Big changes are on the horizon for retirement savings, and if you’re eligible for a 401(k) plan, you’ll want to be prepared for automatic enrollment. As of January 1, 2025, a major shift will take place thanks to the SECURE 2.0 Act – a new law that aims to help more Americans save for retirement. If you’re a new 401(k) participant or recently became eligible, this legislation may directly impact you, and understanding what to expect is key.

Here’s what you need to know about the Mandatory Automatic Enrollment, if you are impacted, and how it works.

Mandatory Automatic Enrollment: What It Is and Why It Matters

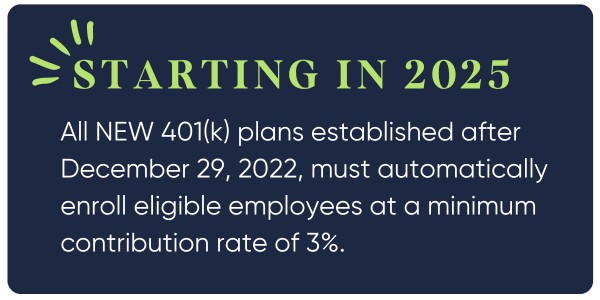

On December 22, 2022, Congress passed landmark retirement plan legislation known as the SECURE 2.0 Act (“SECURE 2.0”) which aims to increase access and participation in retirement plans for millions of workers and it requires changes to your existing 401(k) Plan. Not everyone will be affected by this change, but if you are, you will be notified.

The goal of the new law? To make it easier for you to start saving for retirement. From day one, a portion of your paycheck will go straight into your 401(k) account, building up your nest egg for the future. And if your employer offers a matching contribution, your savings will grow even faster. This is the power of 401(k) auto enrollment.

How SECURE 2.0 Benefits You: Tax Advantages and a Bigger Retirement Cushion

401(k) retirement plans already come with some great tax advantages, and SECURE 2.0 keeps these in place. Your contributions are made with pre-tax dollars, meaning you reduce your taxable income today while your savings grow, tax deferred. You won’t pay taxes on your retirement contributions or investment gains until you withdraw them in retirement—allowing your savings to grow more efficiently.

In addition, SECURE 2.0 aims to help more people retire with confidence by ensuring that more Americans are automatically saving through their employer-sponsored plans. This boost in savings, especially with automatic increases, means that when it’s time to retire, you’ll likely have a bigger cushion to rely on. Use our 401(k) Paycheck Calculator to see how your 401(k) contribution will affect your paycheck and your retirement savings.

How Does This Affect Me?

If you are a participant in a 401(k) plan that was first established after December 29, 2022, you may be automatically enrolled in the plan in January 2025, and you will be notified.

If you are eligible to participate in the 401(k) savings plan but have not elected to contribute, or you have elected to NOT contribute, you will be enrolled in your 401(k) plan automatically. This means your plan will automatically start saving a portion of your paycheck into your retirement account.

If you already elected to contribute to the 401(k) Plan or to not contribute, your contribution level will not be affected by the automatic enrollment. This means if you elected to contribute at any rate of compensation, regardless of whether that contribution is made on a pre-tax or Roth basis, and even if the rate is less than 3% on January 1, 2025, you will not be automatically enrolled. Likewise, if you elected to contribute to your 401(k) plan in the past but have affirmatively elected to stop contributing and have an effective contribution rate of 0% as of January 1, 2025, you will not be automatically enrolled.

There are exceptions for plans that are not subject to Auto Enrollment. For employees whose company 401(k) plan was established prior to December 29, 2022, this mandate does not apply. Please check with your HR department or 401(k) provider for exemptions for other specific details on 401(k) auto enrollment.

Your Default Contribution Rate: 3% to Start, with Automatic Increases

Once you’re automatically enrolled, the standard contribution rate for new 401(k) participants will start at 3% of your salary on a pre-tax basis. And here’s where SECURE 2.0 adds a new twist: automatic contribution increases. Under the law, your retirement contribution will increase by 1% each year, until you’re contributing at least 10% of your salary (and a max of 15%).

This gradual increase helps you save more for retirement over time, without making a big dent in your take-home pay upfront. For example:

- In your first year of automatic enrollment (2025), you’ll contribute 3%.

- In 2026, this will increase to 4%.

- By 2031, you’ll be saving at least 10% annually.

Please note that the starting contribution rate of 3% is the general rule but the percentage contribution may vary based upon your employer’s plan. Be sure to check with your HR department about your individual company’s 401(k) plan.

Can I Change the Amount of My Retirement Contributions?

You can, of course, adjust these numbers! Want to contribute more or less? You have complete control to modify your contribution rate.

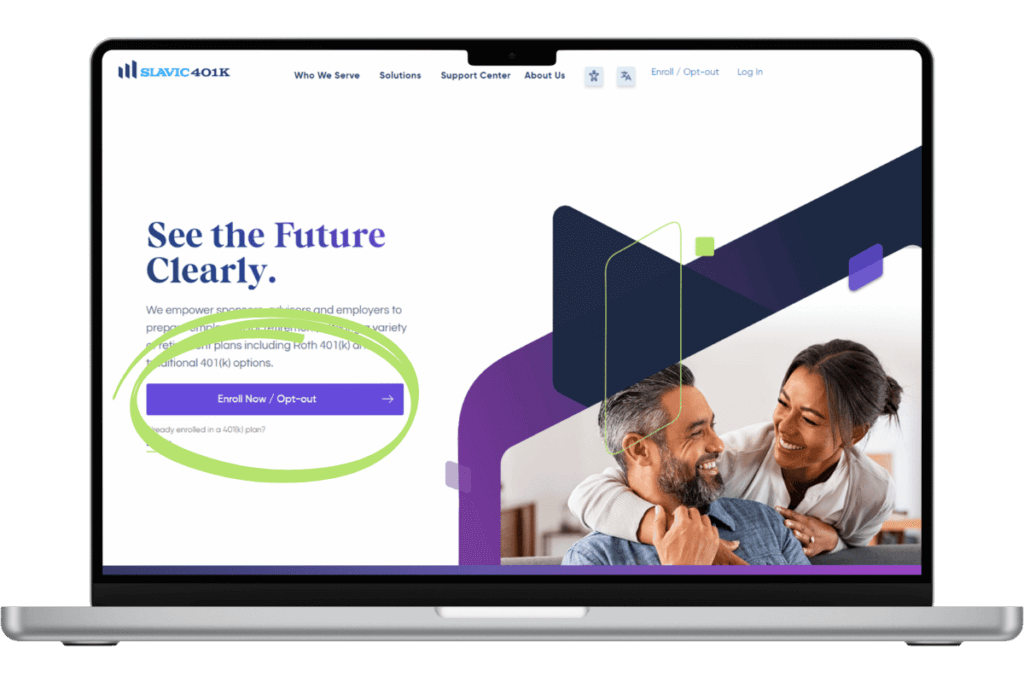

To enroll in your 401(k) and change your contribution elections if your employer uses a Slavic401k plan:

- Go to Slavic401k’s Home page, select “Enroll/Opt-out”

- In the top box, enter your individual social security number and date of birth to get started.

- Follow the enrollment steps until you receive the enrollment confirmation email.

- Watch the Slavic401k Portal Overview video to follow the onboarding steps and explore your 401(k) dashboard.

Employer Matching: Increase Your Money!

A key reason to love your 401(k) retirement savings plan is the potential for employer matching contributions . Many employers match a percentage of what you contribute, essentially giving you more money for your retirement. The specific match rate will depend on your company’s plan. A common structure is a 50% match on the first 6% you contribute.

For instance, if you’re contributing 6% of your salary, and your employer matches 50%, that’s an additional 3% of your salary going into your retirement account—just for participating!

Important tip: Make sure you contribute enough to capture the full employer match. Don’t leave money on the table!

Where Your Money Will Be Invested

The 401(k) plan lets you invest your account in a number of different funds. Unless you choose your investment funds, your 401(k) plan account will be invested in the plan’s default investment options. You may elect different investment options for your account at any time. Just be sure you’re comfortable with the level of risk involved! Try this helpful Investment Risk Tolerance Quiz to figure out your risk profile.

Opting Out: It’s Your Choice

Not ready to start saving just yet? SECURE 2.0 makes automatic enrollment mandatory, but you still have the right to opt-out and a right to withdraw deferrals within 90 days of automatic enrollment. To prevent automatic contributions, you must act as soon as possible before January 1, 2025 . If you have other financial priorities, you can choose to un-enroll in your 401(k) plan if you wish.

How to Opt-out if you have a Slavic401k Plan:

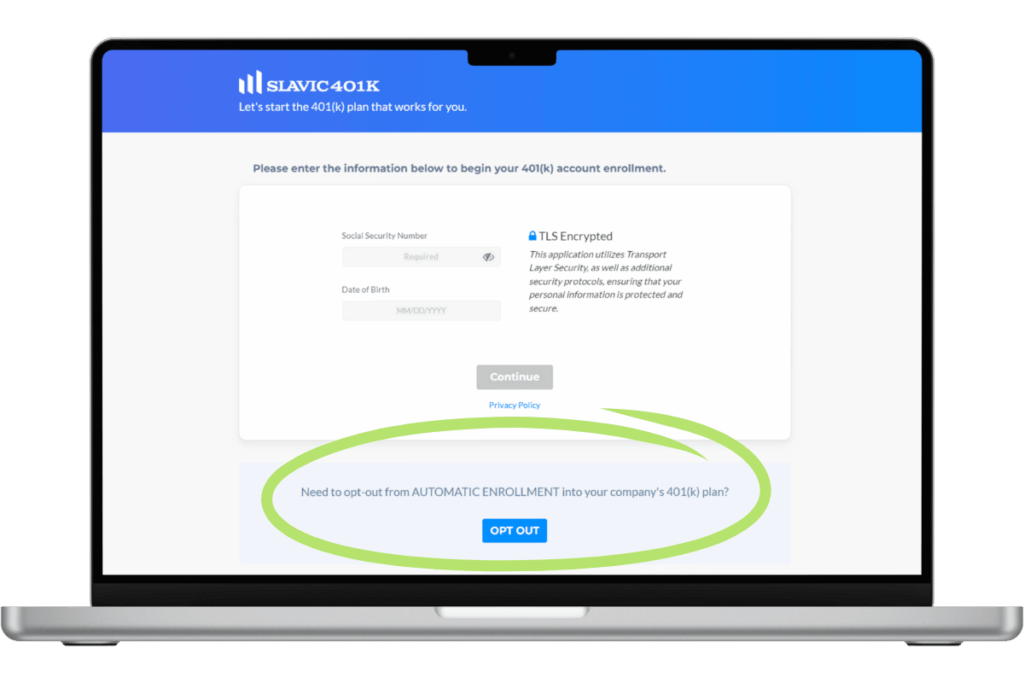

- Visit Slavic401k’s Home page and click “Enroll Now / Opt-out.”

- Then select the “ OPT-OUT ” link at the bottom of the page for “Need to opt-out from AUTOMATIC ENROLLMENT in your company’s 401(k) plan.”

- Follow the steps to opt-out until you receive a confirmation email.

However, opting out means you won’t benefit from employer matching funds or the tax advantages of saving in a 401(k) plan, so weigh the decision carefully. Even a small contribution now can have a big impact on your retirement savings later!

Forgot to Opt-Out? Withdrawing Your Contribution

During the 90 days after automatic contributions are first taken from your pay, you can withdraw your money contributed. Since your contribution will be invested to some degree in the stock market, which fluctuates, your withdrawal may be greater or less than the amount originally contributed. If you take out your automatic contributions, you lose any Employer Match contributions , regardless of your vesting rate. Also, your withdrawal will be subject to a 10% federal income tax (but not the extra 10% tax that normally applies to early distributions.) Remember, if you opt-out, you can always choose to restart your contributions.

To make changes to your 401(k) contribution, opt-out of automatic enrollment, make investment changes, or request a withdrawal of your automatic contributions, please go to Slavic401k’s Home page and follow the steps under “Enroll Now/Opt-out.” You may also contact the Retirement Support Service Center at (800) 356-3009 for assistance.

Securing Your Future with 401(k) Auto Enrollment

Starting in 2025, SECURE 2.0 will make automatic enrollment the new standard for 401(k) participants. This initiative is designed to help you effortlessly start saving for retirement, ensuring you benefit from employer tax savings. While the process is automatic, it’s crucial to take an active role. Adjusting your contributions, reviewing your investments, and understanding your vesting schedule to maximize your long-term financial security are highly recommended.

Remember, not everyone will be affected by this change. If your 401(k) savings plan is subject to this update, you will be notified, so keep an eye out for communications. Don’t wait until retirement is at your doorstep to think about your financial future. Start now, and make sure you’re ready when that day comes!