Switching your company’s 401(k) provider can be complicated, but it doesn’t have to be. If your company has an existing retirement plan, and it is your intention to have the assets from your prior plan transferred into your new 401k plan, a comprehensive due diligence procedure must be completed to ensure the transfer is in compliance with IRS regulations.

Slavic401k will also determine if there are any protected benefits that must be maintained in the new plan, and make recommendations to remedy any compliance issues that may have been uncovered.

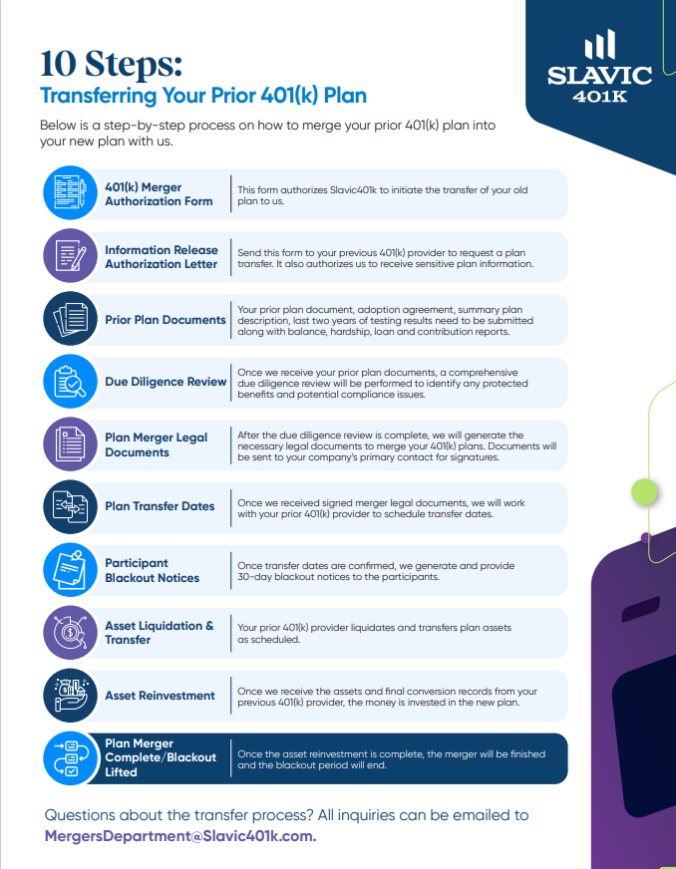

The plan transfer process begins after your plan has been set up. The transfer process of moving your existing 401(k) plan into your new one generally takes between 60-90 days to complete, depending on the prior TPA’s processes.

401(k) Plan Transfer Documentation

In most cases, the documentation below is required for proper due dilligence during the plan transfer process.

Plan Document – A 401(k) plan document identifies what kind of plan it is, how it works, and what special features it has to customize it to your business’ needs and goals. A retirement plan document governs a retirement plan’s features and day-to-day operations.

Adoption Agreement – client selects all the plan features needed to set up a plan, those are: effective date of the plan, age, and service requirements, matching contribution formula if any, profit sharing allocation formula if any, and vesting schedule.

Summary Plan Description – A Summary Plan Description (SPD) is a document that employers must give free to employees who participate in covered retirement plans. The SPD is a detailed guide to the benefits the program provides and how the plan works, as well as how to access them.

Last Two Plan Years of ADP/ACP Testing – The Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) tests assure that 401(k) plans don’t favor higher-paid employees.

Most Recent Plan Year Top Heavy Testing – The top heavy determination is part of the required IRS nondiscrimination tests to ensure plans do not disproportionately favor certain owners and officers.

Participant Balance Report – A plan-level summary or participant detail report for accounts that had either a balance greater than zero on either date OR any cash amount transaction history between the two dates.

Loan Reports – A detailed report of participants that had an outstanding loan balance greater than zero on either the first or last date of the dates selected.

List of Employees with Hardships – A list report of all employees with current hardship loans.

Plan Year-to-Date Contribution Report – This report displays participant-level contribution data by date and source for the specified time period.

Related Resources

Visit our new plans resource page for more information on the plan setup process.