On June 12, 2024 Slavic401k and Morgan Lewis held a joint webinar discussing SECURE 2.0 Provisions Going into Effect in 2025. Download the PDF slide deck here.

On Aug. 30, 2023 Slavic401k held a webinar to discuss the latest compliance implications of SECURE Act 2.0. Download the PDF slide deck here.

On May 23, 2023 Slavic401k and Morgan Lewis held a joint webinar discussing small employer tax credits available under the SECURE Acts. Download the PDF slide deck here.

On March 29, 2023 Slavic401k and Morgan Lewis held a joint webinar discussing SECURE ACT 2.0 implications for employers and plan sponsors. Download the PDF slide deck here.

What is SECURE Act 2.0?

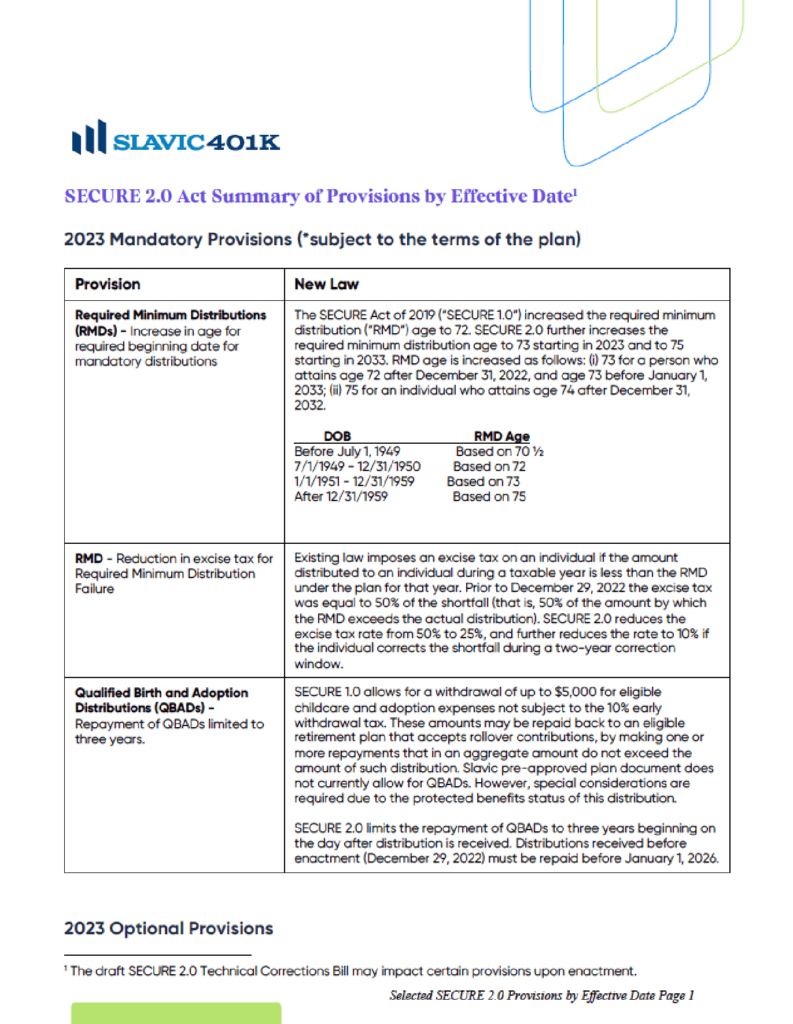

The SECURE 2.0 Act is legislation aimed at modernizing the retirement system and increasing retirement savings. It builds on the 2019 SECURE Act and contains 90 provisions that will have an impact on most plans, potentially in 2023.

For more in-depth information on the most prominent changes, download our guide on this page. Below is a quick summary of a few of the changes that will affect a wide range of employers and participants:

Plan Design Changes

- Any new plan established after December 29, 2022 must adopt automatic enrollment by January 1, 2025.

- An increase in the age for mandatory distributions from retirement accounts.

- Allows employers to offer small non-plan asset financial incentives, such as low-value gift cards, to participate in workplace retirement plans.

- In 2024, long-term part-time workers that meet certain criteria must be allowed to participate in company 401(k) plans.

Contribution and Investment Updates

- Allows individuals over age 60 and 63 to make higher catch-up contributions.

- A 401(k) plan can provide matching contributions to employees who make “qualified student loan payments” outside of the plan.

- New post-tax match available for defined contribution plans.

Distribution and Withdrawal Changes

- New exemption rule to cover emergency expenses without incurring a 10% early withdrawal penalty.

- Automatic portability for certain terminated employee retirement accounts.

- Allows defined contribution plans to offer short-term emergency savings accounts to non-highly compensated employees.

- Increases the involuntary cash-out limit for terminated employees effective in 2024.

- Qualified birth or adoption distributions re-payment changes.

Plan Administration Modifications

- Provides discretion to fiduciaries not to recover inadvertent overpayments to participants and offers retroactive relief for prior good faith interpretations of existing guidance.

- Amended notice requirements for unenrolled participants.

- Altered requirements for paper vs. electronic benefit statements. Provides a safe harbor for employers to correct employee elective deferral failures penalty-free.

If you’re interested in learning specific details about the act and how it will impact your retirement plan, be sure to download the full SECURE 2.0 update.