An old stock market adage is “nothing changes sentiment like price,” with fluctuations in investor optimism often being more closely linked to how much one’s portfolio has risen or fallen in value recently than any actual changes in the underlying fundamentals.

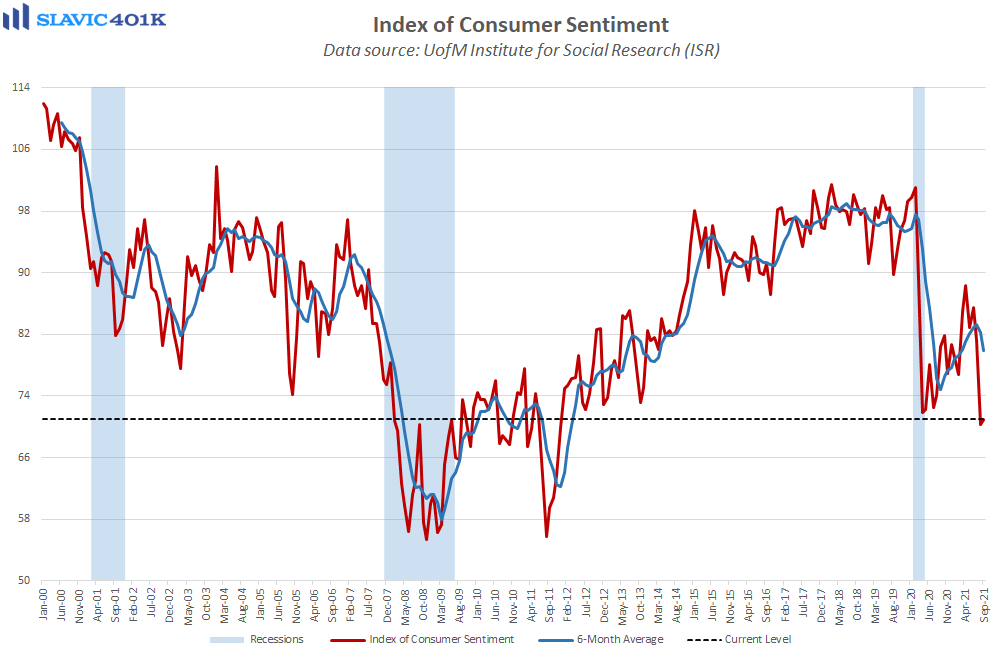

It seems the same can be said about consumer confidence in general because even though most measures of economic activity have improved considerably over the past year and a half, various gauges of sentiment appear to have been weighed down lately by rising prices. For example, the University of Michigan’s consumer confidence index ended October at 71.7, up slightly from the Delta variant low hit in August but still below the April 2020 reading of 71.8.

Although we are skeptical that Americans are actually more pessimistic now than they were during the heart of the lockdowns and COVID-19 uncertainty, as the latest sentiment index reading would imply, the recent weakness in such confidence gauges is a clear sign that inflation has not gone unnoticed by Americans. In fact, in the October poll consumers said that they expect inflation over the next twelve months to run at 4.8 percent, the highest anticipated year-ahead inflation rate since 2008. Of course most consumers are not professional economists with their own inflation forecasting models, but simply the belief that prices are going to keep rising and at an accelerating rate can be all it takes to sufficiently influence spending behavior. The good news is that consumers do not appear to believe such rapid price increases will be permanent because inflation expectations for the next five years in the October survey were only 2.9 percent. That is down from earlier polls and in line with our own disinflationary outlook for the next few years.

Perhaps the bigger takeaway is that as much as inflationary pressures and concerns have risen lately it has yet to materially impact consumption. Rising wages are a key factor behind this and the University of Michigan report even noted that “the positive impact of higher income expectations and the receding coronavirus” has helped offset “higher rates of inflation and falling confidence in government economic policies.” Moreover, one of the bright spots in last week’s release of the October job report was that wage growth in America remains elevated. This report’s particular measure of worker compensation, though, has been extremely volatile due to the economic disruptions caused by the pandemic, both to the downside and the upside. A better (smoother) alternative is the U.S. Labor Department’s Employment Cost Index (ECI), which looks at how companies are adjusting pay for a particular job while holding constant the industry and occupational categories. The latest ECI update showed that overall wage and salary costs in America rose 1.5 percent in the third quarter of 2021, the largest quarter-over-quarter gain on record.

Private sector wages and salaries rose even more (1.6 percent) in Q3, with strong gains seen across a broad spectrum of industries. Benefits costs also lifted in the third quarter, but only by 0.9 percent, continuing the unique dynamic of the current expansion where wage inflation has significantly outpaced benefits inflation. This stands out because in past cycles benefits inflation tended to well exceed wage inflation in the immediate post-recession environment because economic uncertainty was often still elevated and businesses therefore preferred compensation raises such as benefits over wages since benefits typically have a delayed start and incentivize continued work. Better clarity on what is driving the current wages and benefits growth disparity may be available in December when the Labor Department releases a more detailed breakdown of recent compensation trends. Regardless, employment costs have clearly risen a lot this year, and it may still be a few more quarters until the pace at which workers are returning to the labor force picks up enough to finally provide some relief for employers.

What To Watch This Week:

Monday

- Richard Clarida Speaks 9:00 AM ET

- Kenneth Montgomery Speaks 10:00 AM ET

- Jerome Powell Speaks 10:30 AM ET

- Patrick Harker Speaks 12:00 PM ET

- 3-Yr Note Auction 1:00 PM ET

- Charles Evans Speaks 1:50 PM ET

Tuesday

- NFIB Small Business Optimism Index 6:00 AM ET

- James Bullard Speaks 7:50 AM ET

- PPI-Final Demand 8:30 AM ET

- Jerome Powell Speaks 9:00 AM ET

- 10-Yr Note Auction 1:00 PM ET

- Neel Kashkari Speaks 1:30 PM ET

Wednesday

- MBA Mortgage Applications 7:00 AM ET

- CPI 8:30 AM ET

- Jobless Claims 8:30 AM ET

- Atlanta Fed Business Inflation Expectations 10:00 AM ET

- EIA Petroleum Status Report 10:30 AM ET

- 10-Yr TIPS Announcement 11:00 AM ET

- 20-Yr Bond Announcement 11:00 AM ET

- EIA Natural Gas Report 12:00 PM ET

- 30-Yr Bond Auction 1:00 PM ET

Thursday

- Nothing significant scheduled

Friday

- Consumer Sentiment 10:00 AM ET

- JOLTS 10:00 AM ET

- John Williams Speaks 12:10 PM ET

- Baker Hughes Rig Count 1:00 PM ET