Essential Guide to Understanding IRAs:

The IRA numbers don’t lie! With 57 million U.S. households holding a remarkable $16 trillion in IRA retirement accounts, it’s clear these are a cornerstone of American retirement planning, and for good reason!

At Slavic401k we’re committed to helping you and your family build toward financial security at retirement. This guide simplifies the world of IRAs, outlining the distinct advantages you can gain. Discover how to make your retirement savings work smarter for you:

What is an IRA?

An Individual Retirement Arrangement (IRA) is a powerful personal savings plan. It is distinct from employer-sponsored account and designed to help you build wealth for retirement with significant tax advantages.

Unlike a 401(k), you directly open and control your own IRA, giving you greater flexibility and a wider array of investment choices. While your 401(k) is an excellent foundation for retirement savings, an IRA offers a crucial additional avenue for growth and diversification, often complementing your existing workplace plan.

Why IRAs Matter for Your Future

Tax Advantages are the biggest draw:

Defer taxes now with a Traditional or enjoy tax-free withdrawals later with a Roth . Either way you go, compound interest can help your investment grow significantly.

Control Over Investments:

An IRA puts you in the drivers seat for freedom of investment options that align with your goals and risk tolerance.

It’s Yours, No Matter What:

Open an IRA regardless of your job status—as long as you have earned income.

Save More for Retirement:

IRAs can supplement your workplace retirement plan. The earlier and more consistently you invest, the better your chances of reaching your goals—especially with the uncertainty of the future.

The SlavicIRA Advantage

With most IRA products, you have the burden of researching providers, evaluating fees, and managing investments. SlavicIRA handles these tasks for you!

Have a New Job? We Have Easy 401(k) to IRA Rollovers

Starting a new position is exciting, but it often leaves you with a question: What should you do with your old 401(k)? Leaving it behind can mean losing track of your retirement savings or missing out on potential growth. We make it simple to seamlessly transfer funds from your previous employer’s retirement plan into an IRA account that you control.

Don’t leave retirement savings behind. Learn about what to do with an old 401(k) plan and your options.

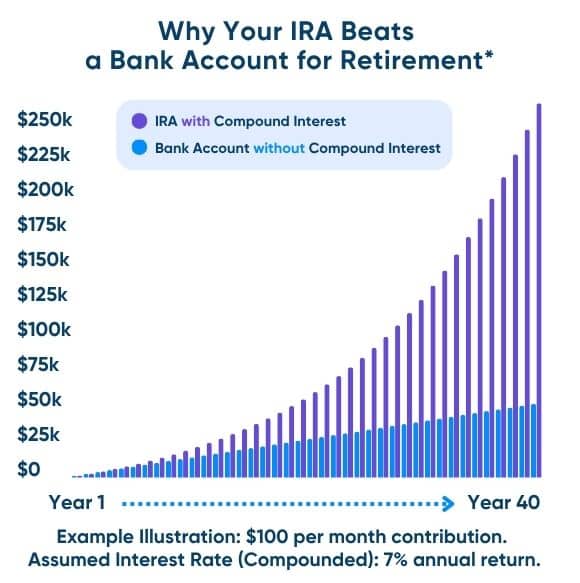

Your Retirement: Grow It Smart

Want your money to work harder? This is where your IRA money truly takes off! With an IRA, your earnings generate more earnings through a tax-advantaged “snowball effect” of compound earnings.

*Illustrative purposes only. Highlights the potential growth of investments versus a basic savings account with an regular monthly $100 contribution to an IRA. Hypothetical 7% annual IRA return is not guaranteed; actual investment returns will vary and may be lower. This does not account for fees, taxes, or inflation. Investing in an IRA involves risk, including principal loss.

Easily Rollover an old 401(k) or Open a New IRA!

1. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Diversification does not ensure a profit or protect against a loss. All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account.

2. IRA Income Eligibility: our employment status itself doesn’t prevent you from opening an IRA, but having earned income is generally a requirement for making contributions, and your contributions cannot exceed your earned income. (For example, if you only earn $3,000, you cannot contribute the maximum allowable amount.) However, a spousal IRA allows a spouse with sufficient earned income to contribute on behalf of a non-working or lower-earning spouse, provided they file as married filing jointly. There’s no income limit to contribute to a Traditional IRA, but your ability to deduct those contributions is phased out based on Modified Adjusted Gross Income (MAGI) if you’re covered by an employer retirement plan. For Roth IRAs, your MAGI directly determines if you’re eligible to contribute at all. Consider consulting a tax professional for specific guidance.

3. Traditional IRA Distribution Rules: Withdrawals from a Traditional IRA are generally taxed as ordinary income in the year they are taken. If taken before age 59½, they may also be subject to a 10% early withdrawal penalty unless an IRS exception applies, such as for a first-time home purchase (up to $10,000), qualified birth or adoption expenses (up to $5,000), qualified higher education expenses, total and permanent disability, death, certain unemployment-related health insurance premiums, unreimbursed medical expenses exceeding 7.5% of adjusted gross income, substantially equal periodic payments, or an IRS tax levy.

4. Roth IRA Distribution Rules: Qualified withdrawals are tax- and penalty-free if the account has been open for at least five years and one of the following applies: you’re age 59½ or older, disabled, using up to $10,000 for a first-time home purchase, or deceased. Withdrawals before meeting these conditions may be subject to income tax and a 10% penalty. (Note: Each Roth conversion has its own five-year holding period.)

5. If you inherit a Roth IRA, you must take RMDs, but they’re tax-free as long as the original account owner held the account for at least 5 years.

6. The services provided to clients will vary based upon the service selected, including management, fees, and eligibility. You may wish to consult a tax advisor about your situation.

7. The method of rollover determines specific rules. If you opt for an indirect rollover (where you receive the funds yourself), you have 60 days to deposit them into an IRA, and this is limited to one such rollover across all your IRAs every 365 days. Direct rollovers from a previous employer’s retirement plan (like a 401(k)) to an IRA, or direct trustee-to-trustee transfers between IRAs, have no frequency or amount limits. You may be able to leave money in your current plan, withdraw cash or rollover the assets to a new employer’s plan, if one is available and rollovers are permitted. Compare the differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions, other plan features and tax treatment.

8. The annual IRA limit applies to all your traditional and Roth IRAs combined. Check your eligibility, including income limits. If you’re a high-income earner, consider a backdoor Roth IRA. Rather than contributing directly to a Roth, you can contribute to a traditional IRA and then convert it to a Roth. All investing is subject to risk, including the possible loss of the money you invest. We recommend that you consult a tax or financial advisor about your individual situation.