Offering a 401(k) retirement plan to your employees makes a statement—a statement that you care about their future and well-being beyond their employment with you. Not only does a retirement savings plan enrich your suite of employee benefits, but it also delivers significant financial advantages for your business. These 401(k) benefits for employers include tax advantages, potential savings on payroll taxes, better recruitment and retention, and improved overall workplace satisfaction.

If you’re an employer who has never offered a 401(k) plan before—or even if you currently have an employer sponsored retirement plan for your trusted workers—you should understand the fundamentals of 401(k)s and their benefits before selecting one for your business.

What is a 401(k) Plan?

A 401(k) is a retirement plan that allows employees to put money into a particular account. Contributions to 401(k)s are invested in mutual funds, stock, bonds, money market accounts, and other investment choices as part of a portfolio. When an employee takes out funds from their 401(k), they’re usually taxed as income: usually at retirement. Employer-sponsored 401(k) plans enable employees to save for their future while also reducing taxes for both parties.

What is the Standard Employer Contribution to a 401(k)?

Employers are not required to make contributions to employees’ 401(k) retirement accounts, as they are with a pension. This flexibility makes the overall expenses significantly lower. While it isn’t necessary, many businesses choose to match 401(k) contributions up to a certain percentage or provide profit-sharing benefits as an added bonus for their workers. Employer matching actually benefits the company supporting the 401(k). See below.

For example, if an employer offers 5% in match dollars, then employees can contribute 5%, doubling down on contributions to their retirement funds annually. But, if an employee only contributes 3%, then so will the employer. For high-earning employees, having a percentage match is more beneficial than a dollar amount, since they are typically a lot lower.

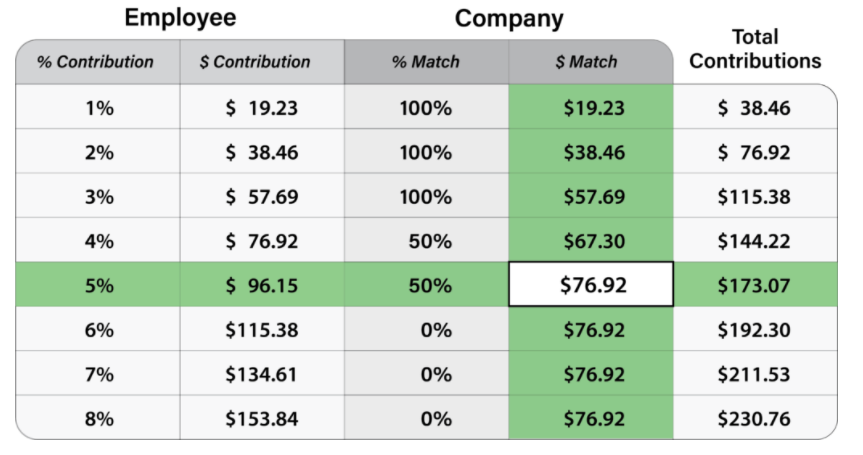

The scenario below shows a range of employee contributions made on a bi-weekly basis using a $50,000 annual salary ($1,923.07 pre-tax, per-pay) with 5% employer-matching contributions – 100% of the first 3% of contributions and 50% of an additional 2%:

Quick Tip: For more on the 401(k) benefits for employers, read our blog on employer matching.

401(k) Benefits for Employers

One of the most popular reasons businesses offer 401(k) plans is to attract and keep top talent at all levels of the organization. Employees enjoy a 401(k) plan since it allows them to set aside money for retirement in a tax-advantaged manner by contributing to an investment fund that is tax-deferred. However, employees aren’t the only ones who benefit from a 401(k) plan; employers can also take a tax deduction for contributions made to their workers’ accounts. Businesses may be eligible for a $500 annual corporate income tax credit during the first three years of having a plan.

Benefits of contributing to a 401(k) for employers include:

Tax Benefits: Tax deductions for employer contributions and IRS tax credits of up to $3,000 over first 3 years*.

Automatic Payroll Deductions: Simple online enrollment and plan participation via automatic payroll deductions.

High Contribution Limits: Each year, the IRS sets a limit maximum subject to change yearly. View the limits here.

Flexible Plan Design Options: Eligibility requirements, employer matching/profit sharing, vesting, automatic enrollment, and more.

Higher Quality and Lower Cost Investment Options: Access to institutional share class funds with lower expense ratios.

401(k) Benefits for Employees

Tax Benefits (Employee): Pre-tax contributions and tax deferred investment growth.

Employer Contributions: Matching and profit sharing, either discretionary or safe harbor contribution options.

Roth Contributions: Tax-deferred investment growth and tax-free distributions*.

*State Mandates for Employer Sponsor Retirement Plan Satisfy state-mandated requirements for offering an employer-sponsored retirement plan.

What Are the Requirements of a 401(k) Plan?

A 401(k) plan must meet a variety of requirements established by the IRS, to be a qualified plan. Some of those requirements include:

Defined Contribution Limits: The IRS sets annual contribution limitations for 401(k) plans. There are two limits: one for employee contributions and the other for overall contributions (including all employee and employer contributions). Employees who are 50 years old or older at the end of the year may make additional “catch-up” contributions up to a maximum amount set by the IRS.

Distribution Rules: The money in a 401(k) plan accumulates tax-deferred, but withdrawals must fulfill certain criteria, such as the employee’s retirement, death, disability, or separation from work. Furthermore, if an employee reaches age 59 1/2 or faces hardship as defined and permitted by the plan, he or she may withdraw funds.

Limits for High-Income Earners: Employees whose yearly income or stake in the company meets a specific level are restricted by the IRS to contributing only a part of their earnings. The IRS does non-discrimination testing (NDT) on 401(k) plans to verify that highly compensated employees (HCEs) are not prohibited from participating disproportionately more than other workers at the firm.

Clear Vesting Schedule: A vesting schedule is a plan that determines when an employee is eligible to receive all or part of the employer contribution. Vesting can be based on how many years the employee has worked for the company, but other factors are possible as well. Generally, employers pick a timeframe where 401(k) plans are fully vested – typically one to three years of service. However, the Internal Revenue Code also allows for retroactive vesting to date of hire if a company so desires.

Visit the IRS website for more information on full qualification requirements, or reach out to one of our client specialists.

SECURE ACT

The SECURE Act further encourages automatic enrollment by providing a $500 incentive for each year the retirement savings plan is implemented. In the year that the retirement savings plan is established, a $500 credit is available.

Employer Tax Credits

In the original SECURE Act, for businesses with 51-100 employees the first credit year (the year when the plan is established) and each of the 2 taxable years immediately following the first credit year, the tax credit available is the greater of $500, or the lesser of $250 for each non-highly compensated employee (NHCE) who is eligible to participate in the plan, or $5,000.

Examples:

Company with 1 eligible NHCE – 1 x $250 = $250 but get the $500 tax credit

Company with 5 eligible NHCE’s – 5 x $250 = $1,250 credit

Company with 10 eligible NHCE’s – 10 x $250 = $2,500 credit

Company with 20 or more eligible NHCE’s – 20 X $250 = $5,000 credit

The tax credit is only available when an employer is establishing a new retirement plan, including 401(k) Plans. If the employer offered a retirement plan at any time during the previous three years which covered substantially the same employees as the new plan, the tax credit is not available.

The tax credit is not a deduction. The tax credit reduces the employer’s tax liability dollar-for-dollar. If this tax credit is calculated to equal $2,000, then the employer’s tax liability is reduced by $2,000.

With the updated SECURE Act legislation, an available tax incentive allows eligible businesses with 50 or fewer employees to receive a tax credit covering 100% of their administrative expenses when setting up a workplace retirement plan. This benefit is applicable for a maximum period of three years.

What Slavic401k Provides Businesses

Payroll Integration: Contribution data is automatically transferred to Slavic401k as a part of payroll processing.

Compliance Notifications: Slavic401k provides compliance notification services for eligibility notices, detailed disclosures, DOL regulations, and email/mailing services.

What’s Unique to Slavic401k?

Sponsor Express: Sponsor Express is a monthly email to the company administrators that provides 401(k) plan adaptor insight. This includes plan demographic data, summaries of employees and the employer contributions and compliance testing results.

Email Express: Our Email Express program provides your employees with weekly insights into the status of their individual account including their account balance as well as updates on market fluctuations and the direct impact those changes may have on their plan. Email Express also includes retirement savings tips and educational articles that promote financial wellness.

Bespoke: Bespoke uses a digital advisor to create a custom investment plan specific to your employees’ circumstances and needs based on age, goals, and risk tolerance. Our proprietary algorithm makes their life goals the center of attention. Bespoke monitors their investment mix on an ongoing basis and will automatically make adjustments to stay aligned with their retirement goals.

A 401(k) plan is a great benefit for any employer to offer their employees, but especially for those of you running a small or medium-sized business. In fact, there are several 401(k) benefits for employers: not only does this plan offer financial advantages—such as providing tax deductions and potentially reducing your company’s taxable income—but when implemented correctly, it also becomes a powerful recruitment tool, attracting top talent in a competitive job market.

If you would like more information on how to set up this type of retirement savings plan for your present and future employees, please contact us today–our team will provide personalized assistance tailored specifically to your business needs. We look forward to assisting you.