In today’s ever-evolving economic landscape, finding a secure path forward is essential for businesses and individuals. Safe Harbor retirement plans stand out as beacons of stability and protection. By adhering to specific regulations outlined by the Internal Revenue Service (IRS), Safe Harbor offers employers a streamlined approach to retirement savings while mitigating the risks associated with traditional plans. This win-win solution promotes financial security for all involved.

Understanding Safe Harbor

The beauty of Safe Harbor plans is the ability to create mutually beneficial scenarios for both employers and employees. We are here to explain the details and benefits and why employers should consider using them.

Compliance Made Simple: Plans automatically satisfy certain nondiscrimination testing requirements imposed by the IRS. These tests, such as the Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) tests, ensure that retirement plan benefits are distributed fairly among highly compensated employees (HCEs) and non-highly compensated employees (NHCEs). By adopting a Safe Harbor plan, employers can bypass these tests, reducing the risk of compliance errors and penalties.

- Tax Benefits: By ensuring compliance with IRS regulations, these plans help employers avoid excise taxes and penalties that may be imposed. It also offers several additional tax benefits for employers, including tax deductions for contributions, tax-deferred growth of retirement savings, and indirect benefits such as improved employee retention and productivity.

- Attracting and Retaining Talent: Employers find themselves empowered to offer attractive retirement benefits without the complexities typically involved. This attracts tops talent and employees benefit from enhanced financial security and a structured approach to retirement savings.

- Protecting Your Business Against Retirement Discrimination: By adhering to plan requirements, employers reduce risk of facing lawsuits or penalties related to retirement plan administration. Safe Harbor plans provide a clear framework for contributions and eligibility criteria, minimizing disputes or legal challenges from employees.

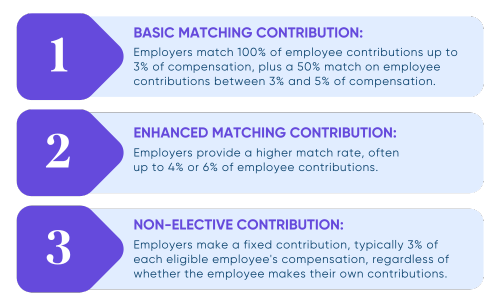

- Flexible Plan Options for Contributions: To qualify, employers must make contributions to employees’ retirement accounts. There are three main types of Safe Harbor contributions:

Slavic401k: Your Partner in Building a Secure Future

Protecting what matters most requires a reliable partner you can trust. Visit Slavic401k Support Center or contact us at (800) 356-3009 to speak to our team of experts and learn more about how we can help you, from plan selection to implementation and beyond.