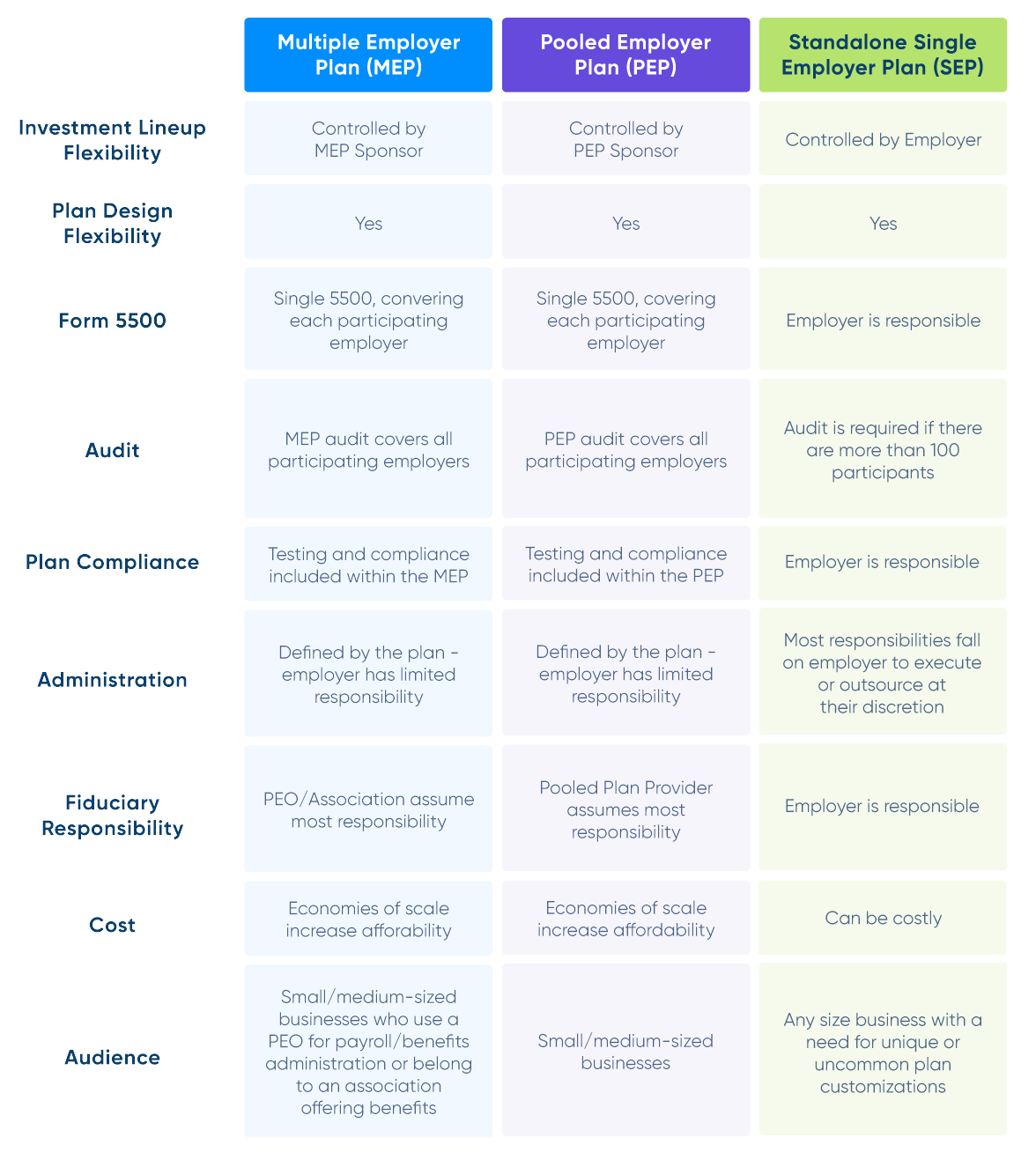

Uncle Sam and the retirement savings industry love acronyms. First, there were SEPs … then came MEPs, and as of 2020, there is a new kid on the block … PEPs. Each of these 401(k) plan types share many fundamental similarities, but there are differences in the administrative models of each.

If you don’t speak fluent tax code and legal/wealth management jargon, don’t worry, we’ve got you covered. Below is a breakdown of each plan and how they differ.

Single Employer 401(k) Plans

A standalone Single Employer Plan (SEP) is a traditional 401(k) plan that is sponsored by a single employer. It is what most people think of when referencing a 401(k) plan. It is often the plan of choice for large corporations as well as some small and medium-sized businesses due to its flexibility. With a SEP, the employer has total control over all plan decisions and fiduciary responsibilities.

Pros: Customization, flexibility and ability to choose your own service providers if outsourcing some of the administrative duties.

Cons: Have the highest level of responsibility for employers, but because of this, can also be the most costly and time consuming in many cases.

Multiple Employer 401(k) Plans

A Multiple Employer Plan (MEP) is a retirement savings plan where multiple employers participate in a single plan. It is sponsored by one entity (typically a professional employer organization (PEO) or association). PEOs and associations are typically the sponsors because all employers participating in the plan must share a common thread. That thread is typically a membership to the association or working with a PEO. Member companies of a MEP are not required to file an individual 5500 report, undergo an annual plan audit and acquire ERISA bond protection.

Pros: Low costs due to shared resources and most administrative duties are outsourced.

Cons: Less customization than an SEP and because participating businesses must have a common bond, you must work through a PEO or association membership to participate in a MEP.

Pooled Employer 401(k) Plans

A Pooled Employer Plan (PEP) is the new kid on the block. Created by the SECURE Act of 2020 and effective January 1, 2021, PEPs are a form of Multiple Employer Plan. In a PEP, a group of participating employers outsources all administration to a Pooled Plan Provider. The Pooled Plan Provider is a 3(16) fiduciary who establishes and administers the PEP. Each of the participating employers do not need to have a common thread between them, like in a traditional MEP.

Pros: Like a MEP, costs are lower due to shared resources and administrative duties are outsourced. Also, there is no need to have a common bond with other participating employers.

Cons: Less customization and flexibility than a SEP. While PEPs are a very exciting product for business owners, they are new to the market which means awareness and adoption is low.

PEPs vs. MEPs vs. SEPs: What’s the Difference?

Administration

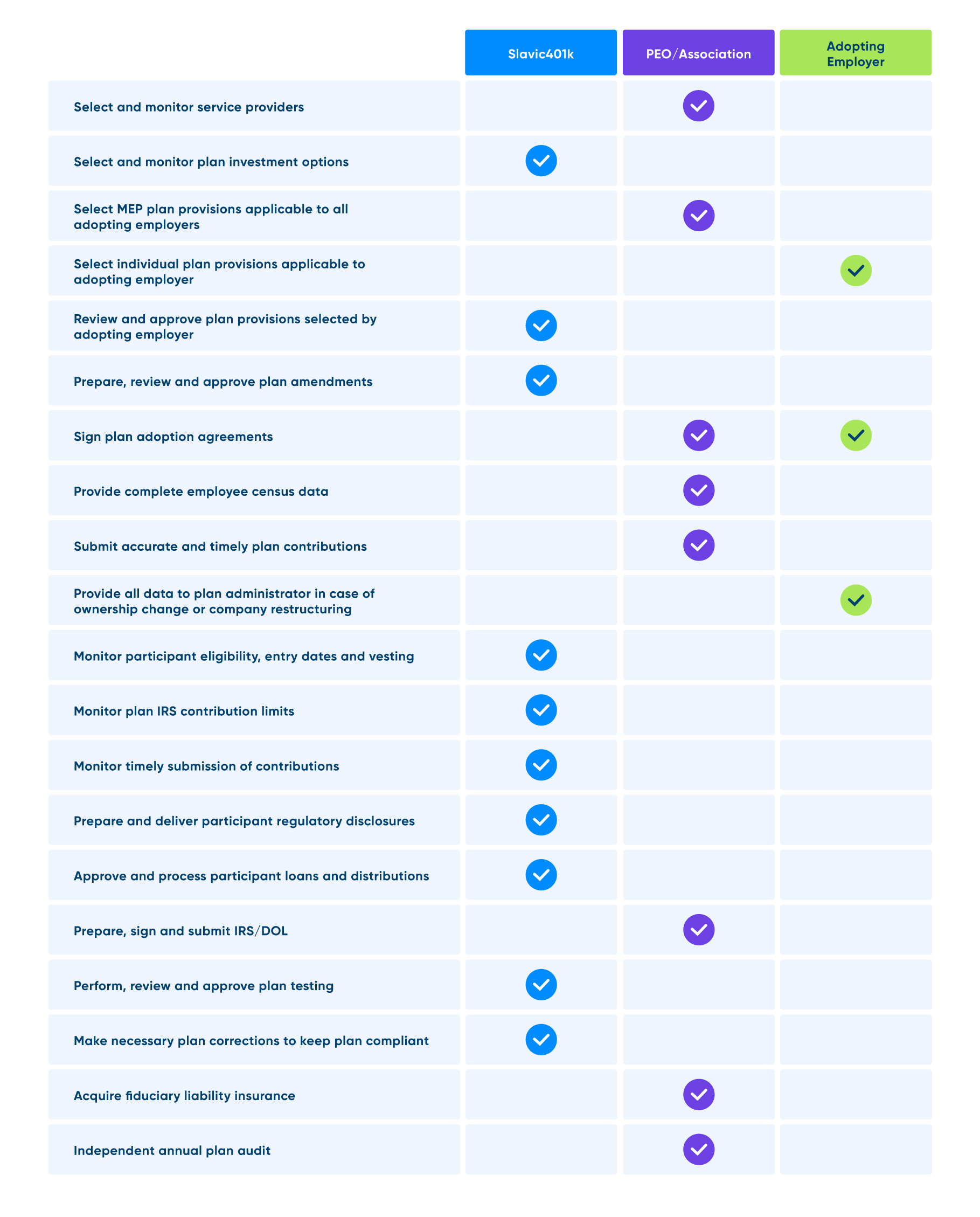

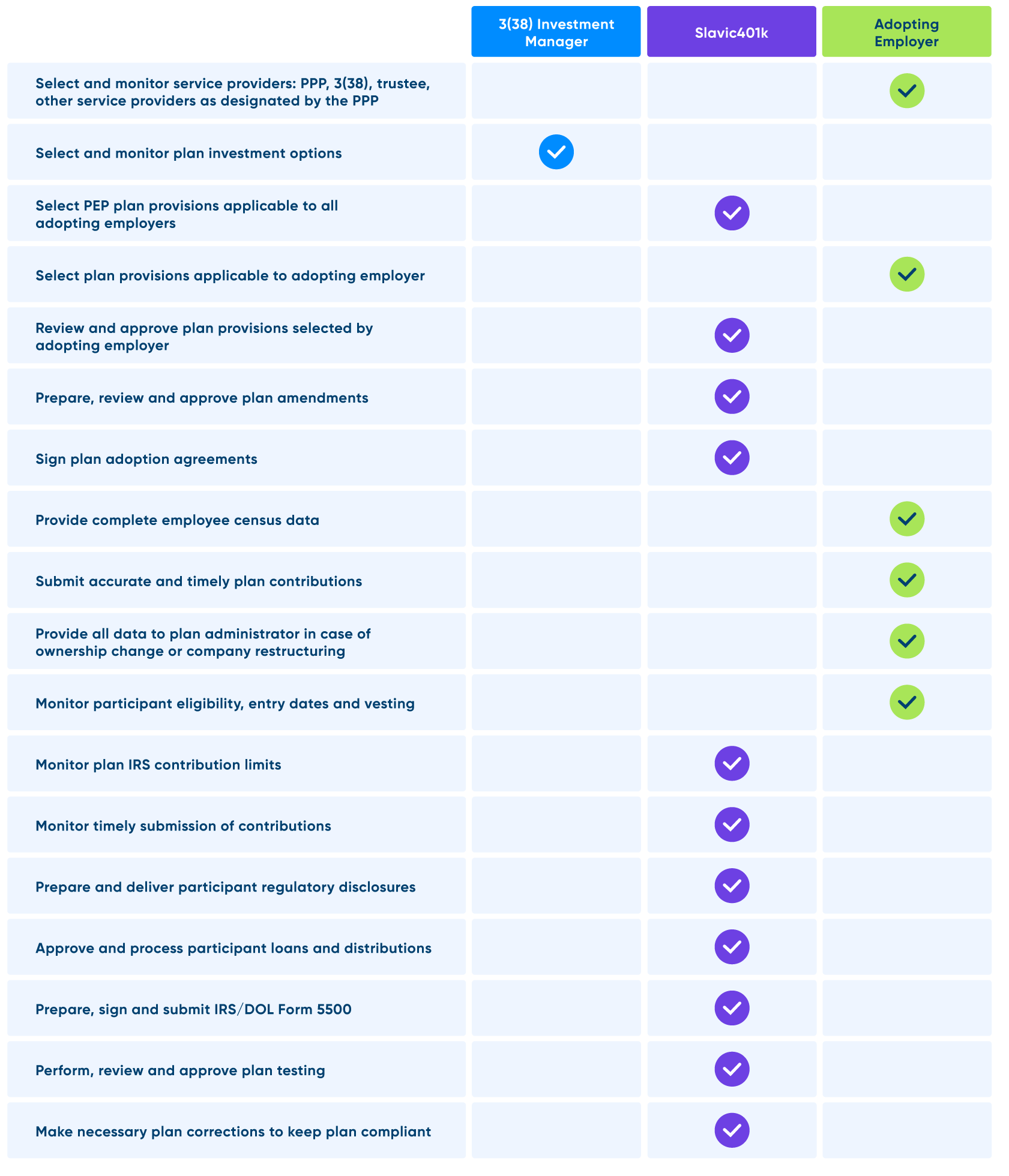

One of the biggest ways MEPs, PEPs and SEPs can differ from each other is who takes on the time and resources commitments of administering the plan and ensuring compliance. Below are three charts that outline who is responsible for each administrative duty in each plan type when working with Slavic401k.

Multiple Employer Plan Administrative Duties

Pooled Employer Plan Administrative Duties

Single Employer Plan Administrative Duties

Picking the Right Retirement Plan

Choosing the right retirement savings plan for your business, PEO or advisory firm is a highly personal decision based on your individual needs, resources and budget. We have experienced plan consultants that can answer your questions and help you determine the best solution for you. Contact us to speak with a team member today.