Reaching milestones in your 401(k) journey isn’t just about marking time—it’s a celebration of your dedication to financial freedom. Each anniversary represents a meaningful step toward a secure and worry-free retirement. But why are these milestones so important, and how can you use them to your advantage?

401(k) Financial Checkpoints

Each anniversary provides a natural opportunity to pause, reflect on your financial journey, and evaluate how far you’ve come. Many aspire to reach millionaire status through their 401(k), and with the right planning and dedication, it’s achievable. Regularly checking your 401(k) status is essential to ensure you’re on track to meet your retirement goals.

Think of each 401(k) anniversary as a financial checkpoint—a moment to review your progress and plot the best course forward to perfect your 401(k) balance. Simply contributing isn’t always enough; actively assessing and adjusting investments is key to ensure you’re on track to meet your retirement goals.

Understanding the Impact of Time

Evaluating your contributions and investment performance at this juncture allows you to witness firsthand the impact of time on your savings. 401(k) contributions are like planting seeds for your future financial security. As you reach a 401(k) anniversary date, the significance becomes clear: from where you started, to where you are now, to what’s possible in future savings.

Identifying Areas for Improvement

Critically examine your financial landscape, considering changes in income, expenses, contributions, investment performance, retirement goals, and market conditions. Are there areas where you could increase contributions to accelerate savings growth? Are your investment choices still aligned with your risk tolerance and long-term goals? Find areas for improvement using this Risk Assessment Test and make necessary adjustments to your savings strategy.

Leveraging Increased Contributions and Compound Interest

While small increases to your 401(k) contributions may seem insignificant in the short term, their cumulative effect over time, combined with the power of compound interest, can substantially enhance your retirement savings and help you achieve your long-term financial goals.

Increasing Contributions

One of the most effective ways to ensure your 401(k) plan continues to grow is to increase your contributions over time. If you receive a raise or bonus, consider directing a portion of it to your 401(k). Maximize your savings using a Contribution Calculator. Even small increases can make a significant difference due to the power of compound interest.

Long-Term Growth with Compound Interest

Every dollar you contribute to your 401(k) earns interest. Over time, this interest compounds, meaning it generates additional earnings on both your initial contributions and the interest that has already accrued. This compounding effect can snowball, resulting in exponential growth of your retirement fund. The earlier you start, the more time your money has to grow.

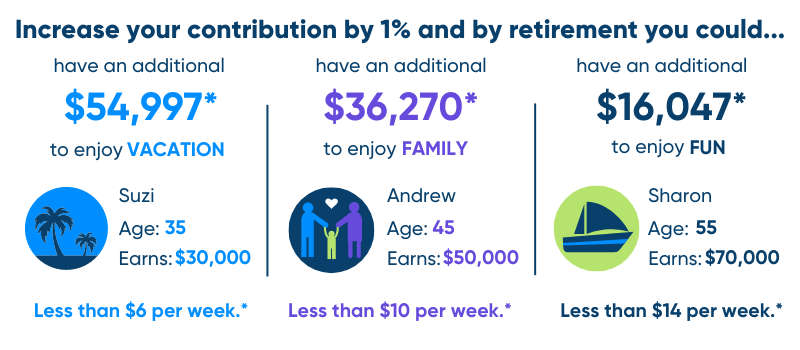

For instance, contributing just 1% more to your 401(k) can have a substantial impact on your final retirement savings. Even if your budget is tight, an added contribution each month could compound and grow into thousands over time.

*This information is intended to be educational and is not tailored to the investment needs of any specific investor. *Source: Fidelity; Approximation based on a 1%, monthly increase in contribution. Continued employment from current age to retirement age, 67. We assume you are exactly your current age (in whole number of years) and will retire on your birthday at your retirement age. Number of years of savings equals retirement age minus current age. Nominal investment growth rate is assumed to be 7%. Hypothetical nominal salary growth rate is assumed to be 4% (2.5% inflation + 1.5% real salary growth rate). All accumulated retirement savings amounts are shown in future (nominal) dollars. This model does not take into account IRS contribution limits or “catch-up” contributions.

Catch-Up Contributions

For those aged 50 and above, catch-up contributions offer a valuable opportunity to boost retirement savings. The IRS allows additional contributions beyond the standard limit, allowing you to accelerate your savings as you approach retirement. Take full advantage of this to maximize your 401(k) balance and ensure a more comfortable retirement.

Navigating 401(k) Challenges: Lessons Learned Along the Way

The journey to building a strong 401(k) plan is not without its challenges. Market volatility, unexpected expenses, and changes in employment can pose hurdles. However, these challenges also offer valuable lessons. Adjusting your investment strategy in response to market conditions, keeping an emergency fund to avoid dipping into your retirement savings, and regularly reviewing and updating your plan are steps in overcoming these obstacles.

Market Fluctuations

Changes in the market can impact your investment returns, making it essential to regularly review and adjust your investment strategy. Diversifying your portfolio and maintaining a balanced asset allocation can help mitigate risks and protect your retirement savings during turbulent times.

Unexpected Expenses

Unexpected expenses can derail your savings efforts if you’re not prepared. Establishing and maintaining an emergency fund is key to avoid dipping into your retirement savings when unexpected costs arise. This fund should cover three to six months of living expenses, providing a financial buffer that protects your 401(k) from premature withdrawals and penalties.

Employment Changes and Life Events

With a career transition or a life change such a marriage, having children or buying a home, it’s important to keep your retirement goals in focus. Adjust to life circumstances but try and continue making contributions to your retirement plan, even if they are smaller than before. If you’re changing jobs, consider rolling over your 401(k) from your previous employer to your new employer’s plan or an IRA to maintain the growth trajectory of your savings.

Looking Ahead

401(k) anniversaries serve as crucial checkpoints in your financial journey. By celebrating these milestones, reflecting on your progress, and planning for the future, you can ensure that your 401(k) remains a potent tool for securing your retirement. To effectively navigate the complexities of retirement planning, creating a 401(k) savings roadmap is essential. Here are some steps to help you get started:

- Early Career: Focus on setting up a solid foundation by contributing a fixed percentage of your salary to your retirement savings. Aim for at least 10-15% if possible. If you can’t meet this threshold right away, don’t worry. The important thing is to save as much as your budget allows and maximize your contributions as best you can. Every bit helps in building a secure financial future.

- Mid-Career: Increase contributions as your income grows. Aim to max out contributions, especially after paying off debts. Set your 401(k) to automatically increase contributions annually or with raises.

- Late Career: Focus on catch-up contributions if you’re over 50, and shift towards more conservative investments to preserve capital.

Regularly revisit and revise. Track your 401(k) performance every quarter and rebalance if necessary to stay on track with your investment strategy. Don’t forget about regularly consulting with a financial advisor who can offer personalized strategies to enhance your savings plan.

Celebrating 401(k) Milestones

Mark each financial milestone, like reaching a savings target or making your first catch-up contribution, with a treat such as a nice dinner or a short trip to reinforce your disciplined saving habits.

By incorporating these practices into your retirement planning, you can make the most of your 401(k) anniversary, ensuring that you stay on track to meet your long-term financial goals. Embrace these milestones as opportunities for reflection and celebration and let them serve as powerful motivators to support and even enhance your disciplined saving habits.