiapp.com/economy/The-Median-Income-in-Every-State-Adjusted-for-Cost-of-Living-1585

Cost of Living Ranking, State Typical Home Value, Home Value Increase past year – https://www.mottomortgage.com/blog/ranking-each-of-the-50-states-by-cost-of-living

No content published here constitutes a recommendation of any particular investment, security, a portfolio of securities, transaction or investment strategy. To the extent any of the content published may be deemed to be investment advise, such information is impersonal and not tailored to the investment needs of any specific person. Consult your advisor about what is best for you.

Exploring the Extreme States that Impact Paychecks

States With No Income Tax: These states allow you to keep more of your gross income, making them attractive for workers aiming to maximize take-home pay. Nine states don’t impose state income taxes, however, each offers unique advantages and challenges:

- Alaska: Residents not only enjoy no income tax but also receive annual payments from the state’s oil revenues. To claim this check you must have lived there continuously for at least one year. However, the high cost of goods and services offsets some of these benefits due to the state’s remote location.

- Florida: No income tax and warm weather make this a popular destination for retirees, but housing costs in some areas can be high.

- Nevada: With no state income tax, rising home prices in cities like Las Vegas could affect affordability.

- Texas: Booming job opportunities and no income tax are attractive, though rising property taxes are worth noting.

- Tennessee: Known for its low cost of living and vibrant culture, Tennessee offers no state income tax on wages, though investment income is taxed.

- Wyoming: This sparsely populated state pairs no income tax with affordable living and low property taxes.

- Washington: While it has no income tax, sales tax rates are among the highest in the nation.

- South Dakota: A low-tax haven with affordable living, particularly outside urban areas.

- New Hampshire: Though it lacks a wage tax, it does impose taxes on dividends and interest income, impacting some retirees.

Pro Tip for Retirees: Without state income tax, retirees can keep more of their retirement income. Whether it comes from pensions, Social Security, or other retirement accounts, this can lead to more financial freedom. Retirees often live on fixed incomes, so every dollar counts. No state income tax can help you stretch your retirement savings further.

States With the Highest Income Taxes: On the other end, high-tax states can significantly reduce take-home pay:

- California: With a top marginal rate of 13.3%, it’s the most taxing state for high earners. The cost of living is also among the nation’s highest, particularly in urban areas.

- New York: Marginal tax rates can reach 10.9%, and this doesn’t include local taxes in cities like New York City.

- Hawaii: While stunning scenery and lifestyle appeal, the 11% top tax rate and high living costs weigh heavily on residents.

- Other states with high income taxes include Oregon, New Jersey, Minnesota, and Vermont, all of which exceed 9%.

Cost of Living: How Affordable Is Everyday Life?

The cost of living includes essential expenses like housing, healthcare, groceries, utilities, and transportation. Even if a state has low- or no-income tax, a high cost of living can quickly eat away at your paycheck. Tip: When evaluating a state, compare your income to the cost of living to determine your purchasing power. Let’s compare:

Most Affordable States:

- Mississippi: With the lowest cost of living index in the nation, expenses like groceries and housing are well below the national average.

- Arkansas: Known for affordable housing and low transportation costs, this state offers excellent value for paycheck stretching.

- West Virginia: Despite modest income levels, residents benefit from a low cost of living and inexpensive real estate.

- Midwestern States (e.g., Kansas, Indiana, Ohio): These states balance modest tax rates with affordable living, creating great opportunities for residents to save.

Least Affordable States:

- Hawaii: The cost of essentials like food and transportation is significantly higher due to the state’s remote location, making it the most expensive state to live in.

- California: Housing and energy costs make California one of the most challenging places to stretch your paycheck, even with high earning potential.

- New York: Urban areas like NYC inflate the state’s cost of living index, with high housing and transportation expenses.

Housing: A Major Factor in Financial Freedom

Housing costs are often the single largest expense for most households, making it a critical factor in how far your paycheck goes.

Most Affordable Housing States:

- West Virginia: The average home value is just over $167,000, the lowest in the nation.

- Mississippi: With an average home value of $178,495 housing is a bargain compared to the national average of $420,400.

- Arkansas: The average home value of $209,251 and a low cost of living make Arkansas a popular choice for budget-conscious individuals.

Expensive Housing States:

- Hawaii: The average home price exceeds $850,000, making homeownership challenging even with higher-than-average incomes.

- California: With median home values over $773,000, the state has some of the highest housing costs in the U.S.

- Colorado: Once affordable, this state has seen significant home price appreciation, now averaging over $544,000.

Moreover, states like Connecticut, Massachusetts, New Jersey, Rhode Island, New York, Washington, and New Hampshire are seeing significant year-over-year increases in home values, which might make buying a home less affordable over time but offer strong investment potential.

Pro Tip for Retirees: States with lower home values often have lower property taxes, making them especially appealing for fixed-income retirees.

Bottom Line: Where Does Your Paycheck Go the Furthest?

Here’s a quick guide to help you choose a state based on your financial goals:

1. For Maximum Savings:

States like Texas, Florida, and Wyoming combine no income tax with a moderate cost of living and affordable housing in many areas.

2. For Affordable Living:

Mississippi, Arkansas, and West Virginia offer low costs of living and housing, making them ideal for those on a tighter budget or looking to save.

3. For High Earning Potential:

States like Massachusetts and Washington have high median incomes but come with a higher cost of living, making them better for those earning above-average wages.

Considerations for Retirement

Retirement brings a unique set of priorities. Here’s what to keep in mind:

Income Tax Exemptions: Some states exempt Social Security benefits, pensions, or distributions from retirement accounts. For example:

- Florida: No state income tax and no taxation on retirement income.

- Nevada: Similarly attractive for retirees, with no income tax on retirement earnings.

- Illinois: While it has an income tax, it exempts most retirement income, making it retiree friendly.

Healthcare Costs: States like Florida and Arizona are popular among retirees due to their robust healthcare infrastructure tailored to aging populations.

Property and Sales Taxes: Even if a state has no income tax, property and sales taxes can quickly add up. For example:

- Texas: While there’s no income tax, high property taxes can offset savings.

- Tennessee: Low property taxes make this state a favorite for retirees.

Climate and Lifestyle: Warm-weather states like Florida, Arizona, and South Carolina are appealing for their year-round sunshine. However, consider whether a more temperate climate like that of North Carolina or Oregon fits your lifestyle better.

Choosing the Best State for Your Retirement

Where your paycheck goes the furthest depends on your priorities, lifestyle, and financial goals. While states with no income tax, like Texas and Florida, might initially seem ideal, it’s important to consider the full picture—including cost of living, housing, and healthcare. These factors can make other states equally competitive.

For retirees, focusing on fixed costs like property taxes and healthcare is crucial for ensuring financial stability. If you’re seeking adventure, affordability, and a lifestyle that aligns with your values, explore these popular retirement destinations and discover what they have to offer.

Take the time to evaluate all factors, and you’ll be better equipped to choose a location where you can live comfortably while meeting your financial goals.